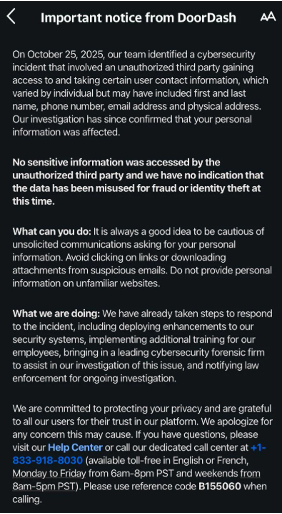

Because Android uses an open source operating system, it usually gets a bad rap for being vulnerable to data loss and compromised apps as a result of malware, insecure app coding, unprotected cloud storage, outdated software, sideloading from untrusted sources, and even specific website vulnerabilities. Suffice it to say that any of these risks can be destructive and costly.

While Google addresses specific vulnerabilities, cyberthreats continue to evolve as criminals become more scheming or desperate. For these reasons, it is still best to exercise caution to protect the data on your device. In this article, we will share vital tips on how you can secure your device.

Determining if you’re vulnerable isn’t always easy. There are, however, some measures you can take to protect your device.

Your first line of defense against Android vulnerability threats is maintaining current software. Android security patches fix security weaknesses that cybercriminals actively take advantage of to access your personal data, install malware, or take control of your device. When you delay updates, you leave known security gaps open for attackers to exploit.

To enable automatic updates, navigate to Settings > System > System update > Advanced settings, then toggle on “Automatic system updates.” For Google Pixel devices, security updates typically arrive monthly, while other manufacturers may have varying schedules.

On top of this, set your Google Play Store to auto-update apps by opening the Play Store, tapping your profile picture, going to Settings > Network preferences > Auto-update apps, and selecting “Over any network” if you have unlimited data or “Over Wi-Fi only” to preserve your data plan.

One of the most effective Android phone security best practices is restricting app installations to the Google Play Store. Sideloading apps from unknown sources significantly increases your risk of installing malware, spyware, or apps with hidden malicious functionality.

Before installing any app, examine the permissions it requests. Apps asking for excessive permissions should raise your suspicions. Navigate to Settings > Apps > Special app access > Install unknown apps and ensure all toggles are disabled.

In addition, choose apps with consistent positive ratings and active developer responses to user concerns. Google’s Play Console policies provide guidelines for safe app development, but your vigilance remains essential.

Google Play Protect scans over 125 billion apps daily for malware and policy violations. While not perfect, this automated screening catches the majority of malicious apps before they reach your device, and even detects them after installation. In contrast, apps outside this ecosystem lack this protection layer.

Activate Play Protect by opening Google Play Store, tapping your profile picture, selecting “Play Protect,” and ensuring both “Scan apps with Play Protect” and “Improve harmful app detection” are enabled. This service runs automatic security scans and can remove or disable harmful apps even after you’ve installed them.

For comprehensive, real-time protection against phishing sites, malware downloads, and suspicious web content, enable safe browsing Android features in Chrome. Open Chrome, tap the three dots menu, go to Settings > Privacy and security > Safe Browsing, and select “Enhanced protection.” This setting checks URLs against Google’s constantly updated database of dangerous sites.

Modern Android devices offer multiple authentication methods, and using them strategically provides layered security for your most sensitive information. Set up a strong screen lock by going to Settings > Security > Screen lock and choosing either a complex PIN with at least 6 digits, a pattern with at least 6 points, or a password that combines letters, numbers, and symbols.

Enable biometric authentication, whether fingerprint and/or facial recognition, as an additional layer, but always maintain a strong backup PIN or password since biometrics can be circumvented.

For critical applications containing sensitive data such as banking apps, password managers, email clients, and social media, enable two-factor authentication (2FA) where possible for extra security.

Android’s built-in backup and encryption features provide essential protection against data loss from device theft, hardware failure, malware attacks, or accidental deletion, forming a crucial part of your Android incident response strategy.

Enable automatic backups of your app data, call history, and device settings by navigating to Settings > System > Backup, then toggle on “Back up to Google Drive.” You can set the frequency to daily. For photos and videos, enable Google Photos backup with high-quality or original quality settings based on your storage plan.

Device encryption can be activated through Settings > Security > Encryption & credentials > Encrypt phone. Modern Android devices (Android 6.0+) typically have encryption enabled by default, but you will need to verify this setting. Google’s Android backup service documentation provides detailed information on what data is protected and how to manage your backup settings effectively.

Your Google account serves as the master key to most Android functionality, so having an account recovery system can be invaluable to restore access to your device when local authentication methods fail. To ensure your recovery information is current, visit Security settings on your account profile, add a secondary email address that you can access independently, but avoid using another Gmail account as your backup. Include a mobile phone number for SMS verification, and consider adding multiple phone numbers if you frequently travel or change devices.

Google also provides one-time-use back-up codes that can restore account access when other methods fail. Download these codes and store them securely offline. Consider using a password manager like Google’s built-in option or a reputable third-party solution. Never store recovery codes in easily accessible digital formats like unencrypted text files or photos on the same device.

Google’s Find My Device service provides powerful remote management capabilities that can prevent permanent data loss during Android vulnerability situations or lockout scenarios. This service allows you to locate, lock, or completely erase your device remotely.

To enable this feature, navigate to Find My Device through Settings > Security > Find My Device. Ensure that your location services remain active for this feature to function properly.

Take note that when you decide to remotely erase your data from your device, this feature completely wipes all local data but preserves the information you backed up to Google’s cloud services. Only use this option when you’re certain your back-up systems are current.

Android offers multiple backup solutions that transform potential data disasters into minor inconveniences. To store your photos, videos, SMS messages, and call logs, you can go to Settings > System > Backup and choose the frequency that matches your usage patterns, daily backups for heavy users, weekly for lighter usage.

For sensitive information that you would like to access even when offline, you might want to consider periodic local backups by connecting your device to a computer monthly and copying important files manually. Test your systems regularly by attempting to restore a small amount of data to ensure your backups work when needed and identify any gaps in your protection strategy.

A mobile security incident can escalate from a nuisance to real damage in minutes, especially if an attacker can access your accounts, intercept messages, or install persistent apps. Speed matters when you respond, especially when prioritizing the high-impact steps that will stop the bleeding, regain control, and protect your data before you move on to cleanup and recovery. The actions below follow that order, so you can respond calmly and effectively even under stress.

When evaluating mobile security solutions for your Android device, focus on apps that offer comprehensive protection across multiple threat vectors. The most effective solutions combine several key capabilities into a single, user-friendly platform that doesn’t slow down your device or drain your battery.

Your Android device holds your most precious digital memories, important work files, and personal information, making it a prime target for cybercriminals who continue to exploit new vulnerabilities. While threats like remote factory resets and malicious web attacks can disrupt your daily digital routine, you do have the power to protect yourself against them by keeping your OS and security patches current, enabling Google Play Protect and built-in safe browsing features, maintaining regular backups of your essential data, and considering a comprehensive mobile security solution that provides real-time protection. For additional steps to safeguard your Android mobile life, visit McAfee’s security best practices.

The post Guard Your Android Phones Against Loss of Data and Infected Apps appeared first on McAfee Blog.

The practice of locking our possessions is relevant in every aspect of our modern lives. We physically lock our houses, cars, bikes, hotel rooms, computers, and even our luggage when we go to the airport. There are lockers at gyms, schools, amusement parks, and sometimes even at the workplace.

Digitally, we lock our phones with passcodes and protect them from malware with a security solution. Why, then, don’t we lock the individual apps that house some of our most personal and sensitive data?

From photos to emails to credit card numbers, our mobile apps hold invaluable data that is often left unprotected, especially given that some of the most commonly used apps on the Android platform such as Facebook, LinkedIn and Gmail don’t necessarily require a log in each time they’re launched.

Without an added layer of security, those apps are leaving room for nosy family members, jealous significant others, prankster friends, and worst of all thieves to hack into your social media or email accounts at the drop of a hat. In this article, we will discuss what an app lock is, everyday scenarios you may need it, and how to set it up on your smartphone.

Your mobile phone is more than just a gadget. It’s your wallet, camera, diary, and connection to the world. You likely keep photos, messages, social media, payment apps, and even confidential work files on it. To protect these bits of personal information, we use PINs, patterns, or biometrics to lock our devices, but once the phone is open, every app is fair game.

I f someone were able to go beyond your phone’s lock screen and gain access to the information in your phone, how much of your life could they see? A friend could scroll through your photos. Your child could open your shopping app and make purchases. Or a thief could get into your banking and social media accounts in seconds.

One way to avoid this from happening is by applying an app lock, a digital padlock that adds an authentication step such as a password, pattern, or biometric before an application can be launched.

In your home, a locked front door keeps strangers out. But what happens if you unwittingly leave the front door unlocked and someone walks in? Without interior locks, your bedroom, office, and safe are now accessible to anyone.

This same concept applies to your device with unprotected apps. Once unlocked, apps like Gmail, Facebook, or mobile banking don’t always require you to log in every time. It’s convenient, until it’s not.

An app lock serves as an indoor lock, protecting your sensitive data even after an unauthorized person has accessed it, and maintaining privacy boundaries.

When you or another person attempts to open an app on your device, the system first triggers an authentication screen. After verifying your PIN, fingerprint, or face, the app will open, ensuring that your personal information stays off-limits to people who do not know your authentication step. In Android, app locks work seamlessly in the background without slowing performance.

This layered defense mirrors the cybersecurity approach used on enterprise systems, but scaled down for consumers. Each layer handles different threats, so if one fails, the others still protect you:

Leaving apps unprotected can do more than just embarrass you. Here are some examples of how unprotected apps could lead to lasting harm:

Even just one unauthorized session could cascade into identity theft or financial fraud. That’s why security experts recommend app-level protection as part of a layered, reinforced mobile defense strategy.

While many Android phones include some app-locking capabilities, dedicated mobile security apps provide more robust options and better protection. Here’s how to set up app locks effectively:

Use a 6-digit or longer PIN, complex pattern, or biometric such as fingerprint or face unlock. Avoid using the same PIN as your main device.

Choose the priority mobile apps that you want to protect. Start with your most sensitive apps, such as:

Set timeouts based on app sensitivity:

Hide notification content for locked apps. This keeps private messages or bank alerts from showing up on your lock screen.

Most Android manufacturers now offer convenient, built-in app locking features. However, they are limited, often lacking biometric integration, cloud backup, or smart settings.

Dedicated solutions go further, providing:

With an app lock, your mischievous friends will never be able to post embarrassing status updates on your Facebook profile, and your jealous partner won’t be able to snoop through your photos or emails. For parents, you can keep your kids locked out of the apps that would allow them to access inappropriate content without having to watch their every move.

Most importantly, app locks protect you from thieves and strangers in case of a stolen or lost device.

Your phone carries more than just apps. It holds the details of your daily life. From private conversations and family photos to financial information and work data, much of what matters most to you lives behind those app icons. While a device lock is an important first step, it isn’t always enough on its own.

App locks give you greater control over your privacy by protecting individual apps, even when your phone is already unlocked. They help prevent accidental access, discourage snooping, and reduce the risk of serious harm if your device is lost or stolen. Most importantly, they allow you to use and share your phone, without worrying about who might see what they shouldn’t.

By adding app-level protection to your mobile security routine, you’re taking a simple but meaningful step toward safeguarding your personal information.

The post App Locks Can Improve the Security of Your Mobile Phones appeared first on McAfee Blog.

It’s no longer possible to deny that your life in the physical world and your digital life are one and the same. Coming to terms with this reality will help you make better decisions in many aspects of your life.

The same identity you use at work, at home, and with friends also exists in apps, inboxes, accounts, devices, and databases, whether you actively post online or prefer to stay quiet. Every purchase, login, location ping, and message leaves a trail. And that trail shapes what people, companies, and scammers can learn about you, how they can reach you, and what they might try to take.

That’s why digital security isn’t just an IT or a “tech person” problem. It’s a daily life skill. When you understand how your digital life works, what information you’re sharing, where it’s stored, and how it can be misused, you make better decisions. This guide is designed to help you build that awareness and translate it into practical habits: protecting your data, securing your accounts, and staying in control of your privacy in a world that’s always connected.

Being digitally secure doesn’t mean hiding from the internet or using complicated tools you don’t understand. It means having intentional control over your digital life to reduce risks while still being able to live, work, and communicate online safely. A digitally secure person focuses on four interconnected areas:

Your personal data is the foundation of your digital identity. Protecting it includes limiting how much data you share, understanding where it’s stored, and reducing how easily it can be collected, sold, or stolen. At its heart, personal information falls into two critical categories that require different levels of protection:

Account security ensures that only you can access them. Strong, unique passwords, multi-factor authentication, and secure recovery options prevent criminals from hijacking your email, banking, cloud storage, social media, and other online accounts, often the gateway to everything else in your digital life.

Privacy control means setting boundaries and deciding who can see what about you, and under what circumstances. This includes managing social media visibility, app permissions, browser tracking, and third-party access to your data.

Digital security is an ongoing effort as threats evolve, platforms change their policies, and new technologies introduce new risks. Staying digitally secure requires periodic check-ins, learning to recognize scams and manipulation, and adjusting your habits as the digital landscape changes.

Your personal information faces exposure risks through multiple channels during routine digital activities, often without your explicit knowledge.

Implementing comprehensive personal data protection requires a systematic approach that addresses the common exposure points. These practical steps provide layers of security that work together to minimize your exposure to identity theft and fraud.

Start by conducting a thorough audit of your online accounts and subscriptions to identify where you have unnecessarily shared more data than needed. Remove or minimize details that aren’t essential for the service to function. Moving forward, provide only the minimum required information to new accounts and avoid linking them across different platforms unless necessary.

Be particularly cautious with loyalty programs, surveys, and promotional offers that ask for extensive personal information, as they may share it with third parties. Read privacy policies carefully, focusing on sections that describe data sharing, retention periods, and your rights regarding your personal information.

If possible, consider using separate email addresses for different accounts to limit cross-platform tracking and reduce the impact if one account is compromised. Create dedicated email addresses for shopping, social media, newsletters, and important accounts like banking and healthcare.

Privacy protection requires regular attention to your account settings across all platforms and services you use. Social media platforms frequently update their privacy policies and settings, often defaulting to less private configurations that allow them to collect and share your data. For this reason, it is a good idea to review your privacy settings at least quarterly. Limit who can see your posts, contact information, and friend lists. Disable location tracking, facial recognition, and advertising customization features that rely on your personal data. Turn off automatic photo tagging and prevent search engines from indexing your profile.

On Google accounts, visit your Activity Controls and disable Web & App Activity, Location History, and YouTube History to stop this data from being saved. You can even opt out of ad personalization entirely if desired by adjusting Google Ad Settings. If you are more tech savvy, Google Takeout allows you to export and review what data Google has collected about you.

For Apple ID accounts, you can navigate to System Preferences on Mac or Settings on iOS devices to disable location-based Apple ads, limit app tracking, and review which apps have access to your contacts, photos, and other personal data.

Meanwhile, Amazon accounts store extensive purchase history, voice recordings from Alexa devices, and browsing behavior. Review your privacy settings to limit data sharing with third parties, delete voice recordings, and manage your advertising preferences.

Regularly audit the permissions you’ve granted to installed applications. Many apps request far more permissions to your location, contacts, camera, and microphone even though they don’t need them. Cancel these unnecessary permissions, and be particularly cautious about granting access to sensitive data.

Create passwords that actually protect you; they should be long and complex enough that even sophisticated attacks can’t easily break them. Combine uppercase letters, lowercase letters, numbers, and special characters to make it harder for attackers to crack.

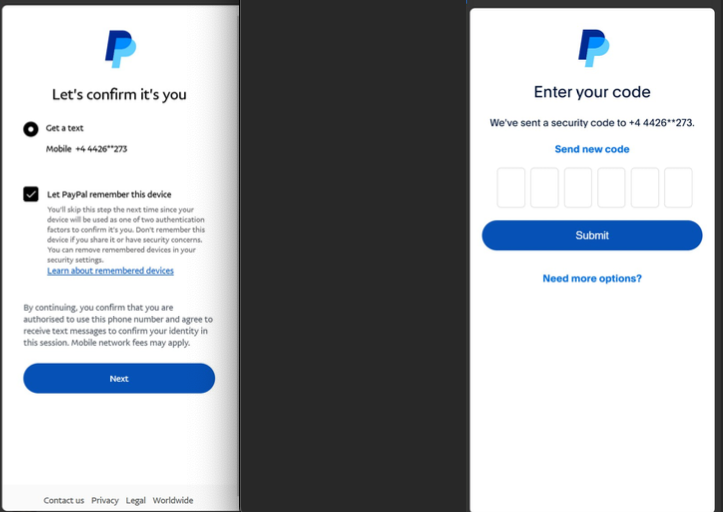

Aside from passwords, enable multi-factor authentication (MFA) on your most critical accounts: banking and financial services, email, cloud storage, social media, work, and healthcare. Use authenticator apps such as Google Authenticator, Microsoft Authenticator, or Authy rather than SMS-based authentication when possible, as text messages can be intercepted through SIM swapping attacks. When setting up MFA, ensure you save backup codes in a secure location and register multiple devices when possible to keep you from being locked out of your accounts if your primary authentication device is lost, stolen, or damaged.

Alternatively, many services now offer passkeys which use cryptographic keys stored on your device, providing stronger security than passwords while being more convenient to use. Consider adopting passkeys for accounts that support them, particularly for your most sensitive accounts.

Device encryption protects your personal information if your smartphone, tablet, or laptop is lost, stolen, or accessed without authorization. Modern devices typically offer built-in encryption options that are easy to enable and don’t noticeably impact performance.

You can implement automatic backup systems such as secure cloud storage services, and ensure backup data is protected. iOS users can utilize encrypted iCloud backups, while Android users should enable Google backup with encryption. Regularly test your backup systems to ensure they’re working correctly and that you can successfully restore your data when needed.

Identify major data brokers that likely have your information and look for their privacy policy or opt-out procedures, which often involves submitting a request with your personal information and waiting for confirmation that your data has been removed.

In addition, review your subscriptions and memberships to identify services you no longer use. Request account deletion rather than simply closing accounts, as many companies retain data from closed accounts. When requesting deletion, ask specifically for all personal data to be removed from their systems, including backups and archives.

Keep records of your opt-out and deletion requests, and follow up if you don’t receive confirmation within the stated timeframe. In the United States, key data broker companies include Acxiom, LexisNexis, Experian, Equifax, TransUnion, Whitepages, Spokeo, BeenVerified, and PeopleFinder. Visit each company’s website.

Connect only to trusted, secure networks to reduce the risk of your data being intercepted by attackers lurking behind unsecured or fake Wi-Fi connections. Avoid logging into sensitive accounts on public networks in coffee shops, airports, or hotels, and use encrypted connections such as HTTPS or a virtual private network to hide your IP address and block third parties from monitoring your online activities.

Rather than using a free VPN service that often collects and sells your data to generate revenue, it is better to choose a premium, reputable VPN service that doesn’t log your browsing activities and offers servers in multiple locations.

Cyber threats evolve constantly, privacy policies change, and new services collect different types of personal information, making personal data protection an ongoing process rather than a one-time task. Here are measures to help regularly maintain your personal data protection:

By implementing these systematic approaches and maintaining regular attention to your privacy settings and data sharing practices, you significantly reduce your risk of identity theft and fraud while maintaining greater control over your digital presence and personal information.

You don’t need to dramatically overhaul your entire digital security in one day, but you can start making meaningful improvements right now. Taking action today, even small steps, builds the foundation for stronger personal data protection and peace of mind in your digital life. Choose one critical account, update its password, enable multi-factor authentication, and you’ll already be significantly more secure than you were this morning. Your future self will thank you for taking these proactive steps to protect what matters most to you.

Every step you take toward better privacy protection strengthens your overall digital security and reduces your risk of becoming a victim of scams, identity theft, or unwanted surveillance. You’ve already taken the first step by learning about digital security risks and solutions. Now it’s time to put that knowledge into action with practical steps that fit seamlessly into your digital routine.

The post What Does It Take To Be Digitally Secure? appeared first on McAfee Blog.

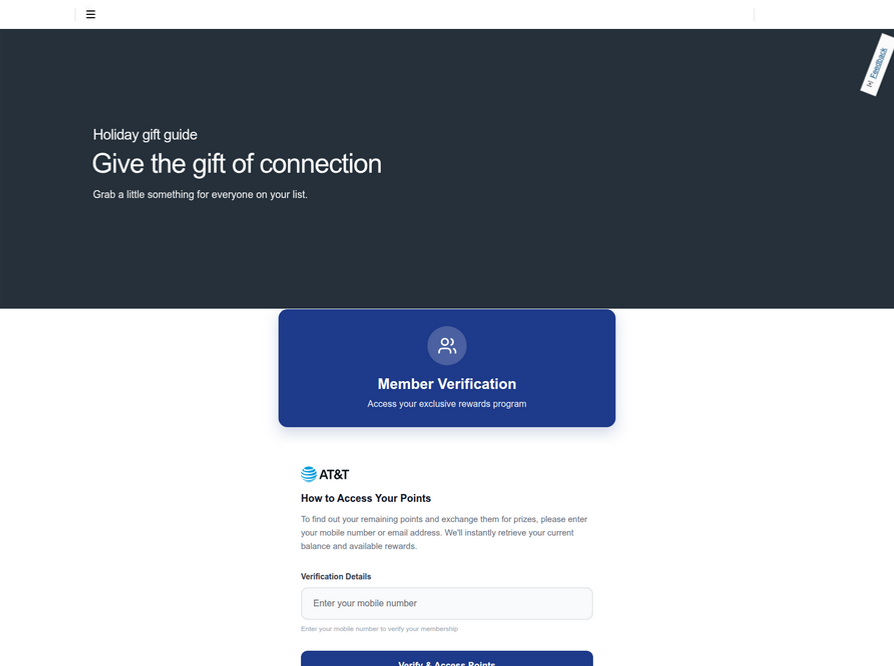

The holidays are just around the corner and amid the hustle and bustle, many of us will fire up our devices to go online, order gifts, plan travel, and spread cheer. But while we’re getting festive, the cybercriminals are getting ready to take advantage of the influx of your good cheer to spread scams and malware.

With online shopping expected to grow by 7.9% year-on-year in the U.S. alone in 2025, according to Mastercard, and more people than ever using social media and mobile devices to connect, the cybercriminals have a lot of opportunities to spoil our fun. Using multiple devices provides the bad guys with more ways to access your valuable “digital assets,” such as personal information and files, especially if the devices are under-protected.

In this guide, let’s look into the 12 most common cybercrimes and scams of Christmas, and what you can do to keep your money, information, and holiday spirit safe.

The festive atmosphere, continued increase in online shopping activity, and charitable spirit that define the holidays create perfect conditions for scammers to exploit your generosity and urgency.

Not surprisingly, digital criminals become more active and professional during this period, driven even more by the increasing power of artificial intelligence. A new McAfee holiday shopping report revealed that 86% of consumers surveyed receive a daily average of 11 shopping-related text or email messages that seem suspicious. This includes 3 scam texts, 5 emails, and 3 social media messages. Meanwhile, 22% admit they have been scammed during a holiday season in the past.

Their scams succeed because they exploit the psychological and behavioral patterns that are rife during the holidays. The excitement and time pressure of holiday shopping often prevail over our usual caution, while the emotional aspects of gift-giving and charitable donations can be exploited and move us to be more generous. Meanwhile, scammers understand that you’re more likely to make quick purchasing decisions when the fear of missing out on limited-time offers overtakes your judgment or when you’re rushing to find the perfect gift before it’s too late.

Overall, the frenzied seasonal themes create an environment where criminals can misuse the urgency of their fake offers and cloud our judgment, making fraudulent emails and websites appear more legitimate, while you’re already operating under the stress of holiday deadlines and budget concerns. After all, holiday promotions and charity appeals are expected during this time of year.

Now that you understand the psychology behind the scams, it’s time to become more aware of the common scams that cybercriminals run during the holiday season.

As you head online this holiday season, stay on guard and stay aware of scammers’ attempts to steal your money and your information. Familiarize yourself with the “12 Scams of Christmas” to ensure a safe and happy holiday season:

Many of us use social media sites to connect with family, friends, and co-workers over the holidays, and the cybercriminals know that this is a good place to catch you off guard because we’re all “friends,” right? Here are some ways that criminals will use these channels to obtain shoppers gift money, identity or other personal information:

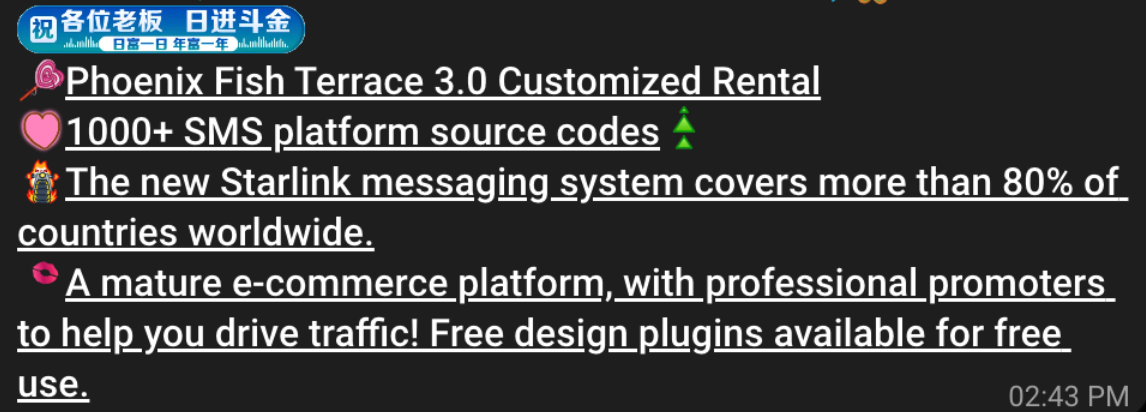

As the popularity of smartphone apps has grown, so have the chances of you downloading a malicious application that steals your information or sends premium-rate text messages without your knowledge. Apps ask for more permissions than they need, such as access to your contacts or location.

If you unwrap a new smartphone this holiday season, make sure that you only download applications from official app stores and check other users’ reviews, as well as the app’s permission policies, before downloading. Software, such as McAfee Mobile Security, can also help protect you against dangerous apps.

Many of us travel to visit family and friends over the holidays. We begin our journey online by looking for deals on airfare, hotels, and rental cars. Before you book, keep in mind that scammers are looking to hook you with phony travel webpages with too-fantastic deals—beautiful pictures and rock-bottom prices—to deceive you into handing over your financial details and money.

Even when you’re already on the road, you need to be careful. Sometimes, scammers who have gained unauthorized access to hotel Wi-Fi will release a malicious pop-up ad on your device screen, and prompt you to install software before connecting. If you agree to the installation, it downloads malware onto your machine. To thwart such an attempt, it’s important that you perform a security software update before traveling.

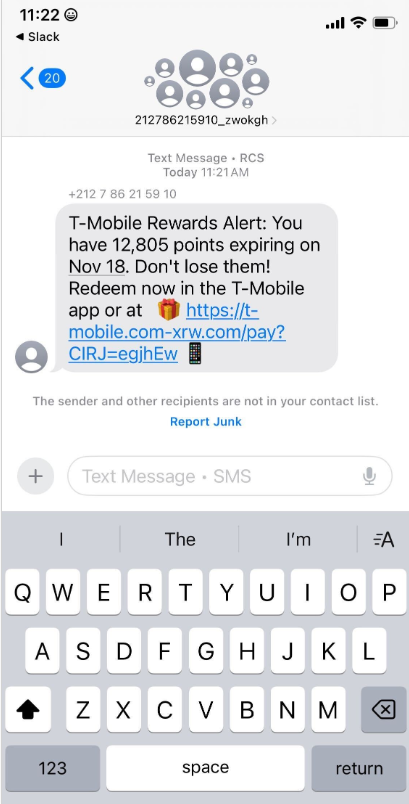

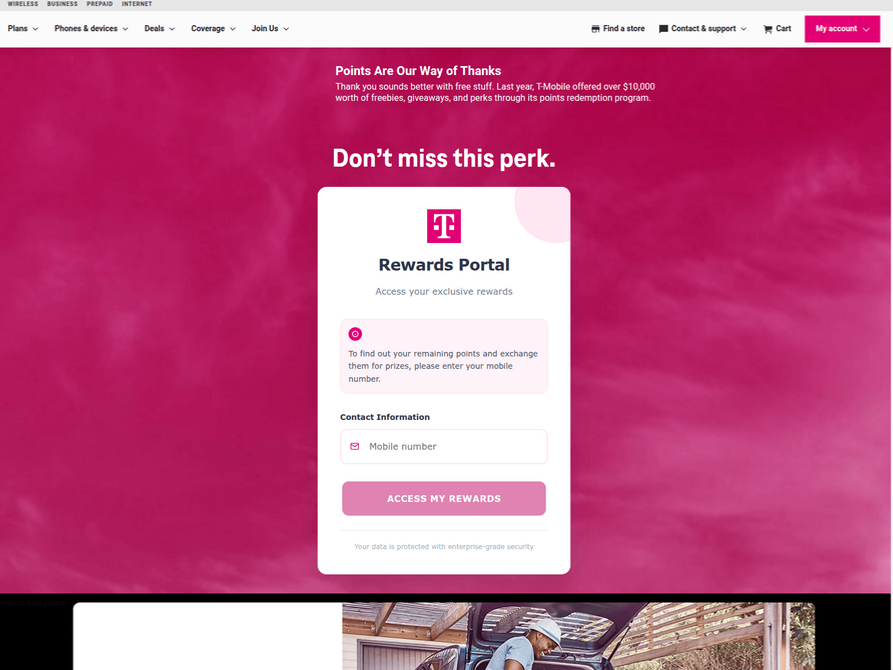

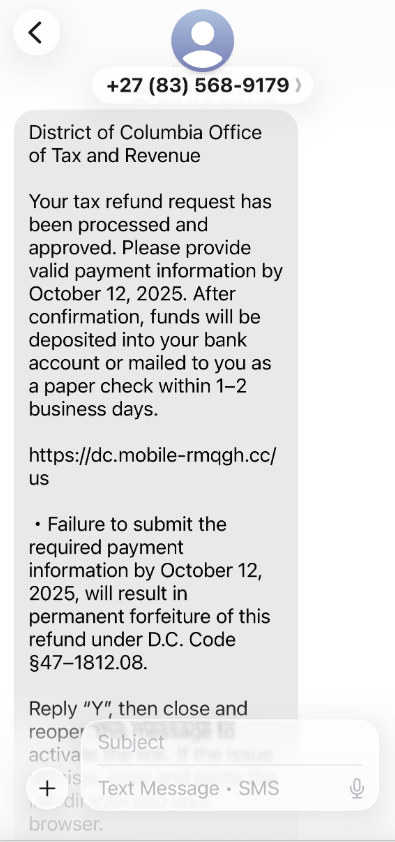

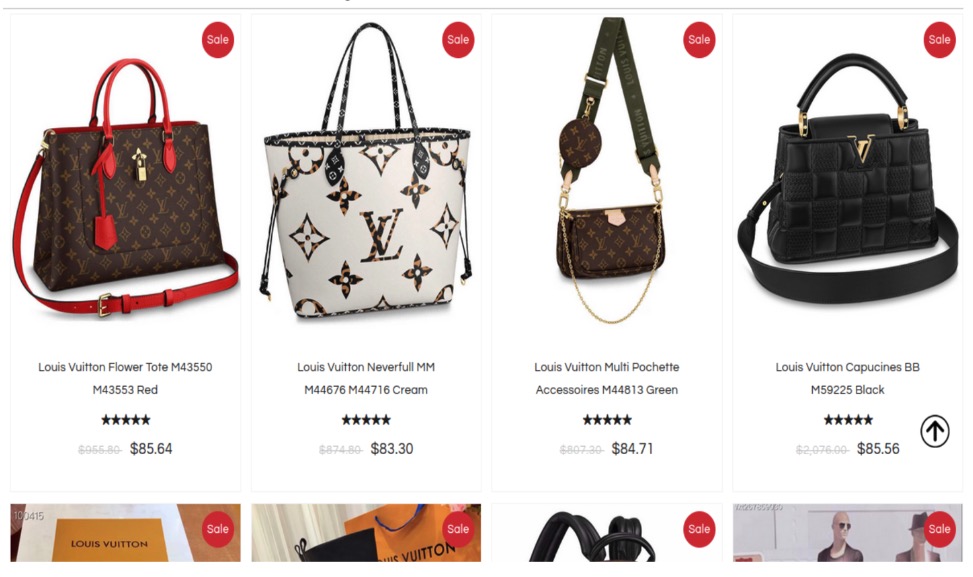

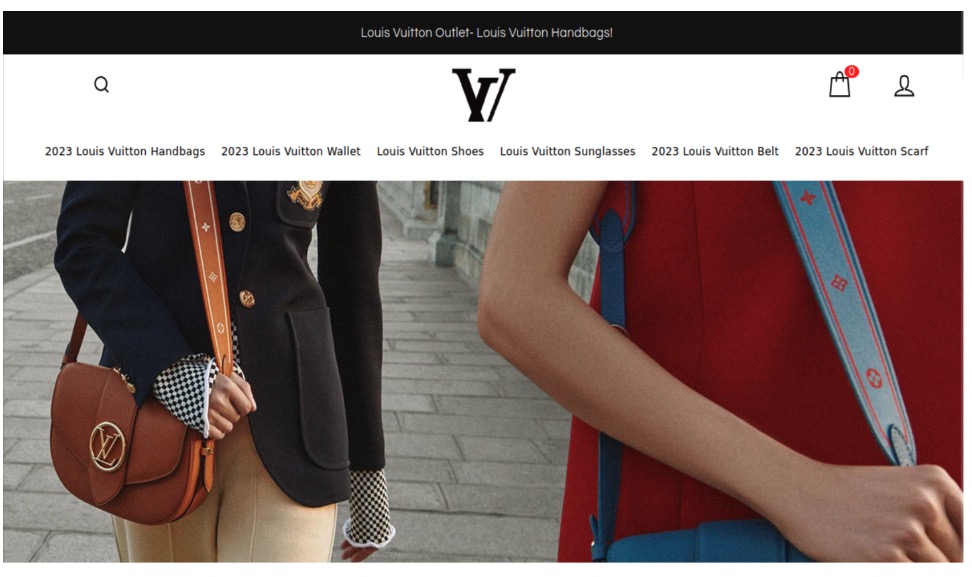

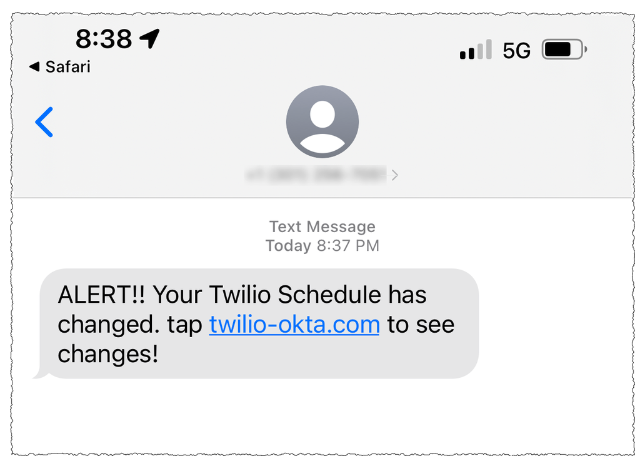

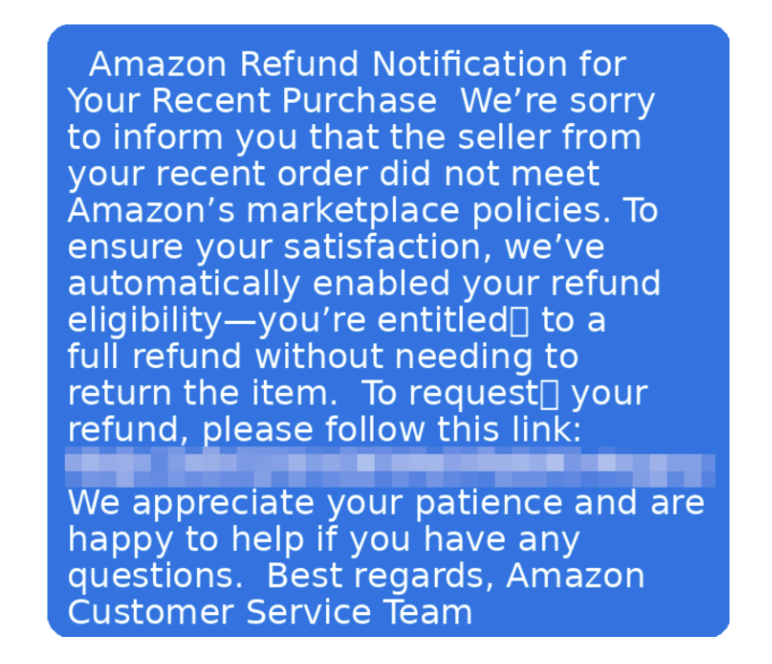

You are probably already familiar with email phishing and SMiShing messages containing questionable offers and links. The scammer will mimic a legitimate organization offering cheap Rolex watches and luxury products as the “perfect gift” for that special someone, or send a message posing as your bank with a holiday promo and try to lure you into revealing information or direct you to a fake webpage. Never respond to these scams or click on an included link. Be aware that real banks won’t ask you to divulge personal information via text message. If you have any questions about your accounts, you should contact your bank directly.

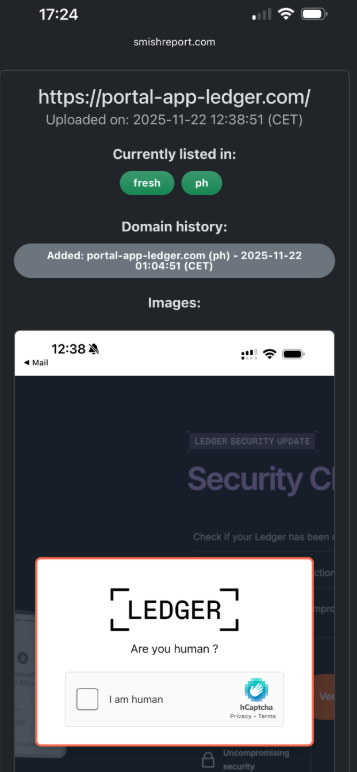

QR code phishing, or “quishing,” has emerged as a significant new threat during holiday shopping seasons. In this scam method, cybercriminals place malicious QR codes in holiday advertisements posted on social media or printed flyers, parking meters and payment kiosks at shopping centers, or at restaurant tables during holiday dining. They could also email attachments claiming to offer exclusive holiday deals or fake shipping labels placed over legitimate tracking QR codes.

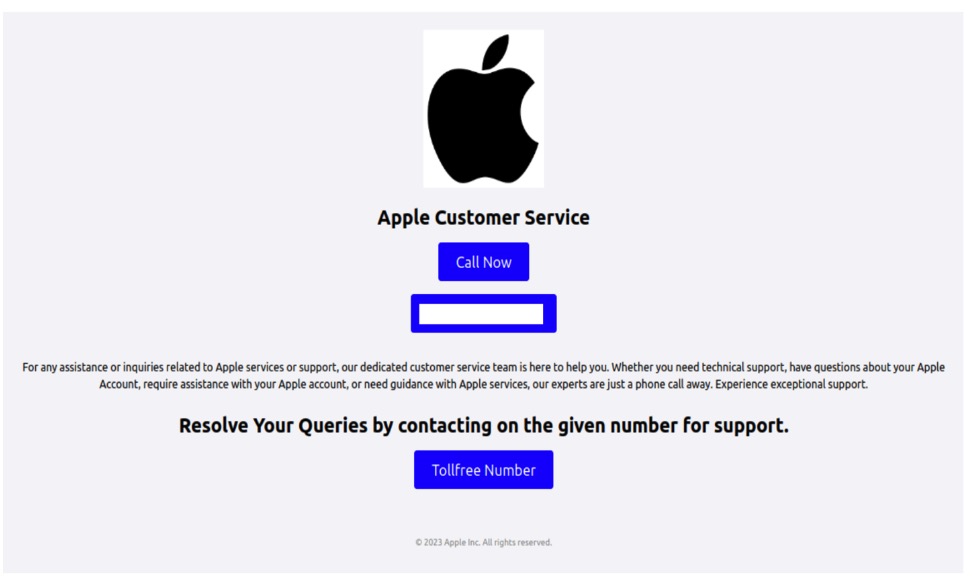

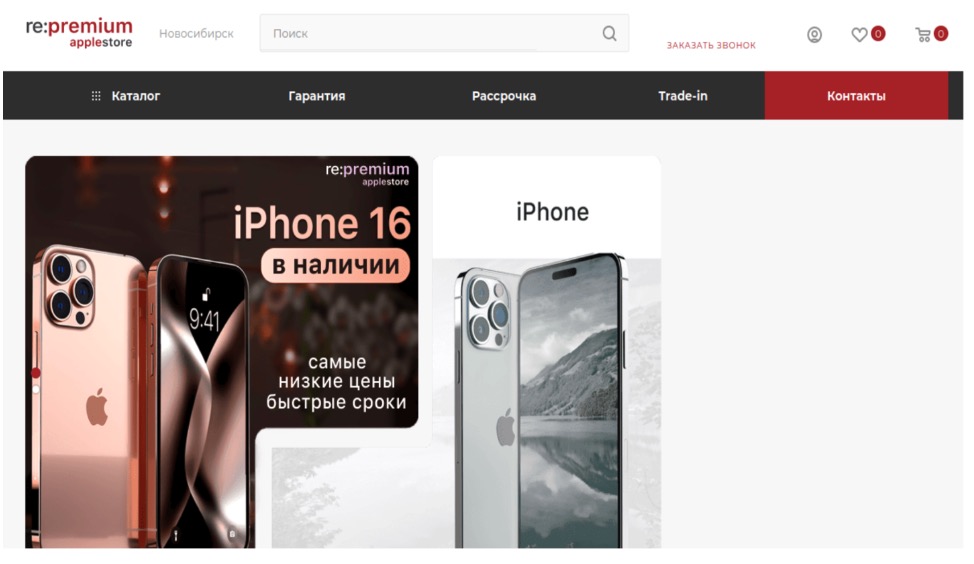

The kind of excitement and buzz surrounding Apple’s new iPad and iPhone is just what cybercrooks dream of when they plot their scams. They will mention must-have holiday gifts in dangerous links, phony contests, and phishing emails to grab your attention. Once they’ve caught your eye, they will again try to get you to reveal personal information or click on a dangerous link that could download malware onto your machine. Be suspicious of any deal mentioning hot holiday gift items—especially at extremely low prices—and try to verify the offer with the real retailer involved.

Cybercriminals exploit employee expectations of year-end communications by creating fake emails that appear to come from your HR department. These messages often claim to contain annual bonus information, updated benefits packages, or mandatory holiday attendance announcements. These scams are particularly effective because they prey on legitimate employee concerns about compensation, benefits, and personal time off during the holiday season. The emails often feature real-looking company logos, proper formatting, and even references to company policies to increase their credibility.

Gift cards are probably the perfect gift for some people on your holiday list. Given their popularity, cybercriminals can’t help but want to get in on the action by offering bogus gift cards online. Be wary of buying gift cards from third parties. It’s best to buy from the official retailer. Just imagine how embarrassing it would be to find out that the gift card you gave your mother-in-law was fraudulent!

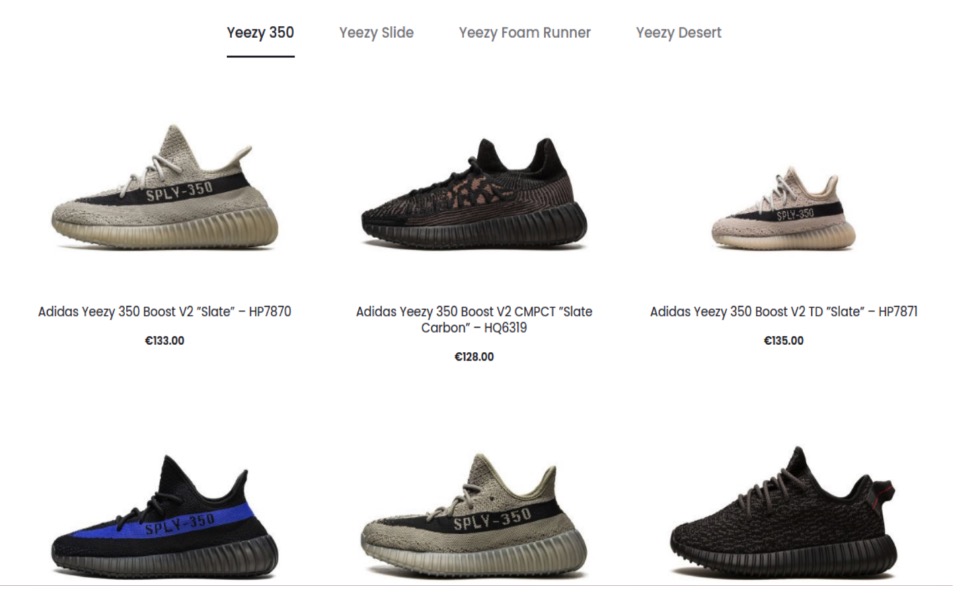

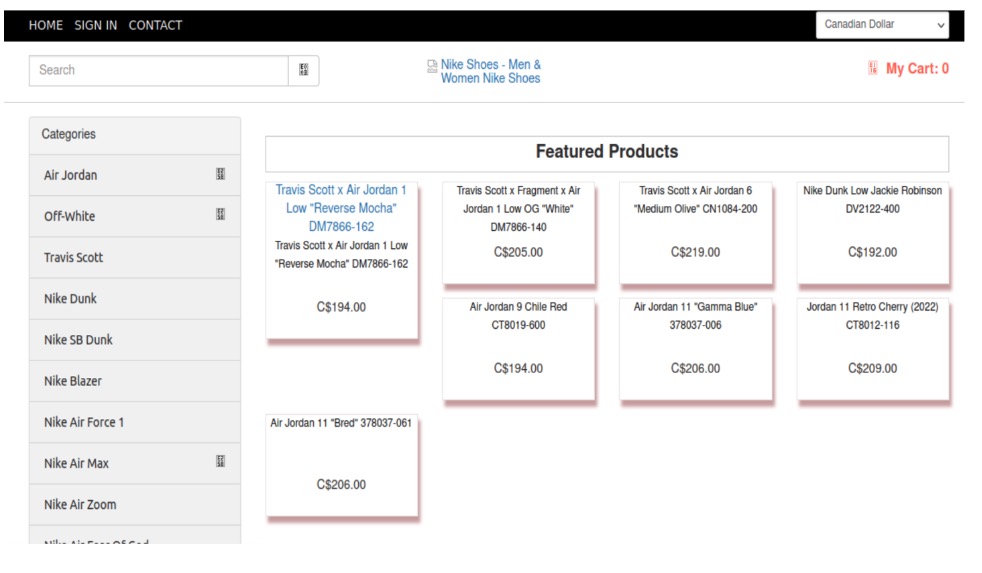

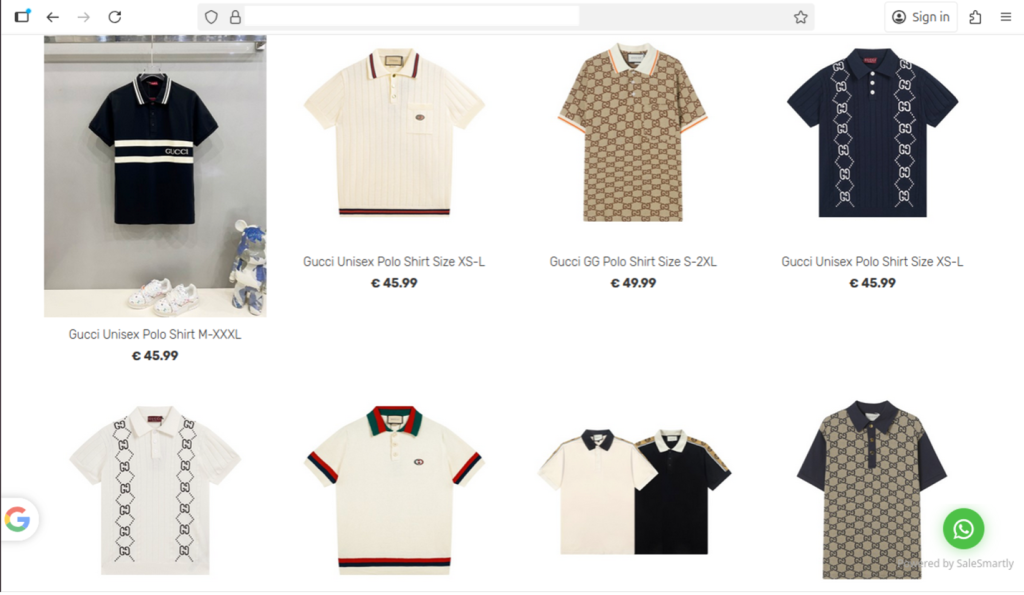

No matter what gift you’re looking for, chances are you can find it quickly and easily online, but you still want to be careful in selecting which site to shop. By promoting great deals, phony e-commerce sites will try to convince you to type in your credit card number and other personal details. After obtaining your money and information, you never receive the merchandise, and your personal information is put at risk. To prevent falling victim to bogus e-commerce stores, shop only at trusted and well-known e-commerce sites. If you’re shopping on a site for the first time, check other users’ reviews and verify that the phone number listed on the site is legitimate.

This is one of the biggest scams of every holiday season. As we open our hearts and wallets, the bad guys will send spam emails and pretend to be a real charity in the hope of getting in on the giving. Their emails will sport a stolen logo and copycat text, or come from an entirely invented charity. If you want to give, it’s always safer to visit the charity’s legitimate website, and do a little research about the charity before you donate.

E-cards are a popular way to send a quick “thank you” or holiday greeting. While most e-cards are safe, some are malicious and may contain spyware or viruses that download onto your computer once you click on the link to view the greeting. Before clicking, look for clues that the e-card is legitimate. Make sure it comes from a well-known e-card site by checking the domain name of the included link. Also check to see that the sender is someone you actually know, and that there are no misspellings or other red flags that the card is a fake.

With increased package deliveries during the holiday season, fake shipping notifications have become a common attack. These messages claim to be from legitimate shipping companies such as UPS, FedEx, or DHL, informing you of package delivery attempts or shipping delays. To complete the delivery, these notices will ask you to click on malicious links or attachments that will download malware or direct you to fake websites that will steal personal information. The timing of these attacks coincides with legitimate increased shipping activity, making them harder to distinguish from authentic communications. To track your deliveries, it is best to check the shipping company’s real website or through the trusted platform from which you ordered the product.

Knowing about these common scam tactics is only the first step toward protecting yourself and those you care about. The next step is for you to learn and implement practical, effective strategies to stay safe while still enjoying digital holiday shopping and giving.

The holiday season brings joy and connection, but it’s also a time when scammers work hardest to exploit your festive but rushed and distracted spirit. Effective Christmas scam prevention starts with awareness. By slowing down and taking a moment to verify before you click or buy, and using layered cybersecurity protections, you can worry about one less thing and focus on what matters most this season.

Stay security-conscious without letting fear diminish your holiday enjoyment and pursue your digital holiday activities with the right knowledge and tools. We hope that the specific, actionable protections will help you identify red flags, verify legitimate offers, secure your devices and accounts, and respond effectively to suspicious activity. Stay informed by following trusted sources for the latest cybersecurity tips during the holidays, and make this season about celebrating safely with the people you care about most.

Send the link to this page to your family and friends to increase their awareness and take steps to protect themselves.

The post The Top 12 Scams Of Christmas To Watch Out For appeared first on McAfee Blog.

Thanksgiving—not before Halloween as we see things in stores and online now. It seems like the holiday season and decorations start earlier and earlier every year.

But one thing that hasn’t changed is that Black Friday is still a big shopping day. With the advent of online shopping has emerged Cyber Monday, another big sale day for online shoppers on the first Monday after Thanksgiving.

Although many of us may take advantage of these great deals that the holidays offer, we also need to be aware of the risks. Online shopping is a fun and convenient way to make purchases, locate hard-to-find items, and discover bargains, but we need to take steps to protect ourselves.

This guide looks at the methods and warning signs behind online shopping scams, shows you how to recognize fake shopping apps and websites, and shares tips for staying safe online.

Online shopping has become a cornerstone of American life. CapitalOne Shopping projects American online spending to reach $1.34 trillion in 2024 and exceed $2.5 trillion in 2030.

With such a massive sum at stake, cybercriminals are laser-focused on taking a share of it, posing financial risk to the 288 million Americans who shop online. As e-commerce grows, so does fraud. In 2024, e-commerce fraud was valued at $44.3 billion, a number seen to grow by 141% to $107 billion in 2029.

Be that as it may, there are many smart shopping habits you can apply to dramatically reduce your risk of becoming a victim of online shopping fraud and enjoy the convenience and benefits of online commerce.

Online shopping scams are designed to look normal—at first glance—especially during busy sale seasons when we’re distracted by a million preparations, moving fast, and chasing deals. These are the very circumstances that fraudsters bank on to victimize you into taking the bait. Being aware of the common scam indicators will help you pause and think, recognize trouble early, and protect both your money and your personal information.

Safe online shopping starts with recognizing the hallmarks of legitimate retailers. Before you enter any payment details, take a moment to verify that the website you’re shopping on is genuine. Scam stores can look polished and convincing, but they often leave behind subtle clues. Here are quick ways to check their authenticity:

trustmark, indicating that the site has been scanned and verified as secure by a trusted third party. This security seal indicates that the site will help protect you from identity theft, credit card fraud, spam, and other malicious threats.

trustmark, indicating that the site has been scanned and verified as secure by a trusted third party. This security seal indicates that the site will help protect you from identity theft, credit card fraud, spam, and other malicious threats.The FTC also recommends these additional tips so you can enjoy all the advantages that online shopping has to offer and prevent risking your personal information.

Online shopping should feel exciting, not a dangerous undertaking you have to brace for, especially during the season of giving. It can be, with a few simple steps—checking the URL, looking for HTTPS, verifying the seller, paying with a credit card or virtual number, and trusting your gut when something feels suspicious. These small habits will keep your money and your identity where they belong: with you.

For increased safety while shopping online, seek out the help of a trusted security solution such as McAfee+ that will alert you of risky links and compromised websites to prevent identity theft or malware infection.

If this guide helps you, pass it along to someone you care about. Scams don’t just target individuals—they cascade into families and friend groups. The more we normalize safe shopping habits and increase our vigilance, the harder it is for fraudsters to win. If you ever feel unsure mid-purchase, take a breath and double-check. A few extra seconds now can save you a lot of stress later. Stay safe, and happy shopping!

The post Helpful Tips for Safe Online Shopping appeared first on McAfee Blog.

This is a critical time for our personal security, especially as it relates to privacy and personal information. A battle is being waged over our data, and there are several parties involved in this fight. My concern is securing the personal details that you prefer to keep private.

Criminal hackers and identity thieves want to use your name to open new accounts, which they can turn into cash. They may try to obtain credit cards, utility services, or mobile phones using your good credit. In other cases, these same thieves take over existing bank or credit card accounts and clean them out entirely. An average of more than ten million people a year are affected by identity theft.

Online, advertisers and marketers are using “supercookies” to glean information about you and your web browsing habits. They can then offer you products or services based on the profile they’ve developed. Almost every major website contains cookies, and they are changing the way advertising is created and targeted.

The Federal Trade Commission (FTC) is working on a way for you to opt out of this data collection, but if a change ever does take place, it will probably be futile. The advertising industry has already partnered with major media and major tech companies, and it’s unlikely that we’ll be able to turn back the clock.

Social media companies compete for your attention and your information because user data is valuable to advertisers and marketers. Whatever you post in your profile is broken down, cataloged, and disseminated. Your name, age, address, email, phone number, contacts, income status, job description, and other personal details are of use to anyone targeting your wallet.

But legitimate advertisers aren’t the only ones going after social networks. Criminal hackers and identity thieves are accessing your data, either through the public portion of these sites or by hacking through the back door. The bad guy is using your profile information to come up with an answer to your password reset question, or to trick you into opening your wallet or entering login credentials that might allow them to take over your existing accounts.

Amid all these developments, the National Cyber Security Alliance established Data Privacy Day, an annual awareness event observed every January 28th that encourages you to take control of your personal information and understand your privacy rights online. Originally launched in 2008, this important day coincides with the anniversary of the signing of Convention 108, the first legally binding international treaty dealing with privacy and data protection.

As a U.S. consumer, Data Privacy Day matters to you more than ever because your personal information has become incredibly valuable and, unfortunately, increasingly vulnerable. Every day, you share personal details through social media, shopping websites, mobile apps, and online services, often without realizing how this information is collected, used, or shared.

The observance of this day highlights several key risks that affect your daily digital life. Data misuse occurs when companies collect more information than necessary or use your personal details in ways you haven’t explicitly approved. Identity theft remains a significant threat, with criminals using stolen personal information to open fraudulent accounts, make unauthorized purchases, or even file fake tax returns. Additionally, data breaches continue to expose millions of Americans’ personal information each year, from social security numbers to financial details.

What makes Data Privacy Day empowering is its focus on actionable steps you can take immediately. Rather than feeling overwhelmed by privacy concerns, you can use this day as motivation to review and strengthen your digital privacy habits. The day is a reminder that privacy and data protection aren’t just technical concepts. They’re fundamental rights that help you maintain control over your digital life.

Before delving deeper into regulations and best practices, let’s take a look at the core concepts. The Federal Trade Commission defines data privacy as the reasonable expectation that your personal information will be handled appropriately by the organizations that collect it. It is your fundamental right to control how your personal information is collected, used, shared, and retained by the companies and services you interact with every day. At its heart, data privacy ensures that you have a say in what happens to details about your life, from your name and email address to your online shopping preferences, videos watched, social media usage, down to your browsing habits and location data.

Your data follows a path that starts with collection, when companies gather information directly from you, such as when you fill out a form, or indirectly through cookies and tracking pixels. The use phase refers to how organizations process your information, whether to improve their services, target advertisements, or analyze user behavior. Sharing involves passing your data to third parties, from business partners to data brokers. Retention determines how long your information stays in their systems, often well beyond your active relationship with the service.

Throughout this process, your information is governed by three principles of modern data privacy:

When Netflix asks if you want to share viewing data to improve recommendations, that’s consent in action. When Google lets you download your search history or delete location tracking, you’re exercising control. When Apple’s privacy labels show exactly what data an app collects, that’s transparency working for you.

Under these newly instituted state privacy laws, you have several key rights that put you in control of your personal information:

Data protection and data privacy are sometimes used interchangeably, but they serve different but complementary roles in keeping your personal information safe:

Here are some everyday scenarios that show how these concepts work differently:

As a consumer, your data privacy rights translate into real, actionable benefits you can use today. However, the effectiveness of these protections often depends on enforcement and your own awareness of the tools available to you.

U.S. state privacy laws are increasingly giving you the right to know what personal information companies collect, the right to delete your data, and the right to opt out of having your information sold or shared.

America’s privacy framework is built on sector-specific federal regulations combined with increasingly robust state legislation. This approach means your rights and protections can vary significantly depending on where you live and what type of data is being collected.

At the federal level, key laws include the Health Insurance Portability and Accountability Act (HIPAA) for healthcare data, the Fair Credit Reporting Act (FCRA) for credit information, and the Children’s Online Privacy Protection Act (COPPA) for children under 13 years. While these provide important protections in specific areas, they leave significant gaps in comprehensive consumer data privacy protection.

To fill these gaps, California established crucial precedents through the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA). Other states are also now enacting comprehensive privacy laws, including Virginia’s Consumer Data Protection Act, Colorado Privacy Act, Connecticut’s Data Privacy Act, and Utah’s Consumer Privacy Act. Each provides residents with fundamental rights over their personal data while requiring businesses to implement stronger protection measures.

Sensitive personal data represents the most valuable and vulnerable information about you—the details that, if compromised, could cause significant harm to your finances, safety, and peace of mind. Unlike basic contact information, sensitive data requires stronger legal protections and your extra vigilance because of its potential for misuse.

Your health information deserves particular care because it reveals intimate details about your physical and mental well-being. HIPAA protections cover medical records, but health data collected by fitness apps, mental health platforms, or wellness websites may not receive the same legal safeguards.

Biometric data—your unique physical characteristics such as fingerprints, voice patterns, or facial features—can’t be changed if stolen, making this information particularly precious.

Children’s data receives special attention under privacy laws because minors can’t meaningfully consent to data collection. The Children’s Online Privacy Protection Act requires explicit parental consent before companies can collect information from children under 13, while some state laws extend these protections to older teens.

Meanwhile, global services such as Google, Facebook, or Netflix apply the Europe-established General Data Protection Regulation (GDPR) laws worldwide to maintain consistent data practices.

GDPR personal data includes obvious identifiers such as your name, email address, phone number, and Social Security number. But it also covers less obvious information such as IP addresses, device IDs, location data, and even your online shopping habits or social media activity. Essentially, if data points can be combined to create a profile of you, they qualify as personal data under GDPR standards. This broader definition gives you stronger control over your information and has influenced many U.S. companies to offer the same rights to all users, not just Europeans.

Whether a company follows GDPR, California’s privacy laws, or other frameworks, the core principle remains the same: you deserve transparency and control over your personal information.

Your privacy rights are expanding, but exercising them effectively requires staying informed and taking proactive steps. As we celebrate Data Privacy Day, we recommend you participate by taking simple, practical steps to exercise your data privacy rights.

Start with the platforms and services you use most frequently. Look for privacy or data protection sections in your account settings and review what information is being collected and shared.

Many major companies now provide online forms or dedicated email addresses for privacy requests. Take advantage of these to understand what data they have about you. Popular platforms such as Google, Facebook, and Amazon have streamlined processes for data downloads.

Look for “Do Not Sell My Personal Information” links on websites, typically found in footers or privacy policy pages. You can also use opt-out tools such as the Global Privacy Control browser setting that automatically signals your opt-out preferences.

Many data brokers now offer opt-out mechanisms, though the process can be time-consuming. Consider using privacy services that handle multiple opt-out requests on your behalf.

Regularly search for your name and personal information online. Set up Google Alerts for your name and key personal details to stay informed about new appearances of your information. In addition, monitor your credit reports for unauthorized changes, and use identity monitoring services that watch for your personal information appearing in data breaches or on the dark web.

When sharing sensitive information online, verify that websites use https:// in the address bar and read privacy policies before providing personal details. Only use well-established, privacy-focused health, financial, and communication platforms with strong privacy and data protection track records.

For children’s data, maintaining active oversight will help you stay ahead of potential problems in their online activities. Review the apps and websites they use, understand what information these platforms collect, and use parental controls to limit data sharing. Teach your children about privacy and the risks of sharing personal information online.

Protecting your personal data doesn’t have to feel like a giant, technical project. Most privacy wins come from small, repeatable habits that you can do in minutes to shrink your digital footprint, and use the internet on your terms.

Your personal information has value, so make sure you’re getting a fair return through services that respect your privacy.

What counts as personal data?

Personal data includes any information that can identify you directly or indirectly. This covers obvious details such as your name, email, and Social Security number, but also extends to IP addresses, device identifiers, location data, browsing history, and even inferences about your preferences or behavior.

How can I opt out of data sale and sharing?

On company websites, look for “Do Not Sell My Personal Information” or “Your Privacy Choices” links, usually found in the footer. You can also use the Global Privacy Control browser signal to automatically send opt-out requests. Services such as DeleteMe or manual removal requests can help you reclaim control of your information from data brokers and multiple platforms.

What should I do after a data breach?

First, change passwords for affected accounts and enable two-factor authentication. Next, monitor your credit reports and bank statements for unusual activity. If Social Security numbers or financial data were involved, place a credit freeze with all three major credit bureaus. Sign up for identity monitoring services if offered by the breached company. Be sure to document everything and report identity theft to the FTC if you notice fraudulent activity.

How do I spot dark consent patterns?

Watch for manipulative design tricks that push you toward sharing more data. Red flags include pre-checked boxes for marketing emails, making privacy-friendly options harder to find or understand, using confusing language that hides the intent, or making it much easier to accept all cookies than customize your preferences. Legitimate consent should be freely given, specific, informed, and easily withdrawn.

What rights do I have over my personal data?

Depending on your location, you may have the right to know what data companies collect about you, request copies of your data, correct inaccurate information, delete your data, and opt out of its sale or use for targeted advertising. Some laws also give you the right to data portability and protect you from discrimination for exercising these rights. Check if your state has comprehensive privacy laws or if you’re covered by GDPR.

What essential resources can I read to stay informed?

To stay current with your privacy rights and the evolving legal landscape, bookmark these authoritative resources:

Data Privacy Day serves as an important annual reminder, but your commitment to privacy and data protection shouldn’t end when January 28th passes. The digital threats we face continue to evolve throughout the year, making ongoing vigilance essential to protect your personal details.

Small, consistent habits can make a profound difference in your digital security. By regularly updating your passwords, enabling multi-factor authentication, reviewing privacy settings on your accounts, and staying informed about emerging threats, you create layers of protection that work together to safeguard your information.

Invest in McAfee+ identity protection, which includes proactive identity surveillance to monitor subscribers’ credit and personal information, as well as access to live fraud resolution agents who help subscribers work through the process of resolving identity theft issues.

The post Celebrate Data Privacy Day by Applying These Best Practices appeared first on McAfee Blog.

The malware landscape is growing more complex and costly by the minute, as indicated by the rising number of cyberattacks that grow each year. According to the Federal Bureau of Investigation, in 2024, approximately $1.4 million in losses were reported due to malware. Meanwhile, complaints of ransomware, a type of malware that locks your files until a ransom is paid to release them, rose by 9% from the year prior, with losses totaling nearly $12.5 million.

With the continued growth of e-commerce, online banking, and artificial intelligence, we can count on even more new cyber threats for all kinds of devices—be it Android, iPhone, PC, or Mac. No device under your family’s roof is immune to cyberattacks. As we speak, one or more of your devices may have already been infected. But would you know it?

In this blog, we’ll dive into the types of viruses and malware that infiltrate devices and their indications, the ways you can remove them, and tips to protect your phones moving forward.

Malware is malicious software designed to harm your device, steal your personal information, or disrupt your digital life. On mobile devices, malware can take many forms—from apps that secretly collect your data to programs that bombard you with unwanted ads or even lock your device for ransom.

Mobile devices, including smartphones and tablets, can be infected with malware and other digital threats, even when their operating systems have built-in security features. How does this happen? Your phone can catch viruses and malware in several ways:

Malware doesn’t always announce itself with a big flashing sign. On the contrary, it slips quietly into your devices and starts causing trouble behind the scenes. Before long, you will see noticeable changes in its behavior. Here are five key signs of malware or a virus to watch for and catch the problem early, before the damage spreads:

As our phones and tablets become extensions of our daily lives, cybercriminals have developed sophisticated malware explicitly designed to infiltrate them, such as:

Sometimes the warning signs are obvious, but at other times, malware operates quietly in the background, stealing data or draining resources without drawing attention. Find out for sure if your device has a virus or malware by following these steps:

Here are more specific measures to ascertain the presence of a virus or malware, based on your mobile device’s operating system:

If you discover malicious apps and profiles in your phone, a clear, step-by-step action plan will help you remove them and restore your device to a secure state. Here’s how to tackle mobile malware confidently and get your device back to normal:

With a few smart habits and simple tools, you can create a safer digital environment for your family members. Here are some practical ways to safeguard family devices and keep threats at bay.

While the threat of malware and viruses continues to evolve, you now have the knowledge and tools to stay digitally protected. The signs we’ve discussed—from unexpected device behavior to suspicious pop-ups—serve as warnings, helping you catch problems before they escalate into major security incidents.

Your best defense combines proactive security measures and vigilant behavior. Applying simple, solid digital habits such as updating software, using strong passwords, and staying alert to suspicious activity will thwart the vast majority of common threats. By incorporating these practices into your routine, along with the right online security tools, you are building a robust defense that works around the clock.

The post 5 Signs Your Device May be Infected with Malware or a Virus appeared first on McAfee Blog.

It’s the screen you never want to see.

Something is seriously wrong with your phone. Or is it? You might not have a broken phone at all. Instead, you might have a hacked phone.

What you see above is a form of scareware, an attack that frightens you into thinking your device is broken or infected with a virus. What the hacker wants you to do next is panic. They want you to tap on a bogus link that says it’ll run a security check, remove a virus, or otherwise fix your phone before the problem gets worse.

Of course, tapping that link takes you to a malware or phishing site, where the hacker takes the next step and installs an even nastier form of malware on your phone. In other cases, they steal your personal info under the guise of a virus removal service. (And yes, sometimes they pose as McAfee when they pull that move. In fact,

Note that in this example above, the hacker behind the phony broken screen is arguably going for a user who’s perhaps less tech savvy. After all, the message atop the “broken” screen appears clear as day. Still, in the heat of the moment, it can be convincing enough.

Scareware typically finds its way onto phones through misleading ads, fake security alerts, or hacked websites. In other cases, downloading apps from places other than an official app store can lead to scareware (and other forms of malware too).

As for malware on phones, you’ll find different risk levels between Android and iOS phones. While neither platform is completely immune to threats, Android phones are reportedly more susceptible to viruses than iPhones due to differences in their app downloading policies. On Android phones, you can install apps from third-party sources outside the official Google Play Store, which increases the risk of downloading malicious software.

In contrast, Apple restricts app installations to its official App Store, making it harder for malware to get on iOS devices. (That’s if you haven’t taken steps to jailbreak your iPhone, which removes the software restrictions imposed by Apple on its iOS operating system. We absolutely don’t recommend jailbreaking because it may void warranties and make it easier for malware, including scareware, to end up on your phone.)

If you think you’ve wound up with a case of scareware, stay calm. The first thing the hacker wants you to do is panic and click that link. Let’s go over the steps you can take.

If you don’t already have mobile security and antivirus for your phone, your best bet is to get the latest virus removal guidance from Android, which you can find on this help page.

Moving forward, you can get protection that helps you detect and steer clear of potential threats as you use your phone. You can pick up McAfee Security: Antivirus VPN in the Google Play store, which also includes our Scam Detector and Identity Monitoring. You can also get it as part of your McAfee+

Step 1: Restart your phone

Hold down the iPhone power button until you see slide to power off on your screen. Slide it, wait for the phone to power down, and then press the power button to restart your iPhone.

Step 2: Download updates

Having the latest version of iOS on your phone ensures you have the best protection in place. Open the Settings app. Look for Software Update in the General tab. Select Software Update. Tap Download and Install to the latest iPhone update.

Step 3: Delete suspicious apps

Press a suspicious app icon on your screen and wait for the Remove App to pop up. Remove it and repeat that as needed for any other suspicious apps.

More steps you can take …

If those steps don’t take care of the issue, there are two stronger steps you can take. The first involves restoring your phone from a backup as described by Apple here.

The most aggressive step you can take is to reset your phone entirely. You can return it to the original factory settings (with the option to keep your content) by following the steps in this help article from Apple.

Clearly these attacks play on fear that one of the most important devices in your life has a problem—your phone.

Comprehensive online protection software can secure your phone in the same ways that it secures your laptops and computers. Installing it can protect your privacy, keep you safe from attacks on public Wi-Fi, automatically block unsafe websites and links, and detect scams, just to name a few things it can do.

Along with installing security software, keeping your phone’s operating system up to date can greatly improve your security. Updates can fix vulnerabilities that hackers rely on to pull off their malware-based attacks. It’s another tried-and-true method of keeping yourself safe—and for keeping your phone running great too.

Google Play and Apple’s App Store have measures in place to review and vet apps to help ensure that they are safe and secure. Third-party sites might very well not, and they might intentionally host malicious apps as part of a front. Further, Google and Apple are quick to remove malicious apps from their stores when discovered, making shopping there safer still.

The post Black or Scrambled Phone Screen? Here’s How to Spot a Hacked vs Broken Phone appeared first on McAfee Blog.

They came by phone, by text, by email, and they even weaseled their way into people’s love lives—an entire host of scams that we covered here in our blogs throughout the year.

Today, we look back, picking five noteworthy scams that firmly established new trends, along with one in particular that gives us a hint at the face of scams to come.

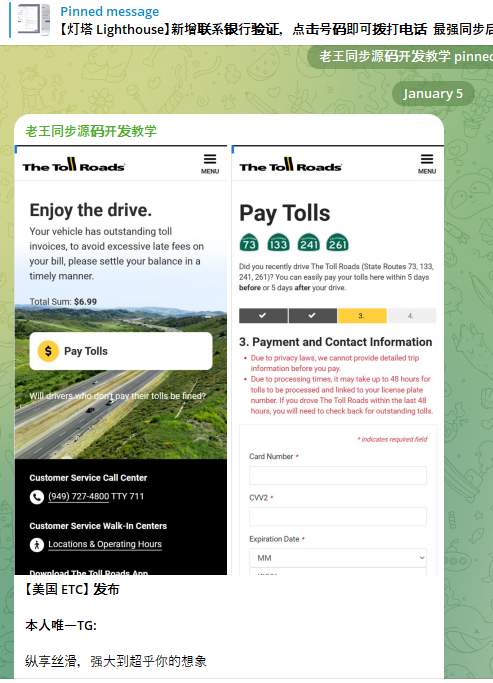

Let’s start it off with one scam that pinged plenty of phones over the spring and summer: those toll road texts.

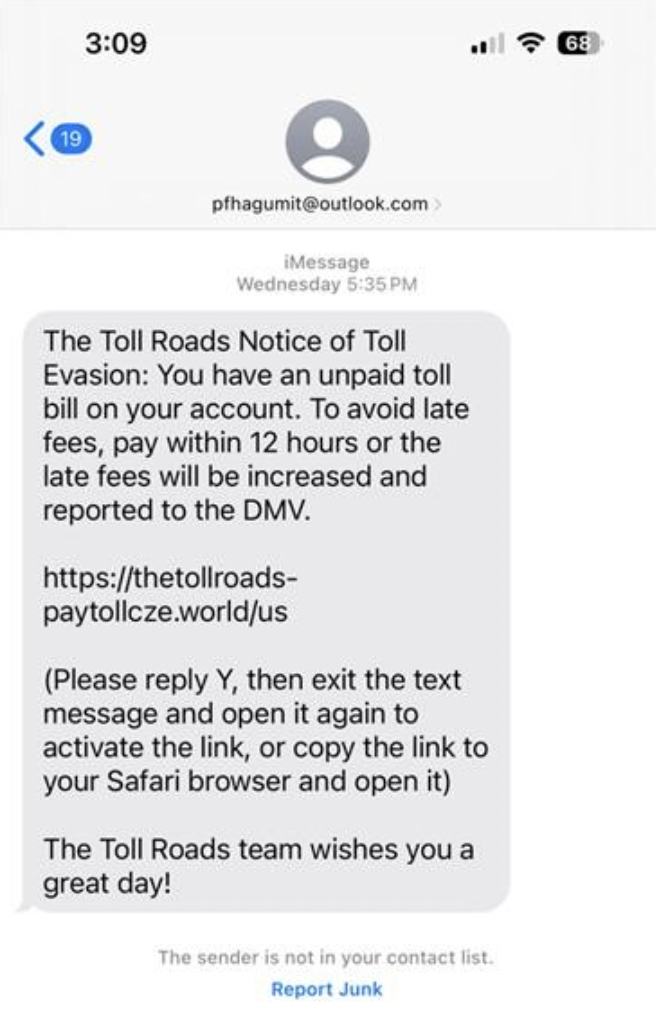

It was the hot new scam of 2025 that increased by 900% in one year: the toll road scam.

There’s a good chance you got a few of these this year,scam texts that say you have an unpaid tab for tolls and that you need to pay right away. And as always, they come with a handy link where you can pay up and avoid that threat of a “late fee.”

Of course, links like those took people to phishing sites where people gave scammers their payment info, which led to fraudulent charges on their cards. In some instances, the scammers took it a step further by asking for driver’s license and Social Security numbers, key pieces of info for big-time identity theft.

Who knows what the hot new text scam for 2026 will be, yet here are several ways you can stop text scams in their tracks, no matter what form they take:

Don’t click on any links in unexpected texts (or respond to them, either). Scammers want you to react quickly, but it’s best to stop and check it out.

Check to see if the text is legit. Reach out to the company that apparently contacted you using a phone number or website you know is real—not the info from the text.

Get our Scam Detector. It automatically detects scams by scanning URLs in your text messages. If you accidentally tap or click? Don’t worry, it blocks risky sites if you follow a suspicious link.

It started with a DM. And a few months later, it cost her $1,200.

Earlier this year, we brought you the story of 25-year-old computer programmer Maggie K. who fell for a romance scam on Instagram. Her story played out like so many. When she and her online boyfriend finally agreed to meet in person, he claimed he missed his flight and needed money to rebook. Desperate to finally see him, she sent the money and never heard from him again.

But here’s the twist—he wasn’t real in the first place.

When she reported the scam to police, they determined his images were all made with AI. In Maggie’s words, “That was the scariest part—I had trusted someone who never even existed.”

Maggie isn’t alone. Our own research earlier this year revealed that more than half (52%) of people have been scammed out of money or pressured to send money or gifts by someone they met online.

Moreover, we found that scammers have fueled those figures with the use of AI. Of people we surveyed, more than 1 in 4 (26%) said they—or someone they know—have been approached by an AI chatbot posing as a real person on a dating app or social media.

We expect this trend will only continue, as AI tools make it easier and more efficient to pull off romance scams on an increasingly larger scale.

Even so, the guidelines for avoiding romance scams remain the same:

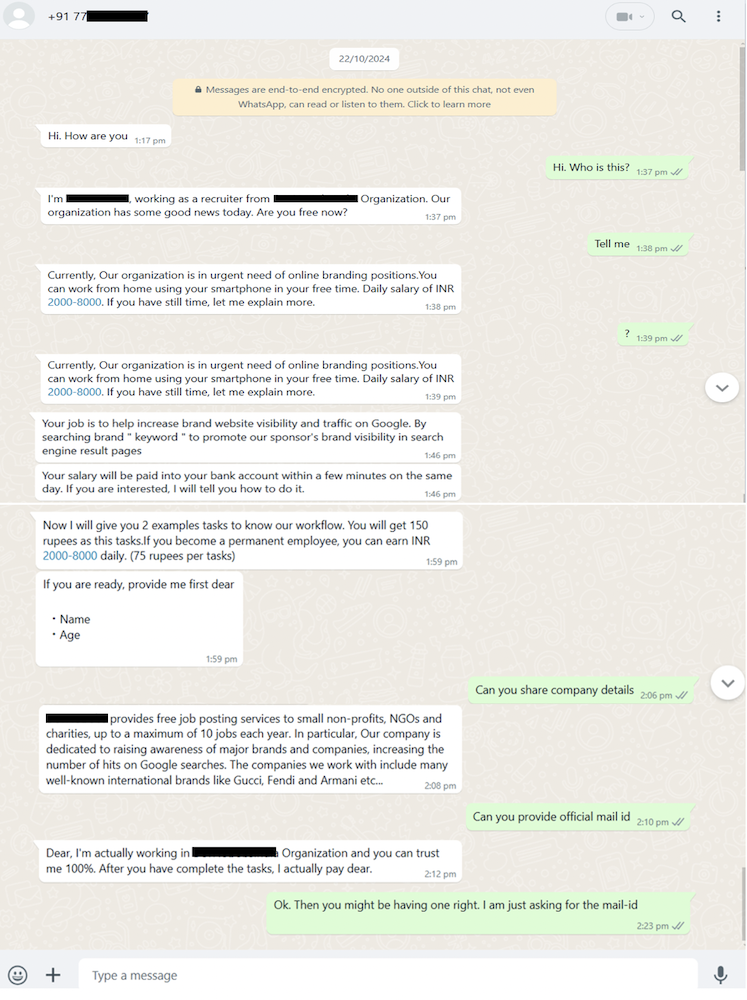

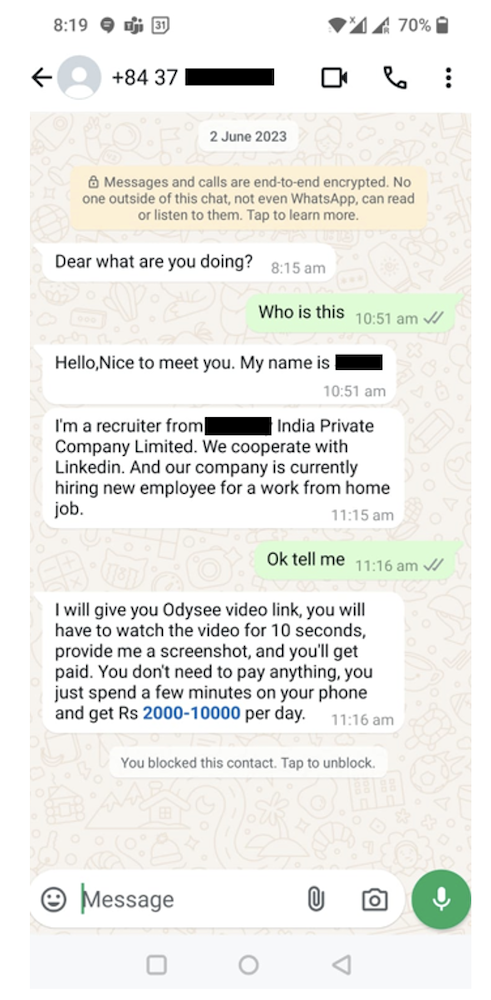

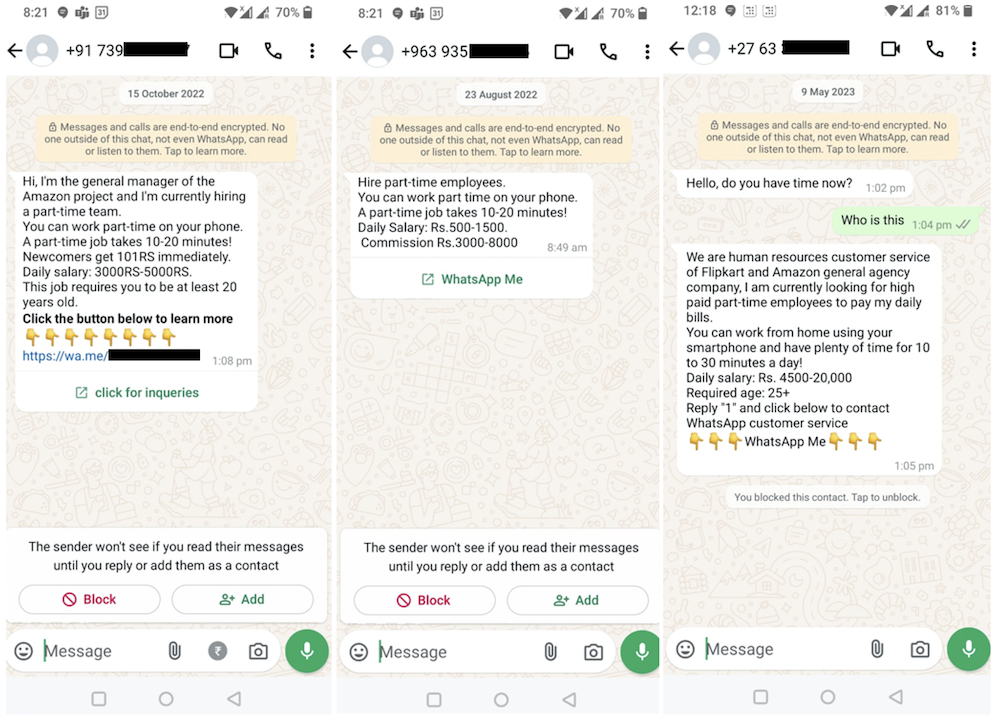

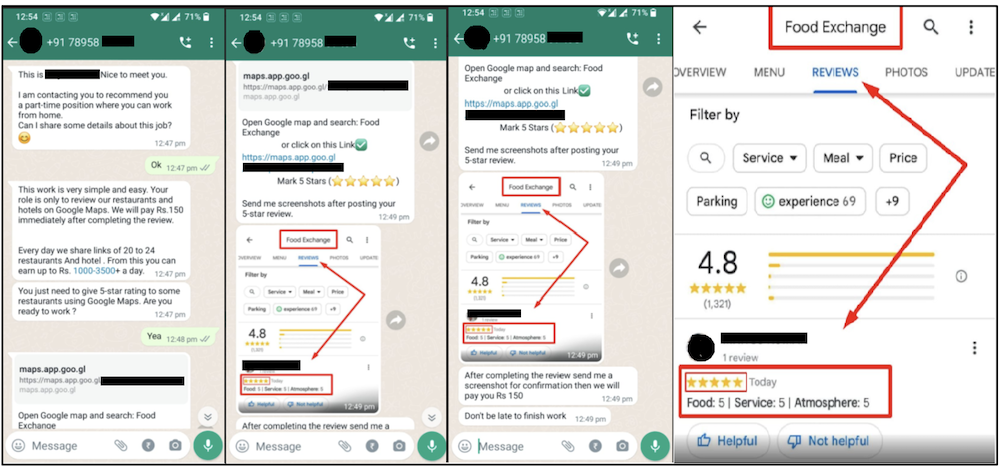

The job offer sounds simple enough … go online, review products, like videos, or do otherwise simple tasks and get paid doing it—until it’s time to get paid.

It’s a new breed of job scam that took root this spring, one where victims found themselves “paying to get paid.”

The FTC dubbed these scams as “gamified job scams” or “task scams.” Given the way these scams work, the naming fits.

It starts with a text or direct message from a “recruiter” offering work with the promise of making good money by “liking” or “rating” sets of videos or product images in an app, all with the vague purpose of “product optimization.” With each click, you earn a “commission” and see your “earnings” rack up in the app. You might even get a payout, somewhere between $5 and $20, just to earn your trust.

Then comes the hook.

Like a video game, the scammer sweetens the deal by saying the next batch of work can “level up” your earnings. But if you want to claim your “earnings” and book more work, you need to pay up. So you make the deposit, complete the task set, and when you try to get your pay the scammer and your money are gone. It was all fake.

This scam and others like it fall right in line with McAfee data that uncovered a spike in job-related scams of 1,000% between May and July,which undoubtedly built on 2024’s record-setting job scam losses of $501 million.

A proper recruiter will reach out to you by email or via a job networking site. Moreover, per the FTC, any job that pays you to “like” or “rate” content is against the law. That alone says it’s a scam.

In the case of job offers in general, look up the company. Check out their background and see if it matches up with the job they’re pitching. In the U.S., The Better Business Bureau (BBB) offers a list of businesses you can search.

Any case where you’re asked to pay to up front, with any form of payment, refuse, whether that’s for “training,” “equipment,” or more work. It’s a sign of a scam.

Prince Harry, Taylor Swift, and now the Today show’s Al Roker, too, they’ve all found themselves as the AI-generated spokesperson for deepfake scams.

In the past, a deepfake Prince Harry pushed bogus investments, while another deepfake of Taylor Swift hawked a phony cookware deal. Then, this spring, a deepfake of Al Roker used his image and voice to promote a bogus hypertension cure—claiming, falsely, that he had suffered “a couple of heart attacks.”

The fabricated clip appeared on Facebook, which appeared convincing enough to fool plenty of people, including some of Roker’s own friends. “I’ve had some celebrity friends call because their parents got taken in by it,” said Roker.

While Meta quickly removed the video from Facebook after being contacted by TODAY, the damage was done. The incident highlights a growing concern in the digital age: how easy it is to create—and believe—convincing deepfakes.

Roker put it plainly, “We used to say, ‘Seeing is believing.’ Well, that’s kind of out the window now.”

In all, this stands as a good reminder to be skeptical of celebrity endorsements on social media. If public figure fronts an apparent deal for an investment, cookware, or a hypertension “cure” in your feed, think twice. And better yet, let our Scam Detector help you spot what’s real and what’s fake out there.

And to close things out, a look at some recent news, which also serves as a look ahead.

Last September, researchers spotted something unseen before:a cyberattack almost entirely run by agentic AI.

What is Agentic AI?

Definition: Artificial intelligence systems that can independently plan, make decisions, and work toward specific goals with minimal human intervention; in this way, it executes complex tasks by adapting to new info and situations on its own.

Reported by AI researcher Anthropic, a Chinese state-sponsored group allegedly used the company’s Claude Code agent to automate most of an espionage campaign across nearly thirty organizations. Attackers allegedly bypassed guardrails that typically prevent such malicious use with jailbreaking techniques, which broke down their attacks into small, seemingly innocent tasks. That way, Claude orchestrated a large-scale attack it wouldn’t otherwise execute.

Once operational, the agent performed reconnaissance, wrote exploit code, harvested credentials, identified high-value databases, created backdoors, and generated documentation of the intrusion. By Anthropic’s estimate, they completed 80–90% of the work without any human involvement.

According to Anthropic: “At the peak of its attack, the AI made thousands of requests, often multiple per second—an attack speed that would have been, for human hackers, simply impossible to match.”

We knew this moment was coming, and now the time has arrived: what once took weeks of human effort to execute a coordinated attack now boils down to minutes as agentic AI does the work on someone’s behalf.

In 2026, we can expect to see more attacks led by agentic AI, along with AI-led scams as well, which raises an important question that Anthropic answers head-on:

If AI models can be misused for cyberattacks at this scale, why continue to develop and release them? The answer is that the very abilities that allow Claude to be used in these attacks also make it crucial for cyber defense. When sophisticated cyberattacks inevitably occur, our goal is for Claude—into which we’ve built strong safeguards—to assist cybersecurity professionals to detect, disrupt, and prepare for future versions of the attack.

That gets to the heart of security online: it’s an ever-evolving game. As new technologies arise, those who protect and those who harm one-up each other in a cycle of innovation and exploits. As we’re on the side of innovation here, you can be sure we’ll continue to roll out protections that keep you safer out there. Even as AI changes the game, our commitment remains the same.

We’re taking a little holiday break here and we’ll be back with our weekly roundups again in 2026. Looking forward to catching up with you then and helping you stay safer in the new year.

The post This Year in Scams: A 2025 Retrospective, and a Look Ahead at 2026 appeared first on McAfee Blog.

If you’re in the market for insurance right now, keep an eye out for scammers in the mix. They’re out in full force once again this open enrollment season.

As people across the U.S. sign up for, renew, or change their health insurance plans, scammers want to cash in as people rush to get their coverage set. And scammers have several factors working in their favor.

For starters, many people find the insurance marketplace confusing, frustrating, and even intimidating, all feelings that scammers can take advantage of. Moreover, concerns about getting the right level of coverage at an affordable price also play into the hands of scammers.

Amidst all this uncertainty and time pressure, health insurance scams crop up online. Whether under the guise of helping people navigate the complex landscape or by offering seemingly low-cost quotes, scammers prey on insurance seekers by stealing their personal information, Social Security numbers, and money.

According to the FBI, health insurance scams cost families millions each year. In some cases, the costs are up front. People pay for fraudulent insurance and have their personal info stolen. And for many, the follow-on costs are far worse, where victims go in for emergency care and find that their treatment isn’t covered—leaving them with a hefty bill.

Like so many of the scams we cover here in our blogs, you can spot health insurance scams relatively quickly once you get to know their ins and outs.

Here’s how some of those scams can play out.

Some are “one and done scams” where the scammer promises a policy or service and then disappears after stealing money and personal info—much like an online shopping scam. It’s a quick and dirty hit where scammers quickly get what they want by reaching victims the usual ways, such as through texts, emails, paid search results, and social media. In the end, victims end up on a phishing site where they think they’re locking in a good deal but handing over their info to scammers instead.

Other scams play a long con game, milking victims for thousands and thousands of dollars over time. The following complaint lodged by one victim in Washington state provides a typical example:

A man purchased a plan to cover himself, his wife, and his two children, only to learn there was no coverage. He was sold a second policy, with the same result, and offered a refund if he purchased a third policy. When he filed a complaint, his family still had no coverage, and he was seeking a refund for more than $20,000 and reimbursement for $55,000 in treatments and prescriptions he’d paid out of pocket.

Scams like these are known as ghost broker scams where scammers pose as insurance brokers who take insurance premiums and pocket the money, leaving victims thinking they have coverage when they don’t. In some cases, scammers initially apply for a genuine policy with a legitimate carrier, only to cancel it later, while still taking premiums from the victim as their “broker.” Many victims only find out that they got scammed when they attempt to file a claim.

Another type of scam comes in the form of policy cancellation scams. These work like any number of other account-based scams, where a scammer pretends to be a customer service rep at a bank, utility, or credit card company. In the insurance version of it, scammers email, text, or call with some bad news—the person’s policy is about to get cancelled. Yet not to worry, the victim can keep the policy active they hand over some personal and financial info. It’s just one more way that scammers use urgency and fear to steal to commit identity theft and fraud.