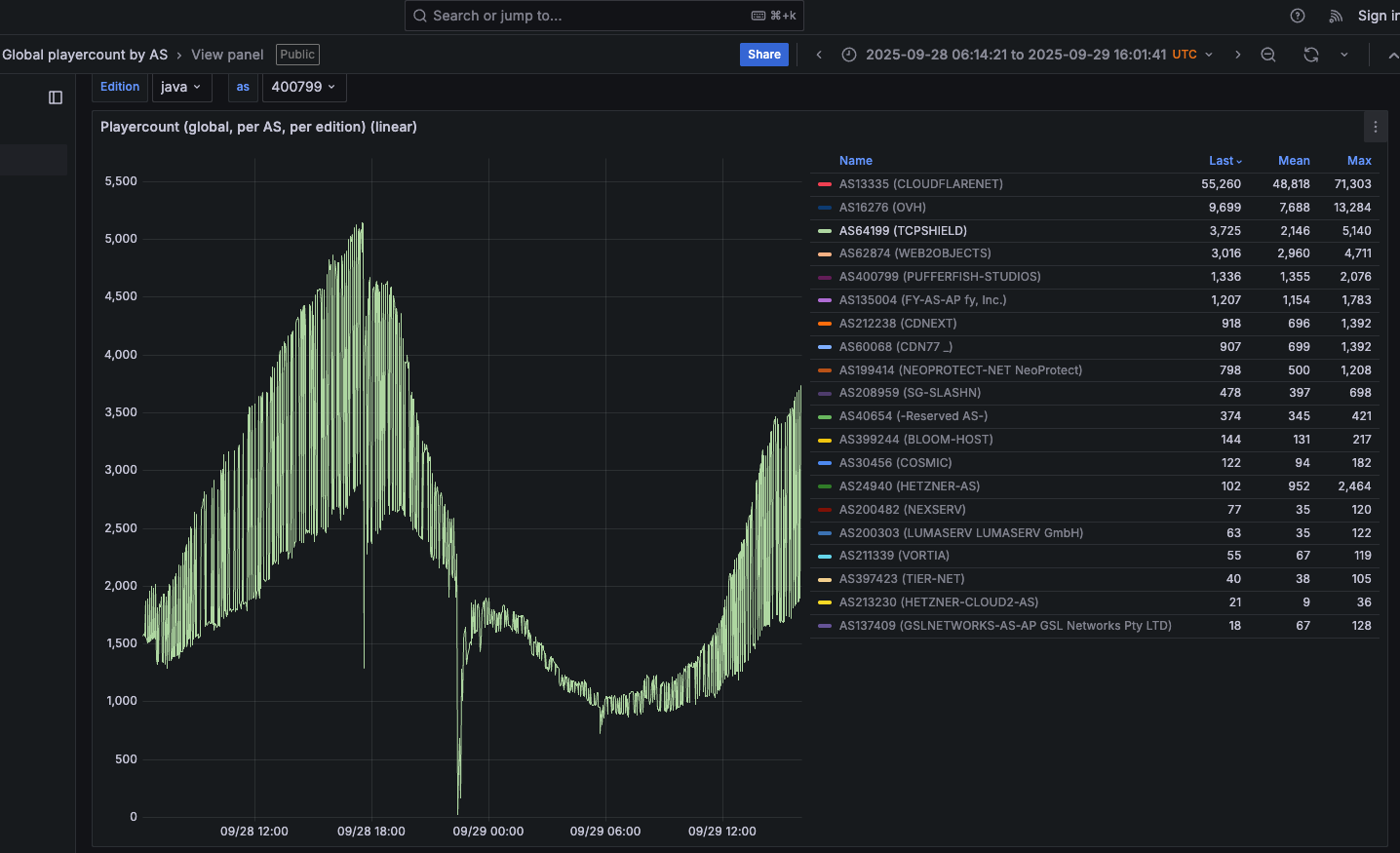

The cybercriminals in control of Kimwolf — a disruptive botnet that has infected more than 2 million devices — recently shared a screenshot indicating they’d compromised the control panel for Badbox 2.0, a vast China-based botnet powered by malicious software that comes pre-installed on many Android TV streaming boxes. Both the FBI and Google say they are hunting for the people behind Badbox 2.0, and thanks to bragging by the Kimwolf botmasters we may now have a much clearer idea about that.

Our first story of 2026, The Kimwolf Botnet is Stalking Your Local Network, detailed the unique and highly invasive methods Kimwolf uses to spread. The story warned that the vast majority of Kimwolf infected systems were unofficial Android TV boxes that are typically marketed as a way to watch unlimited (pirated) movie and TV streaming services for a one-time fee.

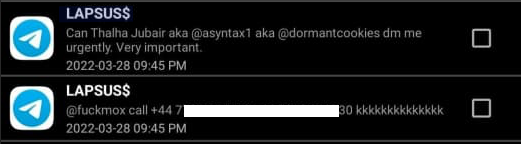

Our January 8 story, Who Benefitted from the Aisuru and Kimwolf Botnets?, cited multiple sources saying the current administrators of Kimwolf went by the nicknames “Dort” and “Snow.” Earlier this month, a close former associate of Dort and Snow shared what they said was a screenshot the Kimwolf botmasters had taken while logged in to the Badbox 2.0 botnet control panel.

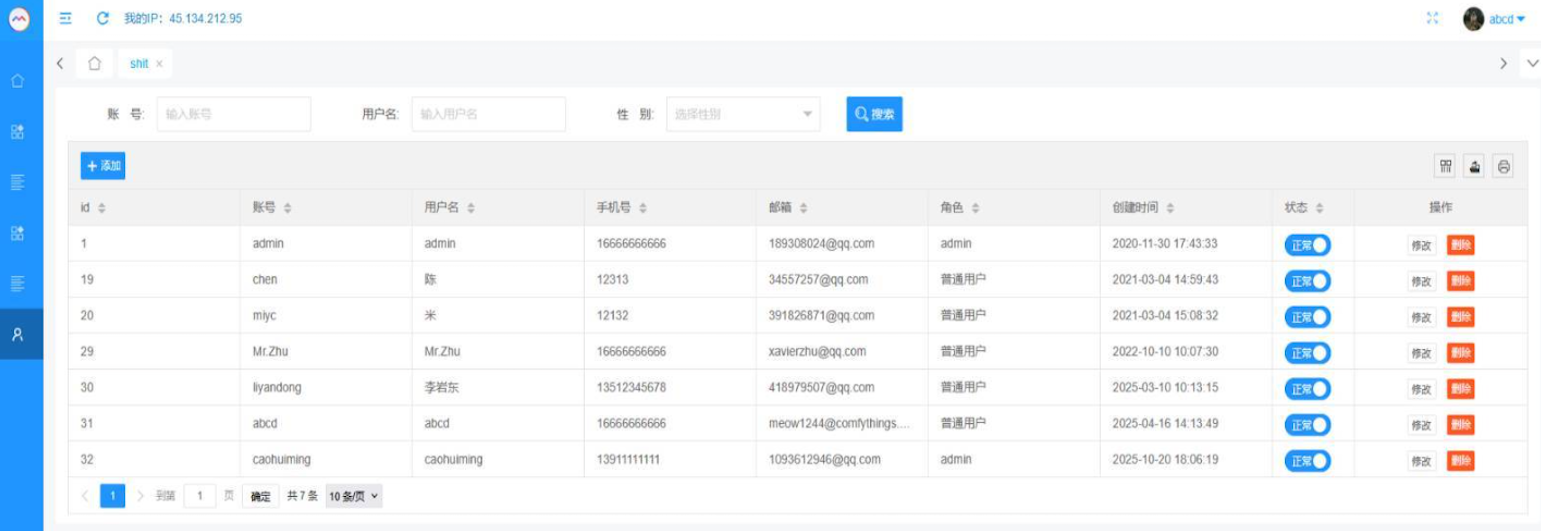

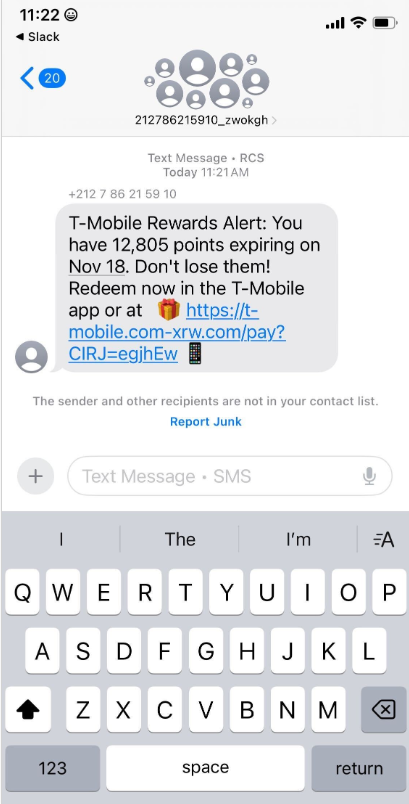

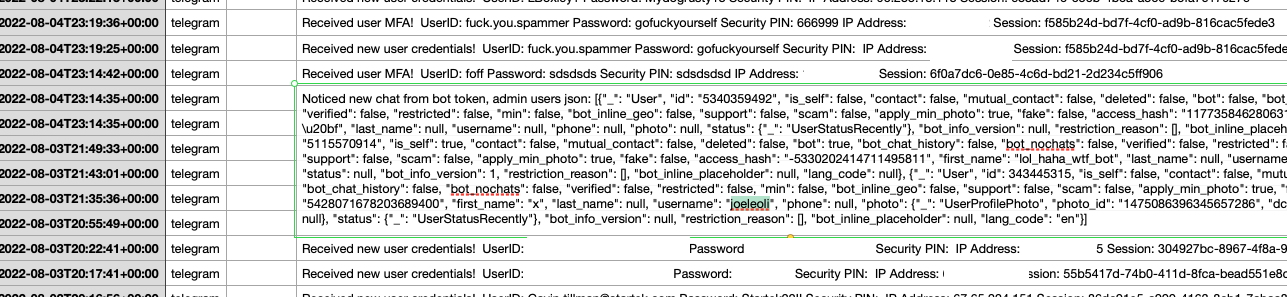

That screenshot, a portion of which is shown below, shows seven authorized users of the control panel, including one that doesn’t quite match the others: According to my source, the account “ABCD” (the one that is logged in and listed in the top right of the screenshot) belongs to Dort, who somehow figured out how to add their email address as a valid user of the Badbox 2.0 botnet.

The control panel for the Badbox 2.0 botnet lists seven authorized users and their email addresses. Click to enlarge.

Badbox has a storied history that well predates Kimwolf’s rise in October 2025. In July 2025, Google filed a “John Doe” lawsuit (PDF) against 25 unidentified defendants accused of operating Badbox 2.0, which Google described as a botnet of over ten million unsanctioned Android streaming devices engaged in advertising fraud. Google said Badbox 2.0, in addition to compromising multiple types of devices prior to purchase, also can infect devices by requiring the download of malicious apps from unofficial marketplaces.

Google’s lawsuit came on the heels of a June 2025 advisory from the Federal Bureau of Investigation (FBI), which warned that cyber criminals were gaining unauthorized access to home networks by either configuring the products with malware prior to the user’s purchase, or infecting the device as it downloads required applications that contain backdoors — usually during the set-up process.

The FBI said Badbox 2.0 was discovered after the original Badbox campaign was disrupted in 2024. The original Badbox was identified in 2023, and primarily consisted of Android operating system devices (TV boxes) that were compromised with backdoor malware prior to purchase.

KrebsOnSecurity was initially skeptical of the claim that the Kimwolf botmasters had hacked the Badbox 2.0 botnet. That is, until we began digging into the history of the qq.com email addresses in the screenshot above.

An online search for the address 34557257@qq.com (pictured in the screenshot above as the user “Chen“) shows it is listed as a point of contact for a number of China-based technology companies, including:

–Beijing Hong Dake Wang Science & Technology Co Ltd.

–Beijing Hengchuang Vision Mobile Media Technology Co. Ltd.

–Moxin Beijing Science and Technology Co. Ltd.

The website for Beijing Hong Dake Wang Science is asmeisvip[.]net, a domain that was flagged in a March 2025 report by HUMAN Security as one of several dozen sites tied to the distribution and management of the Badbox 2.0 botnet. Ditto for moyix[.]com, a domain associated with Beijing Hengchuang Vision Mobile.

A search at the breach tracking service Constella Intelligence finds 34557257@qq.com at one point used the password “cdh76111.” Pivoting on that password in Constella shows it is known to have been used by just two other email accounts: daihaic@gmail.com and cathead@gmail.com.

Constella found cathead@gmail.com registered an account at jd.com (China’s largest online retailer) in 2021 under the name “陈代海,” which translates to “Chen Daihai.” According to DomainTools.com, the name Chen Daihai is present in the original registration records (2008) for moyix[.]com, along with the email address cathead@astrolink[.]cn.

Incidentally, astrolink[.]cn also is among the Badbox 2.0 domains identified in HUMAN Security’s 2025 report. DomainTools finds cathead@astrolink[.]cn was used to register more than a dozen domains, including vmud[.]net, yet another Badbox 2.0 domain tagged by HUMAN Security.

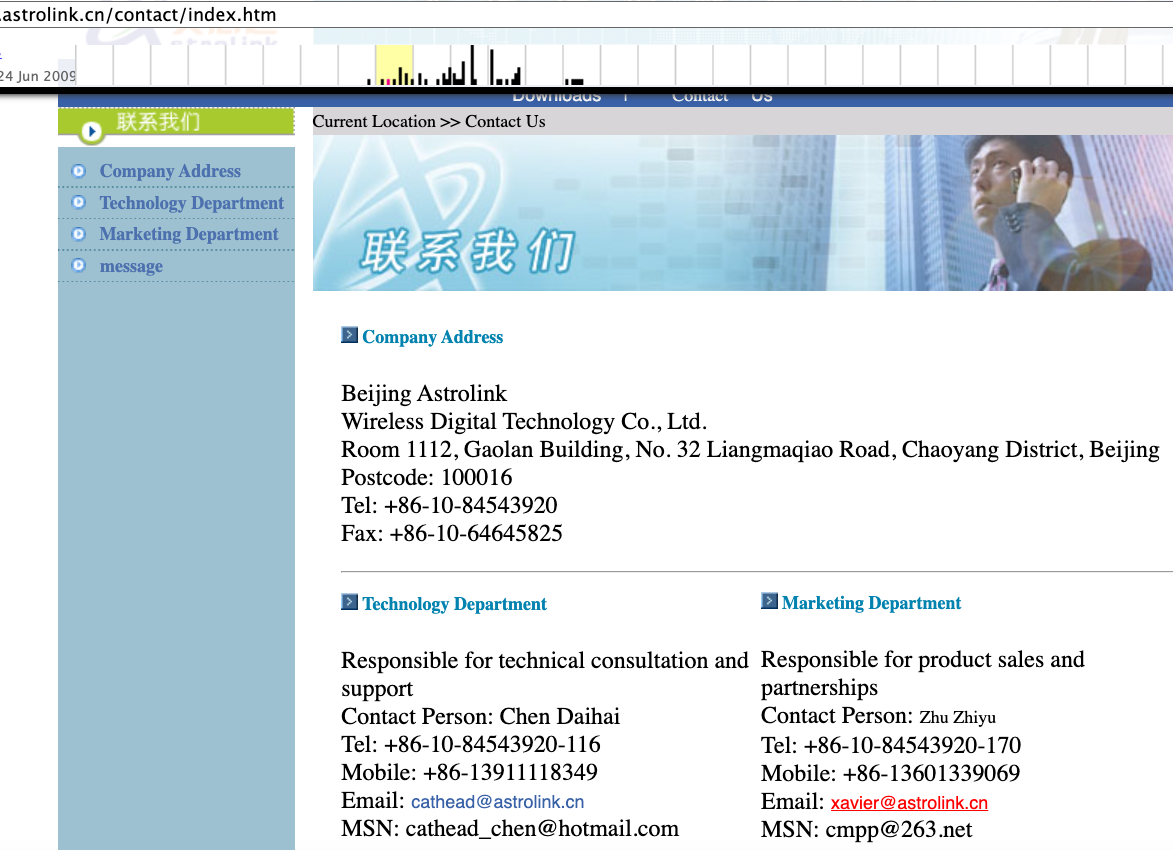

A cached copy of astrolink[.]cn preserved at archive.org shows the website belongs to a mobile app development company whose full name is Beijing Astrolink Wireless Digital Technology Co. Ltd. The archived website reveals a “Contact Us” page that lists a Chen Daihai as part of the company’s technology department. The other person featured on that contact page is Zhu Zhiyu, and their email address is listed as xavier@astrolink[.]cn.

A Google-translated version of Astrolink’s website, circa 2009. Image: archive.org.

Astute readers will notice that the user Mr.Zhu in the Badbox 2.0 panel used the email address xavierzhu@qq.com. Searching this address in Constella reveals a jd.com account registered in the name of Zhu Zhiyu. A rather unique password used by this account matches the password used by the address xavierzhu@gmail.com, which DomainTools finds was the original registrant of astrolink[.]cn.

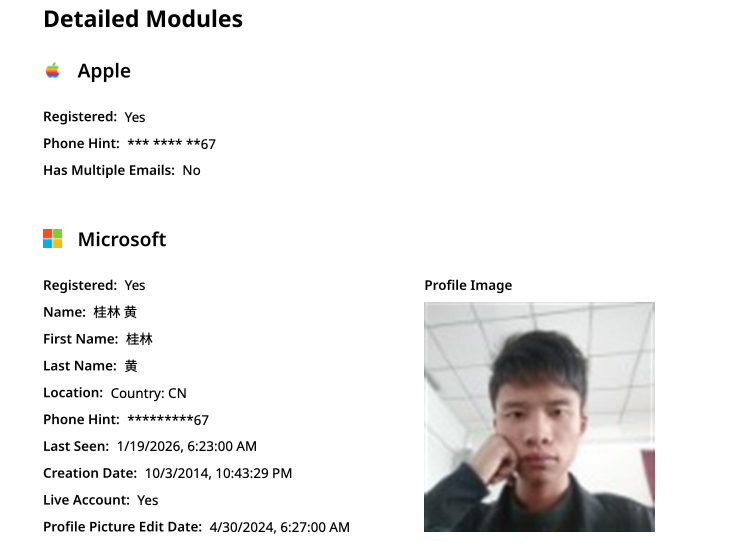

The very first account listed in the Badbox 2.0 panel — “admin,” registered in November 2020 — used the email address 189308024@qq.com. DomainTools shows this email is found in the 2022 registration records for the domain guilincloud[.]cn, which includes the registrant name “Huang Guilin.”

Constella finds 189308024@qq.com is associated with the China phone number 18681627767. The open-source intelligence platform osint.industries reveals this phone number is connected to a Microsoft profile created in 2014 under the name Guilin Huang (桂林 黄). The cyber intelligence platform Spycloud says that phone number was used in 2017 to create an account at the Chinese social media platform Weibo under the username “h_guilin.”

The public information attached to Guilin Huang’s Microsoft account, according to the breach tracking service osintindustries.com.

The remaining three users and corresponding qq.com email addresses were all connected to individuals in China. However, none of them (nor Mr. Huang) had any apparent connection to the entities created and operated by Chen Daihai and Zhu Zhiyu — or to any corporate entities for that matter. Also, none of these individuals responded to requests for comment.

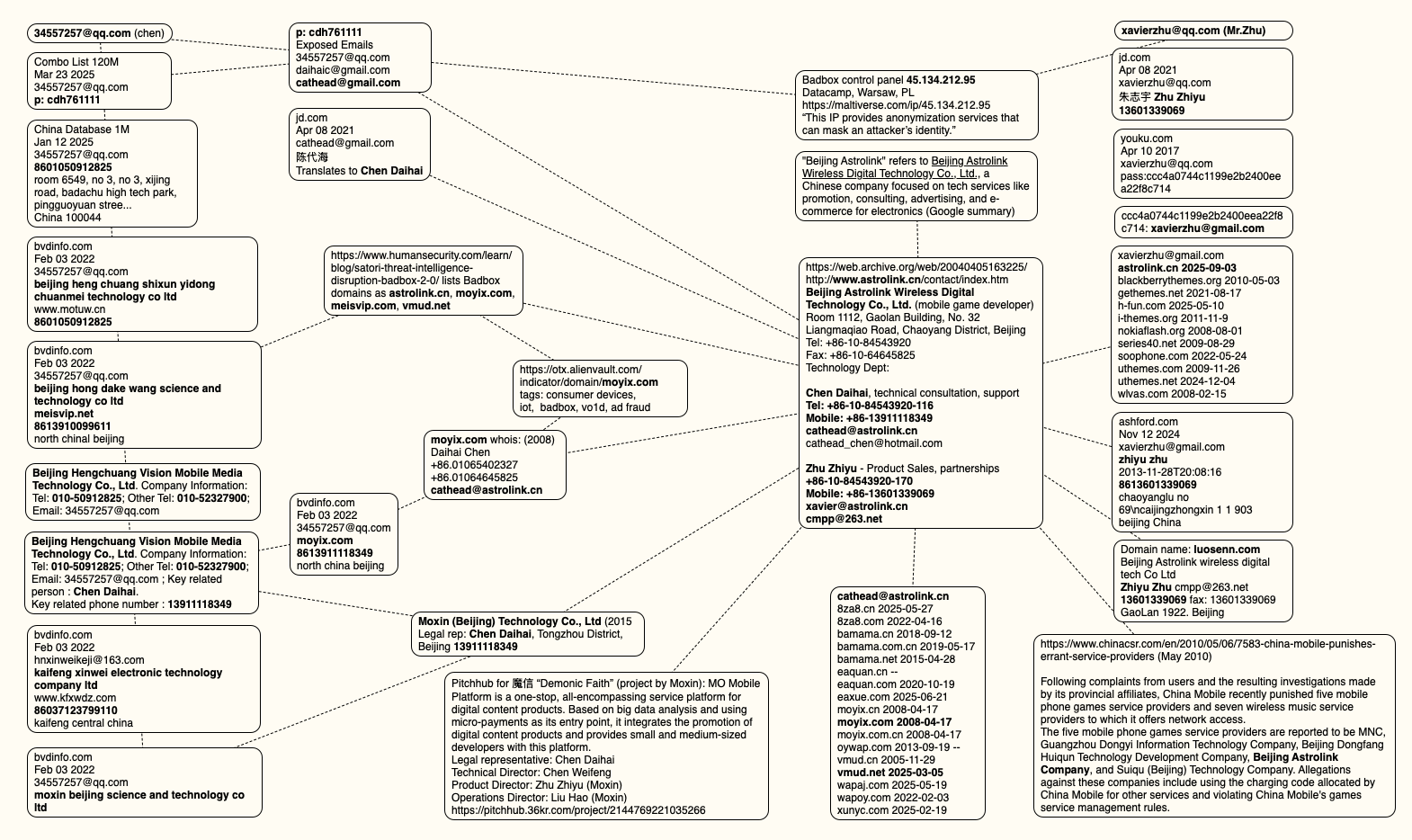

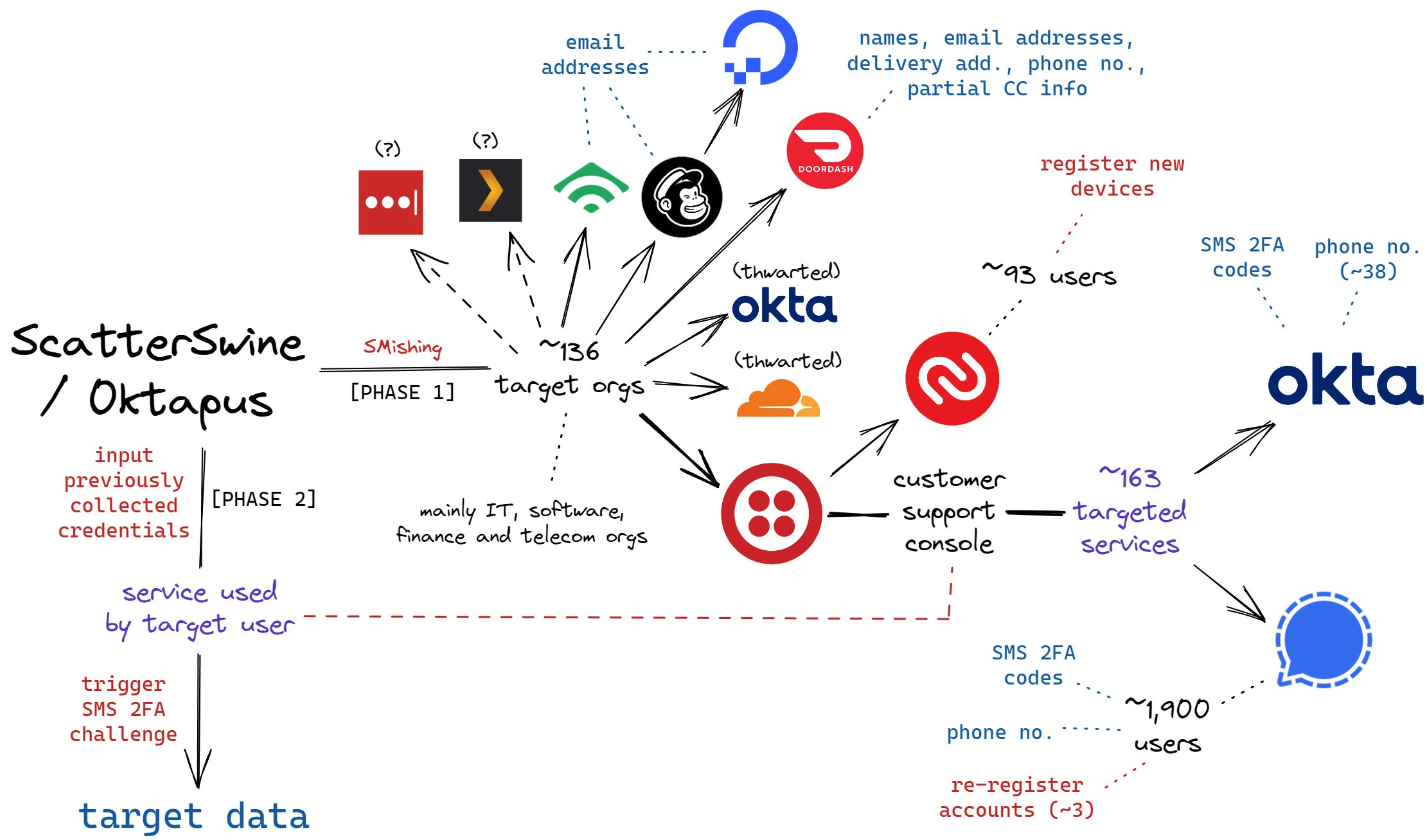

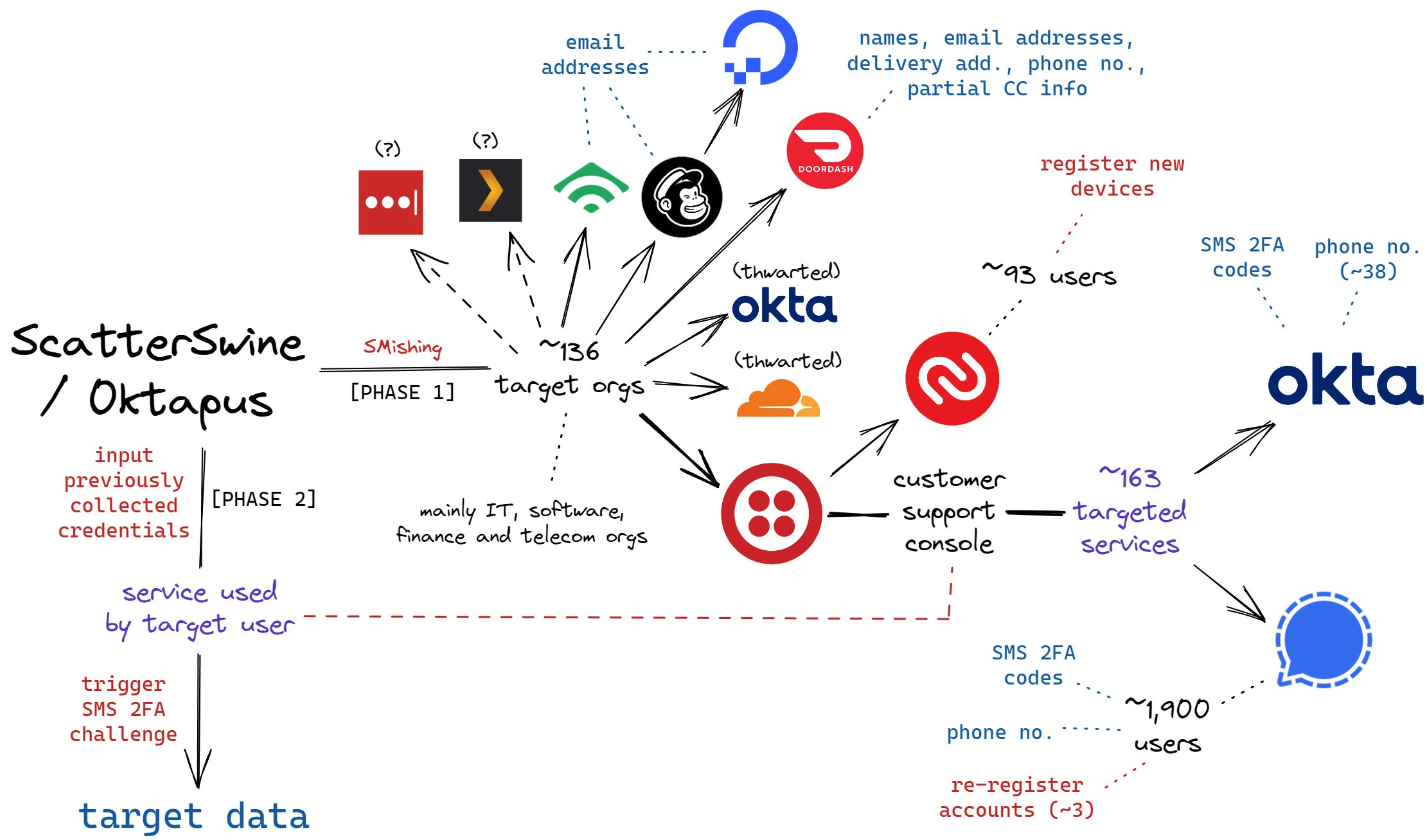

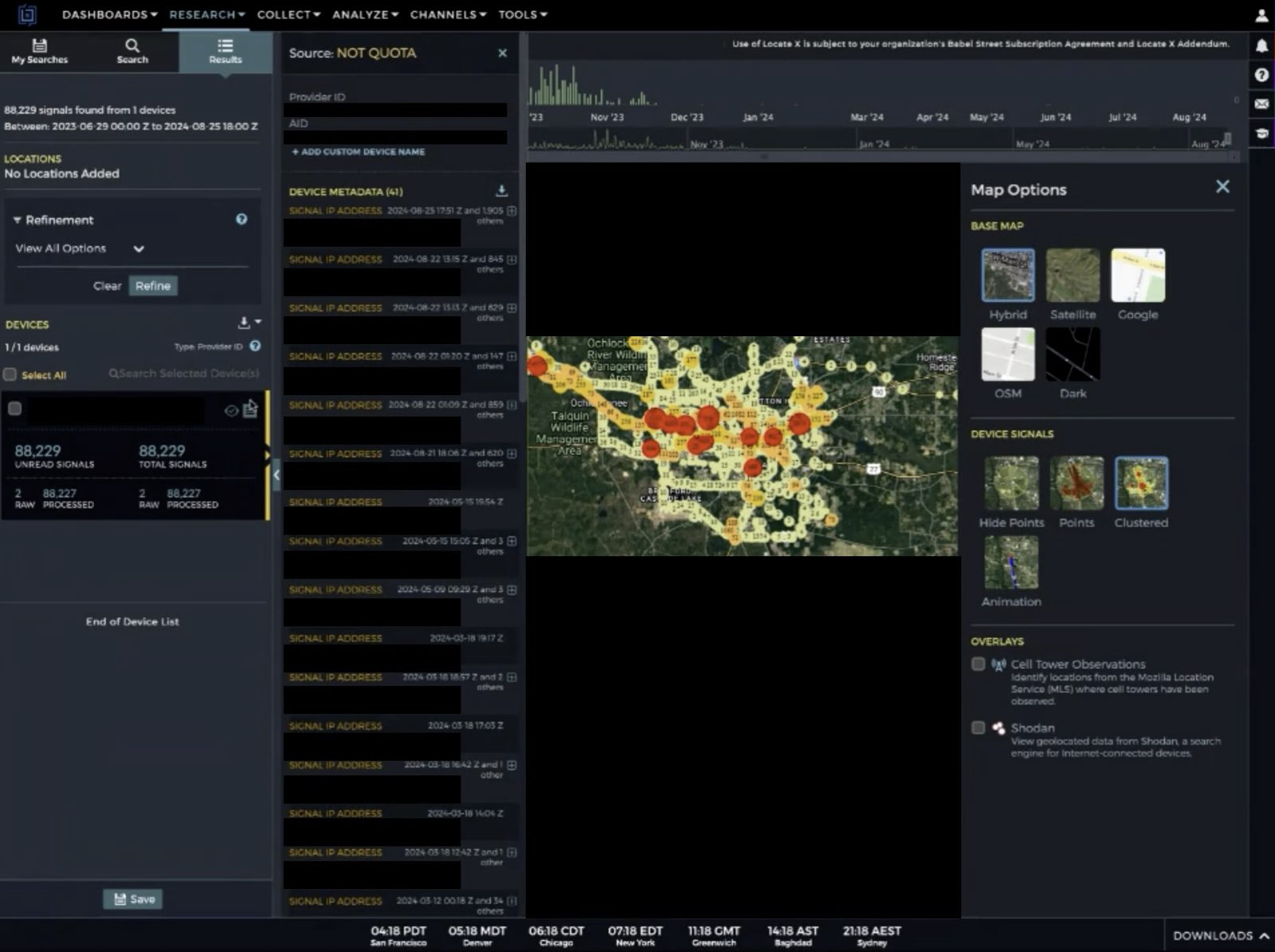

The mind map below includes search pivots on the email addresses, company names and phone numbers that suggest a connection between Chen Daihai, Zhu Zhiyu, and Badbox 2.0.

This mind map includes search pivots on the email addresses, company names and phone numbers that appear to connect Chen Daihai and Zhu Zhiyu to Badbox 2.0. Click to enlarge.

The idea that the Kimwolf botmasters could have direct access to the Badbox 2.0 botnet is a big deal, but explaining exactly why that is requires some background on how Kimwolf spreads to new devices. The botmasters figured out they could trick residential proxy services into relaying malicious commands to vulnerable devices behind the firewall on the unsuspecting user’s local network.

The vulnerable systems sought out by Kimwolf are primarily Internet of Things (IoT) devices like unsanctioned Android TV boxes and digital photo frames that have no discernible security or authentication built-in. Put simply, if you can communicate with these devices, you can compromise them with a single command.

Our January 2 story featured research from the proxy-tracking firm Synthient, which alerted 11 different residential proxy providers that their proxy endpoints were vulnerable to being abused for this kind of local network probing and exploitation.

Most of those vulnerable proxy providers have since taken steps to prevent customers from going upstream into the local networks of residential proxy endpoints, and it appeared that Kimwolf would no longer be able to quickly spread to millions of devices simply by exploiting some residential proxy provider.

However, the source of that Badbox 2.0 screenshot said the Kimwolf botmasters had an ace up their sleeve the whole time: Secret access to the Badbox 2.0 botnet control panel.

“Dort has gotten unauthorized access,” the source said. “So, what happened is normal proxy providers patched this. But Badbox doesn’t sell proxies by itself, so it’s not patched. And as long as Dort has access to Badbox, they would be able to load” the Kimwolf malware directly onto TV boxes associated with Badbox 2.0.

The source said it isn’t clear how Dort gained access to the Badbox botnet panel. But it’s unlikely that Dort’s existing account will persist for much longer: All of our notifications to the qq.com email addresses listed in the control panel screenshot received a copy of that image, as well as questions about the apparently rogue ABCD account.

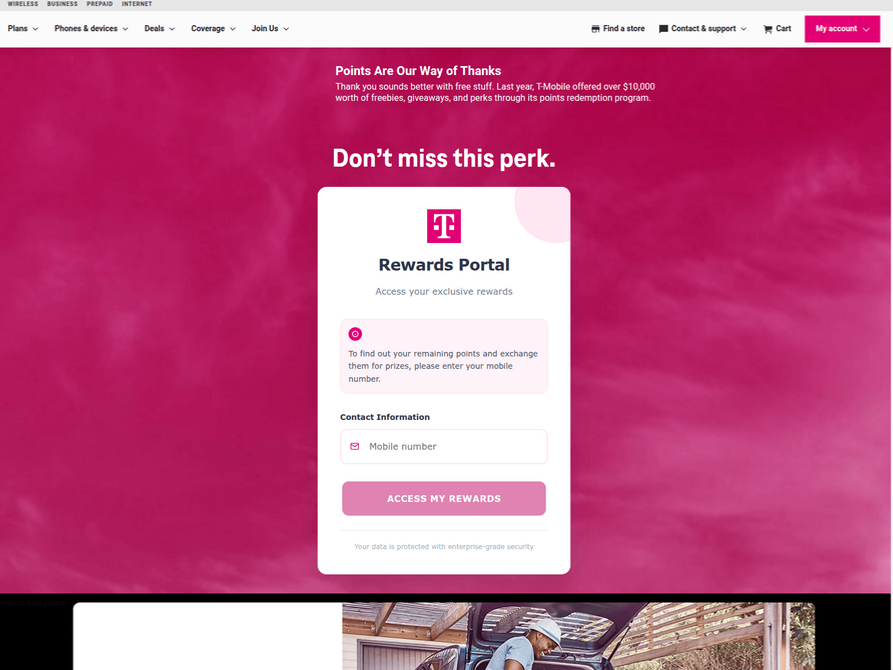

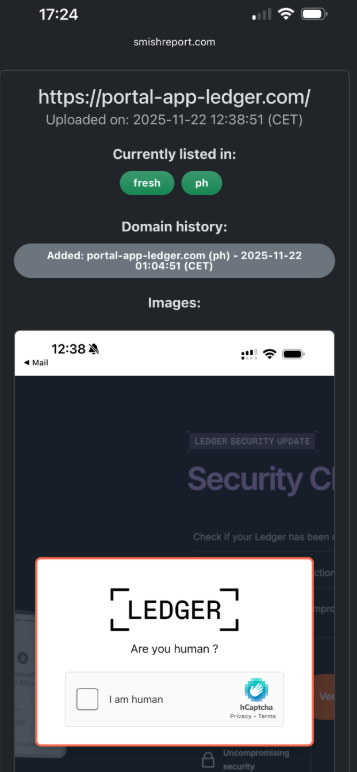

This week in scams, attackers are leaning hard on familiar brands, everyday tools, and routine behavior to trigger fast, unthinking reactions. From fake Netflix billing alerts to malicious browser extensions and QR code phishing tied to foreign espionage, the common thread is trust being weaponized at exactly the right moment.

Every week, this roundup breaks down the scam and cybersecurity stories making news and explains how they actually work, so readers can better recognize risk and avoid being manipulated.

Let’s get into it.

The big picture: Subscription phishing is resurging, with scammers impersonating Netflix and using fake billing failures to push victims into handing over payment details.

What happened: Multiple Netflix impersonation emails circulated again this month, warning recipients that a payment failed and urging them to “update payment” to avoid service interruption. The messages closely mirror Netflix’s real branding and include polished formatting, official-looking language, and even PDF attachments designed to feel like legitimate billing notices.

What makes these scams effective is timing. Victims often receive them while actively reviewing subscriptions, updating payment methods, or considering canceling services. That context lowers skepticism just enough for a quick click before slowing down to verify.

McAfee’s Scam Detector flagged the messages (which one of our own employees received this week) as phishing, confirming they were designed to steal payment information rather than resolve a real billing issue.

Red flags to watch for:

How this scam works: This is classic brand impersonation phishing. Scammers don’t need to hack Netflix itself. They rely on people recognizing the logo, trusting the message, and reacting emotionally to the idea of losing access. The attachment and clean design help bypass instinctive spam filters in the brain, even when technical filters catch it later.

Netflix has warned customers about these scams and offers advice on its site if you encounter one.

What to do instead: If you get a billing alert, don’t click. Open the Netflix app or manually type the site address to check your account. If there’s no issue there, the email wasn’t real.

The big picture: Attackers are exploiting browser crashes themselves as a social engineering tool, turning technical disruption into a pathway for malware installation.

What happened: Researchers reported a malvertising campaign promoting a fake ad-blocking browser extension called “NexShield,” which falsely claimed to be created by the developer of a well-known, legitimate ad blocker. Once installed, the extension intentionally overwhelmed the browser, causing freezes, crashes, and system instability.

After restart, victims were shown fake security warnings instructing them to “fix” the problem by running commands on their own computer. Following those instructions triggered the download of a remote access tool capable of spying, executing commands, and installing additional malware. The reporting was first detailed by Bleeping Computer, with technical analysis from security researchers.

Red flags to watch for:

How this scam works: This is a variant of ClickFix attacks. Instead of faking a problem, attackers cause a real one, then position themselves as the solution. The crash creates urgency and confusion, making people more likely to follow instructions they’d normally question. It turns frustration into compliance.

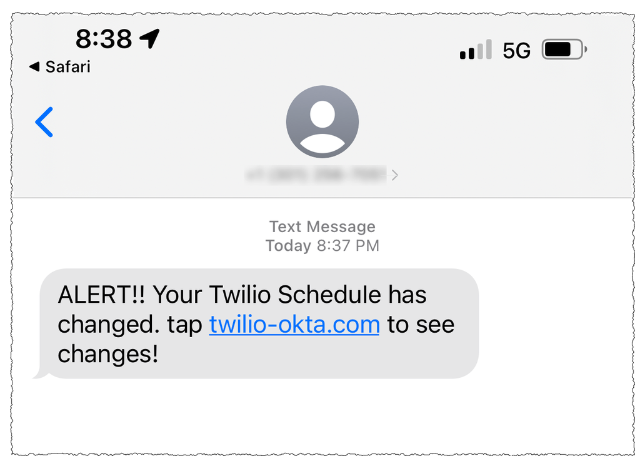

The big picture: QR codes are being used as stealth phishing tools, with highly targeted attacks tied to foreign intelligence operations.

What happened: The Federal Bureau of Investigation issued a warning about QR code phishing, or “quishing,” campaigns linked to a North Korean government-backed hacking group. According to reporting by Fox News, attackers sent emails containing QR codes that redirected victims to fake login pages or malware-hosting sites.

In some cases, simply visiting the site allowed attackers to collect device data, location details, and system information, even if no credentials were entered. These campaigns are highly targeted, often aimed at professionals in policy, research, and technology sectors.

Red flags to watch for:

How this scam works: QR codes hide the destination URL, removing the visual cues people rely on to judge safety. Because scanning feels faster and more “passive” than clicking a link, people often skip verification entirely. That moment of trust is what attackers exploit.

Read our ultimate guide to “quishing” and how to spot and avoid QR code scams here.

McAfee will be back next week with another roundup of the scams making headlines and the practical steps you can take to stay safer online.

The post This Week in Scams: Netflix Phishing and QR Code Espionage appeared first on McAfee Blog.

Microsoft users across the U.S. experienced widespread disruptions Thursday after a technical failure prevented people from sending or receiving email through Outlook, a core service within Microsoft 365.

The outage occurred during U.S. business hours and quickly affected schools, government offices, and companies that rely on Outlook for daily operations. Microsoft confirmed the issue publicly and said it was working to restore service. There is no indication the disruption was caused by a cyberattack, according to company statements.

Still, McAfee warns in these situations to be wary of phishing attempts as scammers latch onto these outages to take advantage of innocent users.

“Outages like this create uncertainty, and scammers move fast to take advantage of it,” said Steve Grobman, McAfee’s Chief Technology Officer. “When people can’t get into email or the tools they use every day, it’s easy to assume something is wrong with your account — and that’s exactly the moment attackers look for.”

“Fake alerts start circulating that look like they’re coming from the real company, with logos and urgent language telling you to reset a password or verify your information,” Grobman added. “Some push fake support numbers or messages claiming they can restore access. If you’re impacted, slow down, go straight to the official source for updates, and don’t share passwords, verification codes, or payment details in response to an unexpected message.”

“Tools that can spot suspicious links and fake login pages help reduce risk — especially when people are trying to get back online quickly,” Grobman said.

Here, we break down what happened and why outages are prime time for scammers.

A Microsoft infrastructure failure disrupted email delivery.

Microsoft said the outage was caused by a portion of its North American service infrastructure that was failing to properly handle traffic. Users attempting to send or receive email encountered a “451 4.3.2 temporary server issue” error message.

Microsoft also warned that related services, including OneDrive search and SharePoint Online, could experience slowdowns or intermittent failures during the incident.

The disruption unfolded over several hours on Thursday afternoon (ET).

Based on timelines reported by CNBC and live coverage from Tom’s Guide, the outage progressed as follows:

Around 2:00 p.m. ET: User reports spike across Microsoft services, especially Outlook, according to Down Detector data cited by Tom’s Guide.

2:37 p.m. ET: Microsoft confirms it is investigating an Outlook email issue, per CNBC.

3:17 p.m. ET: Microsoft says it identified misrouted traffic tied to infrastructure problems in North America, CNBC reports.

4:14 p.m. ET: The company announces affected infrastructure has been restored and traffic is being redirected to recover service.

Tom’s Guide reported that while outage reports declined after Microsoft’s fix, some users continued to experience intermittent access issues as systems rebalanced.

No. Microsoft says the outage was caused by technical infrastructure issues.

According to CNBC, Microsoft has not indicated that the outage was the result of hacking, ransomware, or any external attack. Instead, the company attributed the disruption to internal infrastructure handling errors, similar to a previous Outlook outage last July that lasted more than 21 hours.

A message sent by Microsoft about the server issue.

Modern work depends on shared cloud infrastructure.

That sudden loss of access often leaves users unsure whether:

That uncertainty is exactly what scammers look for.

They impersonate the company and trick users into signing in again.

After major outages involving Microsoft, Google, or Amazon Web Services, security researchers, including McAfee, have observed scam campaigns emerge within hours.

These scams typically work by:

Impersonating Microsoft using logos, branding, and language copied from real outage notices

Sending fake “service restoration” emails or texts claiming users must re-authenticate

Linking to realistic login pages designed to steal Microsoft usernames and passwords

Posing as IT support or Microsoft support and directing users to fake phone numbers

Once credentials are stolen, attackers can access email accounts, reset passwords on other services, or launch further phishing attacks from a trusted address.

How to stay safe during a Microsoft outage

Outages are confusing. Scammers rely on urgency and familiarity.

To reduce risk:

If you already clicked or entered information:

Using advanced artificial intelligence, McAfee’s built-in Scam Detector automatically detects scams across text, email, and video, blocks dangerous links, and identifies deepfakes, helping stop harm before it happens.

McAfee’s identity protection tools also monitor for signs your personal information may be exposed and guide you through recovery if scammers gain access.

|

Q: Is Microsoft Outlook still down? A: Microsoft said Thursday afternoon that it had restored affected infrastructure and was redirecting traffic to recover service, according to CNBC. Some users may still experience intermittent issues. |

|

Q: Was the Microsoft outage caused by hackers? A: No. Microsoft has not reported any cyberattack or data breach related to the outage, per CNBC. |

|

Q: Can scammers really use outages to steal accounts? A: Yes. During major outages, scammers often impersonate companies like Microsoft and trick users into signing in again on fake websites. |

|

Q: Should I reset my password after an outage? A: Only if you clicked a suspicious link or entered your credentials somewhere outside Microsoft’s official site. Otherwise, resetting passwords isn’t necessary. |

The post Today’s Microsoft Outage Explained and Why it Triggers a Scam Playbook appeared first on McAfee Blog.

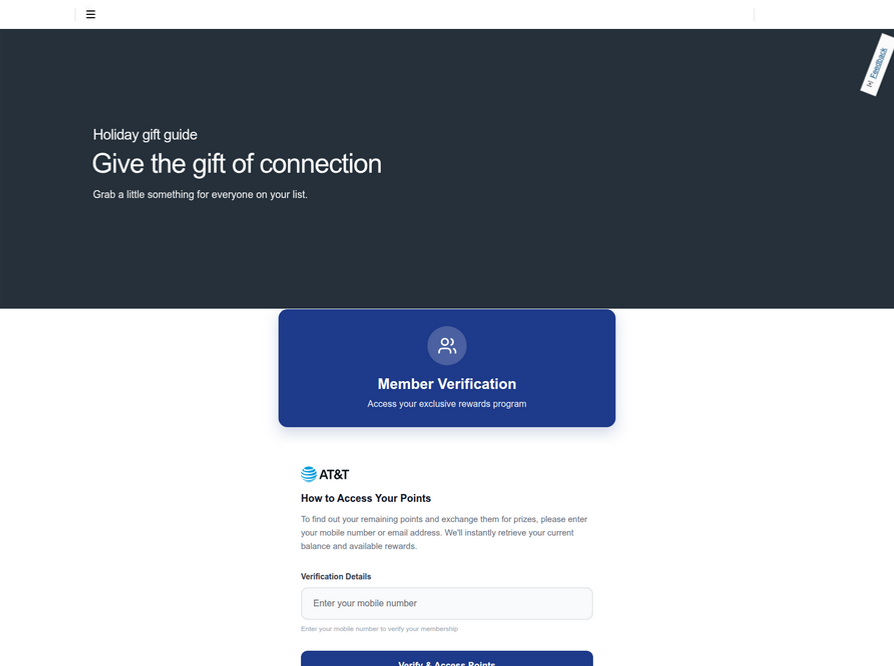

You thought you were scanning a menu.

Or paying for parking. Or checking a package notice taped to your door. A quick scan, a familiar logo, a page that loads instantly on your phone.

Nothing about it felt risky.

That’s exactly why QR code scams are spreading so quickly.

QR codes have become part of everyday life. They’re on restaurant tables, public signs, emails, mailers, and payment screens. We’re taught to treat them as shortcuts—faster than typing a URL, easier than downloading an app, safer than clicking a link.

Scammers know that.

Instead of asking you to click something suspicious, they ask you to scan something ordinary. Once you do, you can be routed to fake login pages, payment requests, or malicious sites designed to steal your information before you realize anything is wrong.

This tactic has a name: quishing.

And as QR codes continue to replace links in the real world, understanding how quishing works is essential to staying safe online.

Quishing is a form of phishing that uses QR codes instead of clickable links to trick people into visiting malicious websites or giving up sensitive information.

The term combines QR and phishing, and it reflects a simple but dangerous shift in scam tactics: instead of asking you to click, scammers ask you to scan.

Once scanned, a fake QR code can lead to:

Because QR codes don’t show a visible URL before you scan, they remove one of the most important scam warning signs people rely on.

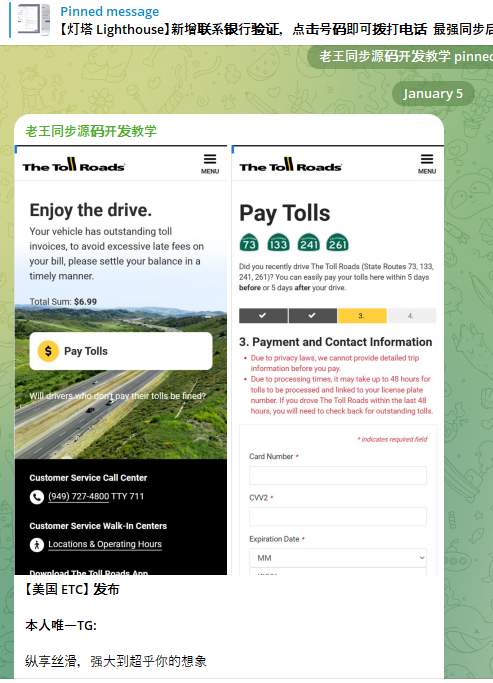

While quishing attacks vary, most fall into a few predictable patterns.

Scammers place stickers over legitimate parking meter QR codes. When scanned, victims are taken to fake payment pages that steal card details.

Red flag: A QR code that asks for full payment details without redirecting to a known parking or city service.

Fraudsters replace real menu QR codes with fake ones that redirect to phishing pages or malicious downloads.

Red flag: A menu page that asks you to “sign in,” download an app, or confirm personal details.

Flyers or door tags claim you missed a delivery and instruct you to scan a QR code to reschedule.

Red flag: Vague delivery details and pressure to act quickly.

QR codes claim your bank, streaming service, or email account needs verification.

Red flag: Any QR code that demands immediate action for “security reasons.”

Some QR codes promise discounts, refunds, or rewards but quietly enroll users in recurring charges.

Red flag: Fine print that’s hard to find, or missing entirely.

QR scams succeed not because people are careless, but because they exploit trust and routine.

Unlike traditional phishing emails, quishing:

Once a victim lands on a fake site, the damage can escalate quickly, from stolen credentials to drained accounts to identity theft.

You don’t need to avoid QR codes entirely, but you do need to slow down.

Check the physical context

Is the QR code taped on, scratched, or layered over another code? That’s a common tactic.

Look for branding inconsistencies

Misspellings, generic logos, or mismatched colors are red flags.

Preview the link

Most phone cameras now show the URL before opening it. Take a second to read it.

Be skeptical of urgency

Any QR code that pressures you to act immediately deserves extra scrutiny.

Step 1: Treat QR codes like links

A QR code is a shortcut to a website. Apply the same caution you would to any link.

Step 2: Avoid entering sensitive information

Legitimate services rarely ask for passwords, payment info, or personal details via QR codes.

Step 3: Use mobile security tools

Security software can help detect malicious sites and block risky downloads before damage is done.

Step 4: When in doubt, go direct

Instead of scanning, manually visit the official website or app you trust.

If you think you interacted with a malicious QR code:

Early action can limit long-term fallout.

What is quishing in simple terms?

Quishing is phishing that uses QR codes to trick people into visiting fake or malicious websites.

Are QR codes inherently unsafe?

No, but they can be exploited. The risk comes from where they lead, not the code itself.

Can scanning a QR code install malware?

In some cases, yes, especially if it prompts a download or redirects to a malicious site.

Are QR scams increasing?

Yes. As QR codes become more common, scammers are increasingly using them to bypass traditional defenses.

The post What Is Quishing? How QR Code Scams Work and How to Avoid Them appeared first on McAfee Blog.

Because Android uses an open source operating system, it usually gets a bad rap for being vulnerable to data loss and compromised apps as a result of malware, insecure app coding, unprotected cloud storage, outdated software, sideloading from untrusted sources, and even specific website vulnerabilities. Suffice it to say that any of these risks can be destructive and costly.

While Google addresses specific vulnerabilities, cyberthreats continue to evolve as criminals become more scheming or desperate. For these reasons, it is still best to exercise caution to protect the data on your device. In this article, we will share vital tips on how you can secure your device.

Determining if you’re vulnerable isn’t always easy. There are, however, some measures you can take to protect your device.

Your first line of defense against Android vulnerability threats is maintaining current software. Android security patches fix security weaknesses that cybercriminals actively take advantage of to access your personal data, install malware, or take control of your device. When you delay updates, you leave known security gaps open for attackers to exploit.

To enable automatic updates, navigate to Settings > System > System update > Advanced settings, then toggle on “Automatic system updates.” For Google Pixel devices, security updates typically arrive monthly, while other manufacturers may have varying schedules.

On top of this, set your Google Play Store to auto-update apps by opening the Play Store, tapping your profile picture, going to Settings > Network preferences > Auto-update apps, and selecting “Over any network” if you have unlimited data or “Over Wi-Fi only” to preserve your data plan.

One of the most effective Android phone security best practices is restricting app installations to the Google Play Store. Sideloading apps from unknown sources significantly increases your risk of installing malware, spyware, or apps with hidden malicious functionality.

Before installing any app, examine the permissions it requests. Apps asking for excessive permissions should raise your suspicions. Navigate to Settings > Apps > Special app access > Install unknown apps and ensure all toggles are disabled.

In addition, choose apps with consistent positive ratings and active developer responses to user concerns. Google’s Play Console policies provide guidelines for safe app development, but your vigilance remains essential.

Google Play Protect scans over 125 billion apps daily for malware and policy violations. While not perfect, this automated screening catches the majority of malicious apps before they reach your device, and even detects them after installation. In contrast, apps outside this ecosystem lack this protection layer.

Activate Play Protect by opening Google Play Store, tapping your profile picture, selecting “Play Protect,” and ensuring both “Scan apps with Play Protect” and “Improve harmful app detection” are enabled. This service runs automatic security scans and can remove or disable harmful apps even after you’ve installed them.

For comprehensive, real-time protection against phishing sites, malware downloads, and suspicious web content, enable safe browsing Android features in Chrome. Open Chrome, tap the three dots menu, go to Settings > Privacy and security > Safe Browsing, and select “Enhanced protection.” This setting checks URLs against Google’s constantly updated database of dangerous sites.

Modern Android devices offer multiple authentication methods, and using them strategically provides layered security for your most sensitive information. Set up a strong screen lock by going to Settings > Security > Screen lock and choosing either a complex PIN with at least 6 digits, a pattern with at least 6 points, or a password that combines letters, numbers, and symbols.

Enable biometric authentication, whether fingerprint and/or facial recognition, as an additional layer, but always maintain a strong backup PIN or password since biometrics can be circumvented.

For critical applications containing sensitive data such as banking apps, password managers, email clients, and social media, enable two-factor authentication (2FA) where possible for extra security.

Android’s built-in backup and encryption features provide essential protection against data loss from device theft, hardware failure, malware attacks, or accidental deletion, forming a crucial part of your Android incident response strategy.

Enable automatic backups of your app data, call history, and device settings by navigating to Settings > System > Backup, then toggle on “Back up to Google Drive.” You can set the frequency to daily. For photos and videos, enable Google Photos backup with high-quality or original quality settings based on your storage plan.

Device encryption can be activated through Settings > Security > Encryption & credentials > Encrypt phone. Modern Android devices (Android 6.0+) typically have encryption enabled by default, but you will need to verify this setting. Google’s Android backup service documentation provides detailed information on what data is protected and how to manage your backup settings effectively.

Your Google account serves as the master key to most Android functionality, so having an account recovery system can be invaluable to restore access to your device when local authentication methods fail. To ensure your recovery information is current, visit Security settings on your account profile, add a secondary email address that you can access independently, but avoid using another Gmail account as your backup. Include a mobile phone number for SMS verification, and consider adding multiple phone numbers if you frequently travel or change devices.

Google also provides one-time-use back-up codes that can restore account access when other methods fail. Download these codes and store them securely offline. Consider using a password manager like Google’s built-in option or a reputable third-party solution. Never store recovery codes in easily accessible digital formats like unencrypted text files or photos on the same device.

Google’s Find My Device service provides powerful remote management capabilities that can prevent permanent data loss during Android vulnerability situations or lockout scenarios. This service allows you to locate, lock, or completely erase your device remotely.

To enable this feature, navigate to Find My Device through Settings > Security > Find My Device. Ensure that your location services remain active for this feature to function properly.

Take note that when you decide to remotely erase your data from your device, this feature completely wipes all local data but preserves the information you backed up to Google’s cloud services. Only use this option when you’re certain your back-up systems are current.

Android offers multiple backup solutions that transform potential data disasters into minor inconveniences. To store your photos, videos, SMS messages, and call logs, you can go to Settings > System > Backup and choose the frequency that matches your usage patterns, daily backups for heavy users, weekly for lighter usage.

For sensitive information that you would like to access even when offline, you might want to consider periodic local backups by connecting your device to a computer monthly and copying important files manually. Test your systems regularly by attempting to restore a small amount of data to ensure your backups work when needed and identify any gaps in your protection strategy.

A mobile security incident can escalate from a nuisance to real damage in minutes, especially if an attacker can access your accounts, intercept messages, or install persistent apps. Speed matters when you respond, especially when prioritizing the high-impact steps that will stop the bleeding, regain control, and protect your data before you move on to cleanup and recovery. The actions below follow that order, so you can respond calmly and effectively even under stress.

When evaluating mobile security solutions for your Android device, focus on apps that offer comprehensive protection across multiple threat vectors. The most effective solutions combine several key capabilities into a single, user-friendly platform that doesn’t slow down your device or drain your battery.

Your Android device holds your most precious digital memories, important work files, and personal information, making it a prime target for cybercriminals who continue to exploit new vulnerabilities. While threats like remote factory resets and malicious web attacks can disrupt your daily digital routine, you do have the power to protect yourself against them by keeping your OS and security patches current, enabling Google Play Protect and built-in safe browsing features, maintaining regular backups of your essential data, and considering a comprehensive mobile security solution that provides real-time protection. For additional steps to safeguard your Android mobile life, visit McAfee’s security best practices.

The post Guard Your Android Phones Against Loss of Data and Infected Apps appeared first on McAfee Blog.

The practice of locking our possessions is relevant in every aspect of our modern lives. We physically lock our houses, cars, bikes, hotel rooms, computers, and even our luggage when we go to the airport. There are lockers at gyms, schools, amusement parks, and sometimes even at the workplace.

Digitally, we lock our phones with passcodes and protect them from malware with a security solution. Why, then, don’t we lock the individual apps that house some of our most personal and sensitive data?

From photos to emails to credit card numbers, our mobile apps hold invaluable data that is often left unprotected, especially given that some of the most commonly used apps on the Android platform such as Facebook, LinkedIn and Gmail don’t necessarily require a log in each time they’re launched.

Without an added layer of security, those apps are leaving room for nosy family members, jealous significant others, prankster friends, and worst of all thieves to hack into your social media or email accounts at the drop of a hat. In this article, we will discuss what an app lock is, everyday scenarios you may need it, and how to set it up on your smartphone.

Your mobile phone is more than just a gadget. It’s your wallet, camera, diary, and connection to the world. You likely keep photos, messages, social media, payment apps, and even confidential work files on it. To protect these bits of personal information, we use PINs, patterns, or biometrics to lock our devices, but once the phone is open, every app is fair game.

I f someone were able to go beyond your phone’s lock screen and gain access to the information in your phone, how much of your life could they see? A friend could scroll through your photos. Your child could open your shopping app and make purchases. Or a thief could get into your banking and social media accounts in seconds.

One way to avoid this from happening is by applying an app lock, a digital padlock that adds an authentication step such as a password, pattern, or biometric before an application can be launched.

In your home, a locked front door keeps strangers out. But what happens if you unwittingly leave the front door unlocked and someone walks in? Without interior locks, your bedroom, office, and safe are now accessible to anyone.

This same concept applies to your device with unprotected apps. Once unlocked, apps like Gmail, Facebook, or mobile banking don’t always require you to log in every time. It’s convenient, until it’s not.

An app lock serves as an indoor lock, protecting your sensitive data even after an unauthorized person has accessed it, and maintaining privacy boundaries.

When you or another person attempts to open an app on your device, the system first triggers an authentication screen. After verifying your PIN, fingerprint, or face, the app will open, ensuring that your personal information stays off-limits to people who do not know your authentication step. In Android, app locks work seamlessly in the background without slowing performance.

This layered defense mirrors the cybersecurity approach used on enterprise systems, but scaled down for consumers. Each layer handles different threats, so if one fails, the others still protect you:

Leaving apps unprotected can do more than just embarrass you. Here are some examples of how unprotected apps could lead to lasting harm:

Even just one unauthorized session could cascade into identity theft or financial fraud. That’s why security experts recommend app-level protection as part of a layered, reinforced mobile defense strategy.

While many Android phones include some app-locking capabilities, dedicated mobile security apps provide more robust options and better protection. Here’s how to set up app locks effectively:

Use a 6-digit or longer PIN, complex pattern, or biometric such as fingerprint or face unlock. Avoid using the same PIN as your main device.

Choose the priority mobile apps that you want to protect. Start with your most sensitive apps, such as:

Set timeouts based on app sensitivity:

Hide notification content for locked apps. This keeps private messages or bank alerts from showing up on your lock screen.

Most Android manufacturers now offer convenient, built-in app locking features. However, they are limited, often lacking biometric integration, cloud backup, or smart settings.

Dedicated solutions go further, providing:

With an app lock, your mischievous friends will never be able to post embarrassing status updates on your Facebook profile, and your jealous partner won’t be able to snoop through your photos or emails. For parents, you can keep your kids locked out of the apps that would allow them to access inappropriate content without having to watch their every move.

Most importantly, app locks protect you from thieves and strangers in case of a stolen or lost device.

Your phone carries more than just apps. It holds the details of your daily life. From private conversations and family photos to financial information and work data, much of what matters most to you lives behind those app icons. While a device lock is an important first step, it isn’t always enough on its own.

App locks give you greater control over your privacy by protecting individual apps, even when your phone is already unlocked. They help prevent accidental access, discourage snooping, and reduce the risk of serious harm if your device is lost or stolen. Most importantly, they allow you to use and share your phone, without worrying about who might see what they shouldn’t.

By adding app-level protection to your mobile security routine, you’re taking a simple but meaningful step toward safeguarding your personal information.

The post App Locks Can Improve the Security of Your Mobile Phones appeared first on McAfee Blog.

It’s no longer possible to deny that your life in the physical world and your digital life are one and the same. Coming to terms with this reality will help you make better decisions in many aspects of your life.

The same identity you use at work, at home, and with friends also exists in apps, inboxes, accounts, devices, and databases, whether you actively post online or prefer to stay quiet. Every purchase, login, location ping, and message leaves a trail. And that trail shapes what people, companies, and scammers can learn about you, how they can reach you, and what they might try to take.

That’s why digital security isn’t just an IT or a “tech person” problem. It’s a daily life skill. When you understand how your digital life works, what information you’re sharing, where it’s stored, and how it can be misused, you make better decisions. This guide is designed to help you build that awareness and translate it into practical habits: protecting your data, securing your accounts, and staying in control of your privacy in a world that’s always connected.

Being digitally secure doesn’t mean hiding from the internet or using complicated tools you don’t understand. It means having intentional control over your digital life to reduce risks while still being able to live, work, and communicate online safely. A digitally secure person focuses on four interconnected areas:

Your personal data is the foundation of your digital identity. Protecting it includes limiting how much data you share, understanding where it’s stored, and reducing how easily it can be collected, sold, or stolen. At its heart, personal information falls into two critical categories that require different levels of protection:

Account security ensures that only you can access them. Strong, unique passwords, multi-factor authentication, and secure recovery options prevent criminals from hijacking your email, banking, cloud storage, social media, and other online accounts, often the gateway to everything else in your digital life.

Privacy control means setting boundaries and deciding who can see what about you, and under what circumstances. This includes managing social media visibility, app permissions, browser tracking, and third-party access to your data.

Digital security is an ongoing effort as threats evolve, platforms change their policies, and new technologies introduce new risks. Staying digitally secure requires periodic check-ins, learning to recognize scams and manipulation, and adjusting your habits as the digital landscape changes.

Your personal information faces exposure risks through multiple channels during routine digital activities, often without your explicit knowledge.

Implementing comprehensive personal data protection requires a systematic approach that addresses the common exposure points. These practical steps provide layers of security that work together to minimize your exposure to identity theft and fraud.

Start by conducting a thorough audit of your online accounts and subscriptions to identify where you have unnecessarily shared more data than needed. Remove or minimize details that aren’t essential for the service to function. Moving forward, provide only the minimum required information to new accounts and avoid linking them across different platforms unless necessary.

Be particularly cautious with loyalty programs, surveys, and promotional offers that ask for extensive personal information, as they may share it with third parties. Read privacy policies carefully, focusing on sections that describe data sharing, retention periods, and your rights regarding your personal information.

If possible, consider using separate email addresses for different accounts to limit cross-platform tracking and reduce the impact if one account is compromised. Create dedicated email addresses for shopping, social media, newsletters, and important accounts like banking and healthcare.

Privacy protection requires regular attention to your account settings across all platforms and services you use. Social media platforms frequently update their privacy policies and settings, often defaulting to less private configurations that allow them to collect and share your data. For this reason, it is a good idea to review your privacy settings at least quarterly. Limit who can see your posts, contact information, and friend lists. Disable location tracking, facial recognition, and advertising customization features that rely on your personal data. Turn off automatic photo tagging and prevent search engines from indexing your profile.

On Google accounts, visit your Activity Controls and disable Web & App Activity, Location History, and YouTube History to stop this data from being saved. You can even opt out of ad personalization entirely if desired by adjusting Google Ad Settings. If you are more tech savvy, Google Takeout allows you to export and review what data Google has collected about you.

For Apple ID accounts, you can navigate to System Preferences on Mac or Settings on iOS devices to disable location-based Apple ads, limit app tracking, and review which apps have access to your contacts, photos, and other personal data.

Meanwhile, Amazon accounts store extensive purchase history, voice recordings from Alexa devices, and browsing behavior. Review your privacy settings to limit data sharing with third parties, delete voice recordings, and manage your advertising preferences.

Regularly audit the permissions you’ve granted to installed applications. Many apps request far more permissions to your location, contacts, camera, and microphone even though they don’t need them. Cancel these unnecessary permissions, and be particularly cautious about granting access to sensitive data.

Create passwords that actually protect you; they should be long and complex enough that even sophisticated attacks can’t easily break them. Combine uppercase letters, lowercase letters, numbers, and special characters to make it harder for attackers to crack.

Aside from passwords, enable multi-factor authentication (MFA) on your most critical accounts: banking and financial services, email, cloud storage, social media, work, and healthcare. Use authenticator apps such as Google Authenticator, Microsoft Authenticator, or Authy rather than SMS-based authentication when possible, as text messages can be intercepted through SIM swapping attacks. When setting up MFA, ensure you save backup codes in a secure location and register multiple devices when possible to keep you from being locked out of your accounts if your primary authentication device is lost, stolen, or damaged.

Alternatively, many services now offer passkeys which use cryptographic keys stored on your device, providing stronger security than passwords while being more convenient to use. Consider adopting passkeys for accounts that support them, particularly for your most sensitive accounts.

Device encryption protects your personal information if your smartphone, tablet, or laptop is lost, stolen, or accessed without authorization. Modern devices typically offer built-in encryption options that are easy to enable and don’t noticeably impact performance.

You can implement automatic backup systems such as secure cloud storage services, and ensure backup data is protected. iOS users can utilize encrypted iCloud backups, while Android users should enable Google backup with encryption. Regularly test your backup systems to ensure they’re working correctly and that you can successfully restore your data when needed.

Identify major data brokers that likely have your information and look for their privacy policy or opt-out procedures, which often involves submitting a request with your personal information and waiting for confirmation that your data has been removed.

In addition, review your subscriptions and memberships to identify services you no longer use. Request account deletion rather than simply closing accounts, as many companies retain data from closed accounts. When requesting deletion, ask specifically for all personal data to be removed from their systems, including backups and archives.

Keep records of your opt-out and deletion requests, and follow up if you don’t receive confirmation within the stated timeframe. In the United States, key data broker companies include Acxiom, LexisNexis, Experian, Equifax, TransUnion, Whitepages, Spokeo, BeenVerified, and PeopleFinder. Visit each company’s website.

Connect only to trusted, secure networks to reduce the risk of your data being intercepted by attackers lurking behind unsecured or fake Wi-Fi connections. Avoid logging into sensitive accounts on public networks in coffee shops, airports, or hotels, and use encrypted connections such as HTTPS or a virtual private network to hide your IP address and block third parties from monitoring your online activities.

Rather than using a free VPN service that often collects and sells your data to generate revenue, it is better to choose a premium, reputable VPN service that doesn’t log your browsing activities and offers servers in multiple locations.

Cyber threats evolve constantly, privacy policies change, and new services collect different types of personal information, making personal data protection an ongoing process rather than a one-time task. Here are measures to help regularly maintain your personal data protection:

By implementing these systematic approaches and maintaining regular attention to your privacy settings and data sharing practices, you significantly reduce your risk of identity theft and fraud while maintaining greater control over your digital presence and personal information.

You don’t need to dramatically overhaul your entire digital security in one day, but you can start making meaningful improvements right now. Taking action today, even small steps, builds the foundation for stronger personal data protection and peace of mind in your digital life. Choose one critical account, update its password, enable multi-factor authentication, and you’ll already be significantly more secure than you were this morning. Your future self will thank you for taking these proactive steps to protect what matters most to you.

Every step you take toward better privacy protection strengthens your overall digital security and reduces your risk of becoming a victim of scams, identity theft, or unwanted surveillance. You’ve already taken the first step by learning about digital security risks and solutions. Now it’s time to put that knowledge into action with practical steps that fit seamlessly into your digital routine.

The post What Does It Take To Be Digitally Secure? appeared first on McAfee Blog.

The holidays are just around the corner and amid the hustle and bustle, many of us will fire up our devices to go online, order gifts, plan travel, and spread cheer. But while we’re getting festive, the cybercriminals are getting ready to take advantage of the influx of your good cheer to spread scams and malware.

With online shopping expected to grow by 7.9% year-on-year in the U.S. alone in 2025, according to Mastercard, and more people than ever using social media and mobile devices to connect, the cybercriminals have a lot of opportunities to spoil our fun. Using multiple devices provides the bad guys with more ways to access your valuable “digital assets,” such as personal information and files, especially if the devices are under-protected.

In this guide, let’s look into the 12 most common cybercrimes and scams of Christmas, and what you can do to keep your money, information, and holiday spirit safe.

The festive atmosphere, continued increase in online shopping activity, and charitable spirit that define the holidays create perfect conditions for scammers to exploit your generosity and urgency.

Not surprisingly, digital criminals become more active and professional during this period, driven even more by the increasing power of artificial intelligence. A new McAfee holiday shopping report revealed that 86% of consumers surveyed receive a daily average of 11 shopping-related text or email messages that seem suspicious. This includes 3 scam texts, 5 emails, and 3 social media messages. Meanwhile, 22% admit they have been scammed during a holiday season in the past.

Their scams succeed because they exploit the psychological and behavioral patterns that are rife during the holidays. The excitement and time pressure of holiday shopping often prevail over our usual caution, while the emotional aspects of gift-giving and charitable donations can be exploited and move us to be more generous. Meanwhile, scammers understand that you’re more likely to make quick purchasing decisions when the fear of missing out on limited-time offers overtakes your judgment or when you’re rushing to find the perfect gift before it’s too late.

Overall, the frenzied seasonal themes create an environment where criminals can misuse the urgency of their fake offers and cloud our judgment, making fraudulent emails and websites appear more legitimate, while you’re already operating under the stress of holiday deadlines and budget concerns. After all, holiday promotions and charity appeals are expected during this time of year.

Now that you understand the psychology behind the scams, it’s time to become more aware of the common scams that cybercriminals run during the holiday season.

As you head online this holiday season, stay on guard and stay aware of scammers’ attempts to steal your money and your information. Familiarize yourself with the “12 Scams of Christmas” to ensure a safe and happy holiday season:

Many of us use social media sites to connect with family, friends, and co-workers over the holidays, and the cybercriminals know that this is a good place to catch you off guard because we’re all “friends,” right? Here are some ways that criminals will use these channels to obtain shoppers gift money, identity or other personal information:

As the popularity of smartphone apps has grown, so have the chances of you downloading a malicious application that steals your information or sends premium-rate text messages without your knowledge. Apps ask for more permissions than they need, such as access to your contacts or location.

If you unwrap a new smartphone this holiday season, make sure that you only download applications from official app stores and check other users’ reviews, as well as the app’s permission policies, before downloading. Software, such as McAfee Mobile Security, can also help protect you against dangerous apps.

Many of us travel to visit family and friends over the holidays. We begin our journey online by looking for deals on airfare, hotels, and rental cars. Before you book, keep in mind that scammers are looking to hook you with phony travel webpages with too-fantastic deals—beautiful pictures and rock-bottom prices—to deceive you into handing over your financial details and money.

Even when you’re already on the road, you need to be careful. Sometimes, scammers who have gained unauthorized access to hotel Wi-Fi will release a malicious pop-up ad on your device screen, and prompt you to install software before connecting. If you agree to the installation, it downloads malware onto your machine. To thwart such an attempt, it’s important that you perform a security software update before traveling.

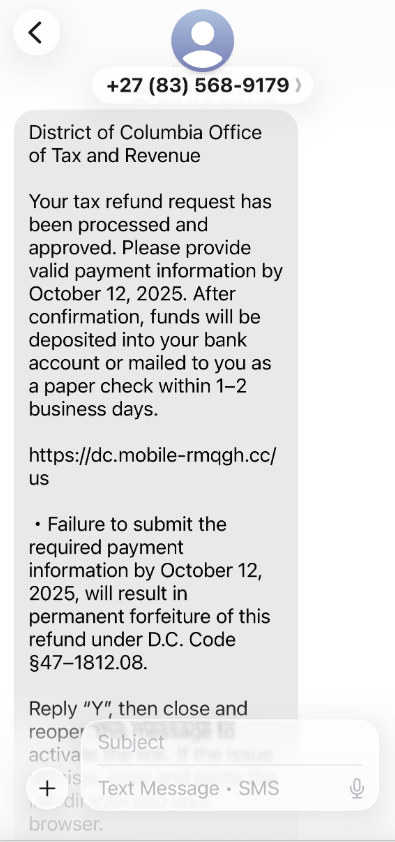

You are probably already familiar with email phishing and SMiShing messages containing questionable offers and links. The scammer will mimic a legitimate organization offering cheap Rolex watches and luxury products as the “perfect gift” for that special someone, or send a message posing as your bank with a holiday promo and try to lure you into revealing information or direct you to a fake webpage. Never respond to these scams or click on an included link. Be aware that real banks won’t ask you to divulge personal information via text message. If you have any questions about your accounts, you should contact your bank directly.

QR code phishing, or “quishing,” has emerged as a significant new threat during holiday shopping seasons. In this scam method, cybercriminals place malicious QR codes in holiday advertisements posted on social media or printed flyers, parking meters and payment kiosks at shopping centers, or at restaurant tables during holiday dining. They could also email attachments claiming to offer exclusive holiday deals or fake shipping labels placed over legitimate tracking QR codes.

The kind of excitement and buzz surrounding Apple’s new iPad and iPhone is just what cybercrooks dream of when they plot their scams. They will mention must-have holiday gifts in dangerous links, phony contests, and phishing emails to grab your attention. Once they’ve caught your eye, they will again try to get you to reveal personal information or click on a dangerous link that could download malware onto your machine. Be suspicious of any deal mentioning hot holiday gift items—especially at extremely low prices—and try to verify the offer with the real retailer involved.

Cybercriminals exploit employee expectations of year-end communications by creating fake emails that appear to come from your HR department. These messages often claim to contain annual bonus information, updated benefits packages, or mandatory holiday attendance announcements. These scams are particularly effective because they prey on legitimate employee concerns about compensation, benefits, and personal time off during the holiday season. The emails often feature real-looking company logos, proper formatting, and even references to company policies to increase their credibility.

Gift cards are probably the perfect gift for some people on your holiday list. Given their popularity, cybercriminals can’t help but want to get in on the action by offering bogus gift cards online. Be wary of buying gift cards from third parties. It’s best to buy from the official retailer. Just imagine how embarrassing it would be to find out that the gift card you gave your mother-in-law was fraudulent!

No matter what gift you’re looking for, chances are you can find it quickly and easily online, but you still want to be careful in selecting which site to shop. By promoting great deals, phony e-commerce sites will try to convince you to type in your credit card number and other personal details. After obtaining your money and information, you never receive the merchandise, and your personal information is put at risk. To prevent falling victim to bogus e-commerce stores, shop only at trusted and well-known e-commerce sites. If you’re shopping on a site for the first time, check other users’ reviews and verify that the phone number listed on the site is legitimate.

This is one of the biggest scams of every holiday season. As we open our hearts and wallets, the bad guys will send spam emails and pretend to be a real charity in the hope of getting in on the giving. Their emails will sport a stolen logo and copycat text, or come from an entirely invented charity. If you want to give, it’s always safer to visit the charity’s legitimate website, and do a little research about the charity before you donate.

E-cards are a popular way to send a quick “thank you” or holiday greeting. While most e-cards are safe, some are malicious and may contain spyware or viruses that download onto your computer once you click on the link to view the greeting. Before clicking, look for clues that the e-card is legitimate. Make sure it comes from a well-known e-card site by checking the domain name of the included link. Also check to see that the sender is someone you actually know, and that there are no misspellings or other red flags that the card is a fake.

With increased package deliveries during the holiday season, fake shipping notifications have become a common attack. These messages claim to be from legitimate shipping companies such as UPS, FedEx, or DHL, informing you of package delivery attempts or shipping delays. To complete the delivery, these notices will ask you to click on malicious links or attachments that will download malware or direct you to fake websites that will steal personal information. The timing of these attacks coincides with legitimate increased shipping activity, making them harder to distinguish from authentic communications. To track your deliveries, it is best to check the shipping company’s real website or through the trusted platform from which you ordered the product.

Knowing about these common scam tactics is only the first step toward protecting yourself and those you care about. The next step is for you to learn and implement practical, effective strategies to stay safe while still enjoying digital holiday shopping and giving.

The holiday season brings joy and connection, but it’s also a time when scammers work hardest to exploit your festive but rushed and distracted spirit. Effective Christmas scam prevention starts with awareness. By slowing down and taking a moment to verify before you click or buy, and using layered cybersecurity protections, you can worry about one less thing and focus on what matters most this season.

Stay security-conscious without letting fear diminish your holiday enjoyment and pursue your digital holiday activities with the right knowledge and tools. We hope that the specific, actionable protections will help you identify red flags, verify legitimate offers, secure your devices and accounts, and respond effectively to suspicious activity. Stay informed by following trusted sources for the latest cybersecurity tips during the holidays, and make this season about celebrating safely with the people you care about most.

Send the link to this page to your family and friends to increase their awareness and take steps to protect themselves.

The post The Top 12 Scams Of Christmas To Watch Out For appeared first on McAfee Blog.

Thanksgiving—not before Halloween as we see things in stores and online now. It seems like the holiday season and decorations start earlier and earlier every year.

But one thing that hasn’t changed is that Black Friday is still a big shopping day. With the advent of online shopping has emerged Cyber Monday, another big sale day for online shoppers on the first Monday after Thanksgiving.

Although many of us may take advantage of these great deals that the holidays offer, we also need to be aware of the risks. Online shopping is a fun and convenient way to make purchases, locate hard-to-find items, and discover bargains, but we need to take steps to protect ourselves.

This guide looks at the methods and warning signs behind online shopping scams, shows you how to recognize fake shopping apps and websites, and shares tips for staying safe online.

Online shopping has become a cornerstone of American life. CapitalOne Shopping projects American online spending to reach $1.34 trillion in 2024 and exceed $2.5 trillion in 2030.

With such a massive sum at stake, cybercriminals are laser-focused on taking a share of it, posing financial risk to the 288 million Americans who shop online. As e-commerce grows, so does fraud. In 2024, e-commerce fraud was valued at $44.3 billion, a number seen to grow by 141% to $107 billion in 2029.

Be that as it may, there are many smart shopping habits you can apply to dramatically reduce your risk of becoming a victim of online shopping fraud and enjoy the convenience and benefits of online commerce.

Online shopping scams are designed to look normal—at first glance—especially during busy sale seasons when we’re distracted by a million preparations, moving fast, and chasing deals. These are the very circumstances that fraudsters bank on to victimize you into taking the bait. Being aware of the common scam indicators will help you pause and think, recognize trouble early, and protect both your money and your personal information.

Safe online shopping starts with recognizing the hallmarks of legitimate retailers. Before you enter any payment details, take a moment to verify that the website you’re shopping on is genuine. Scam stores can look polished and convincing, but they often leave behind subtle clues. Here are quick ways to check their authenticity:

trustmark, indicating that the site has been scanned and verified as secure by a trusted third party. This security seal indicates that the site will help protect you from identity theft, credit card fraud, spam, and other malicious threats.

trustmark, indicating that the site has been scanned and verified as secure by a trusted third party. This security seal indicates that the site will help protect you from identity theft, credit card fraud, spam, and other malicious threats.The FTC also recommends these additional tips so you can enjoy all the advantages that online shopping has to offer and prevent risking your personal information.

Online shopping should feel exciting, not a dangerous undertaking you have to brace for, especially during the season of giving. It can be, with a few simple steps—checking the URL, looking for HTTPS, verifying the seller, paying with a credit card or virtual number, and trusting your gut when something feels suspicious. These small habits will keep your money and your identity where they belong: with you.

For increased safety while shopping online, seek out the help of a trusted security solution such as McAfee+ that will alert you of risky links and compromised websites to prevent identity theft or malware infection.

If this guide helps you, pass it along to someone you care about. Scams don’t just target individuals—they cascade into families and friend groups. The more we normalize safe shopping habits and increase our vigilance, the harder it is for fraudsters to win. If you ever feel unsure mid-purchase, take a breath and double-check. A few extra seconds now can save you a lot of stress later. Stay safe, and happy shopping!

The post Helpful Tips for Safe Online Shopping appeared first on McAfee Blog.

This is a critical time for our personal security, particularly in terms of privacy and personal information. A battle is being waged over our data by multiple parties, from criminal hackers to advertisers and data brokers. This article provides essential tips to help you protect the personal details you want to keep private and stay safe online.

Criminal hackers and identity thieves want to use your name to open new accounts, which they can turn into cash. They may try to obtain credit cards, utility services, or mobile phones using your good credit. In other cases, these same thieves take over existing bank or credit card accounts and completely empty them out. Identity theft affects millions of Americans each year, with over 1.4 million reports filed to the FTC in recent years and an estimated 15 million victims annually.

Online, advertisers and marketers use tracking cookies and sophisticated technologies to gather information about you and your web browsing habits. They can then offer you products or services based on the profile they’ve developed. Almost every major website contains cookies, and they are changing the way advertising is created and targeted.

The Federal Trade Commission (FTC) has explored options, such as “Do Not Track” mechanisms, to allow consumers to opt out of data collection; however, these efforts have faced significant challenges. Browser-based solutions have been proposed, but the advertising industry’s partnerships with major media and tech companies have made comprehensive opt-out mechanisms difficult to implement effectively.

Social media companies compete for your attention and your information because user data is valuable to advertisers and marketers. Whatever you post in your profile is broken down, cataloged, and disseminated. Your name, age, address, email, phone number, contacts, income status, job description, and other personal details are of use to anyone targeting your wallet.

However, legitimate advertisers aren’t the only ones targeting social networks. Criminal hackers and identity thieves are accessing your data, either through the public portion of these sites or by hacking through the back door. The bad guy is using your profile information to come up with an answer to your password reset question, or to trick you into opening your wallet or entering login credentials that might allow them to take over your existing accounts.

Amid all these developments, the National Cyber Security Alliance established Data Privacy Day, an annual awareness event observed every January 28, which encourages you to take control of your personal information and understand your online privacy rights. Initially launched in 2008, this important day coincides with the anniversary of the signing of Convention 108, the first legally binding international treaty dealing with privacy and data protection.

As a U.S. consumer, Data Privacy Day matters to you more than ever because your personal information has become incredibly valuable and, unfortunately, increasingly vulnerable. Every day, you share personal details through social media, shopping websites, mobile apps, and online services, often without realizing how this information is collected, used, or shared.

The observance of this day highlights several key risks that affect your daily digital life. Data misuse occurs when companies collect more information than necessary or use your personal details in ways you haven’t explicitly approved. Identity theft remains a significant threat, with criminals using stolen personal information to open fraudulent accounts, make unauthorized purchases, or even file fake tax returns. Additionally, data breaches continue to expose millions of Americans’ personal information each year, from social security numbers to financial details.

What makes Data Privacy Day empowering is its focus on actionable steps you can take immediately. Rather than feeling overwhelmed by privacy concerns, you can use this day as motivation to review and strengthen your digital privacy habits. The day is a reminder that privacy and data protection aren’t just technical concepts. They’re fundamental rights that help you maintain control over your digital life.

Before delving deeper into regulations and best practices, let’s take a look at the core concepts. The Federal Trade Commission defines data privacy as the reasonable expectation that your personal information will be handled appropriately by the organizations that collect it. It is your fundamental right to control how your personal information is collected, used, shared, and retained by the companies and services you interact with every day. At its heart, data privacy ensures that you have a say in what happens to details about your life, from your name and email address to your online shopping preferences, videos watched, social media usage, and down to your browsing habits and location data.

Your data follows a path that starts with collection, when companies gather information directly from you, such as when you fill out a form, or indirectly through cookies and tracking pixels. The use phase refers to how organizations process your information, whether to improve their services, target advertisements, or analyze user behavior. Sharing involves passing your data to third parties, from business partners to data brokers. Retention determines how long your information stays in their systems, often well beyond the end of your active relationship with the service.

Throughout this process, your information is governed by three principles of modern data privacy:

When Netflix asks if you want to share viewing data to improve recommendations, that’s consent in action. When Google lets you download your search history or delete location tracking, you’re exercising control. When Apple’s privacy labels show exactly what data an app collects, that’s transparency working for you.

Under these newly instituted state privacy laws, you have several key rights that put you in control of your personal information:

Data protection and data privacy are sometimes used interchangeably, but they serve different but complementary roles in keeping your personal information safe:

Here are some everyday scenarios that show how these concepts work differently:

As a consumer, your data privacy rights translate into real, actionable benefits you can use today. However, the effectiveness of these protections often depends on enforcement and your own awareness of the tools available to you.

U.S. state privacy laws are increasingly giving you the right to know what personal information companies collect, the right to delete your data, and the right to opt out of having your information sold or shared.

America’s privacy framework is built on sector-specific federal regulations combined with increasingly robust state legislation. This approach means your rights and protections can vary significantly depending on where you live and what type of data is being collected.

At the federal level, key laws include the Health Insurance Portability and Accountability Act (HIPAA) for healthcare data, the Fair Credit Reporting Act (FCRA) for credit information, and the Children’s Online Privacy Protection Act (COPPA) for children under 13 years. While these provide important protections in specific areas, they leave significant gaps in comprehensive consumer data privacy protection.

To fill these gaps, California established crucial precedents through the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA). Other states are also now enacting comprehensive privacy laws, including Virginia’s Consumer Data Protection Act, Colorado Privacy Act, Connecticut’s Data Privacy Act, and Utah’s Consumer Privacy Act. Each provides residents with fundamental rights over their personal data while requiring businesses to implement stronger protection measures.

Sensitive personal data represents the most valuable and vulnerable information about you—the details that, if compromised, could cause significant harm to your finances, safety, and peace of mind. Unlike basic contact information, sensitive data requires stronger legal protections and your extra vigilance because of its potential for misuse.

Your health information deserves particular care because it reveals intimate details about your physical and mental well-being. HIPAA protections cover medical records, but health data collected by fitness apps, mental health platforms, or wellness websites may not receive the same legal safeguards.

Biometric data—your unique physical characteristics such as fingerprints, voice patterns, or facial features—can’t be changed if stolen, making this information particularly precious.

Children’s data receives special attention under privacy laws because minors can’t meaningfully consent to data collection. The Children’s Online Privacy Protection Act requires explicit parental consent before companies can collect information from children under 13, while some state laws extend these protections to older teens.

Meanwhile, global services such as Google, Facebook, or Netflix apply the Europe-established General Data Protection Regulation (GDPR) laws worldwide to maintain consistent data practices.

GDPR personal data includes obvious identifiers such as your name, email address, phone number, and Social Security number. But it also covers less obvious information, such as IP addresses, device IDs, location data, and even your online shopping habits or social media activity. Essentially, if data points can be combined to create a profile of you, they qualify as personal data under GDPR standards. This broader definition gives you stronger control over your information and has influenced many U.S. companies to offer the same rights to all users, not just those in the European Union.

Whether a company follows GDPR, California’s privacy laws, or other frameworks, the core principle remains the same: you deserve transparency and control over your personal information.

Your privacy rights are expanding, but exercising them effectively requires staying informed and taking proactive steps. As we celebrate Data Privacy Day, we recommend you participate by taking simple, practical steps to exercise your data privacy rights.

Start with the platforms and services you use most frequently. Look for the privacy or data protection section in your account settings and review the information being collected and shared.

Many major companies now provide online forms or dedicated email addresses for privacy requests. Take advantage of these to understand what data they have about you. Popular platforms such as Google, Facebook, and Amazon have streamlined processes for data downloads.

Look for “Do Not Sell My Personal Information” links on websites, typically found in footers or privacy policy pages. You can also use opt-out tools such as the Global Privacy Control browser setting that automatically signals your opt-out preferences.

Many data brokers now offer opt-out mechanisms, though the process can be time-consuming. Consider using privacy services that handle multiple opt-out requests on your behalf.

Regularly search for your name and personal information online. Set up Google Alerts for your name and key personal details to stay informed about new appearances of your information. In addition, monitor your credit reports for unauthorized changes, and use identity monitoring services that watch for your personal information appearing in data breaches or on the dark web.

When sharing sensitive information online, verify that websites use https:// in the address bar and read privacy policies before providing personal details. Only use well-established, privacy-focused health, financial, and communication platforms with a strong track record of privacy and data protection.

For children’s data, maintaining active oversight will help you stay ahead of potential problems in their online activities. Review the apps and websites they use, understand what information these platforms collect, and use parental controls to limit data sharing. Teach your children about privacy and the risks of sharing personal information online.

Protecting your personal data doesn’t have to feel like a giant, technical project. Most privacy wins come from small, repeatable habits that you can do in minutes to shrink your digital footprint, and use the internet on your terms.

Your personal information has value, so make sure you’re getting a fair return through services that respect your privacy.