The malware landscape is growing more complex and costly by the minute, as indicated by the rising number of cyberattacks that grow each year. According to the Federal Bureau of Investigation, in 2024, approximately $1.4 million in losses were reported due to malware. Meanwhile, complaints of ransomware, a type of malware that locks your files until a ransom is paid to release them, rose by 9% from the year prior, with losses totaling nearly $12.5 million.

With the continued growth of e-commerce, online banking, and artificial intelligence, we can count on even more new cyber threats for all kinds of devices—be it Android, iPhone, PC, or Mac. No device under your family’s roof is immune to cyberattacks. As we speak, one or more of your devices may have already been infected. But would you know it?

In this blog, we’ll dive into the types of viruses and malware that infiltrate devices and their indications, the ways you can remove them, and tips to protect your phones moving forward.

Malware is malicious software designed to harm your device, steal your personal information, or disrupt your digital life. On mobile devices, malware can take many forms—from apps that secretly collect your data to programs that bombard you with unwanted ads or even lock your device for ransom.

Mobile devices, including smartphones and tablets, can be infected with malware and other digital threats, even when their operating systems have built-in security features. How does this happen? Your phone can catch viruses and malware in several ways:

Malware doesn’t always announce itself with a big flashing sign. On the contrary, it slips quietly into your devices and starts causing trouble behind the scenes. Before long, you will see noticeable changes in its behavior. Here are five key signs of malware or a virus to watch for and catch the problem early, before the damage spreads:

As our phones and tablets become extensions of our daily lives, cybercriminals have developed sophisticated malware explicitly designed to infiltrate them, such as:

Sometimes the warning signs are obvious, but at other times, malware operates quietly in the background, stealing data or draining resources without drawing attention. Find out for sure if your device has a virus or malware by following these steps:

Here are more specific measures to ascertain the presence of a virus or malware, based on your mobile device’s operating system:

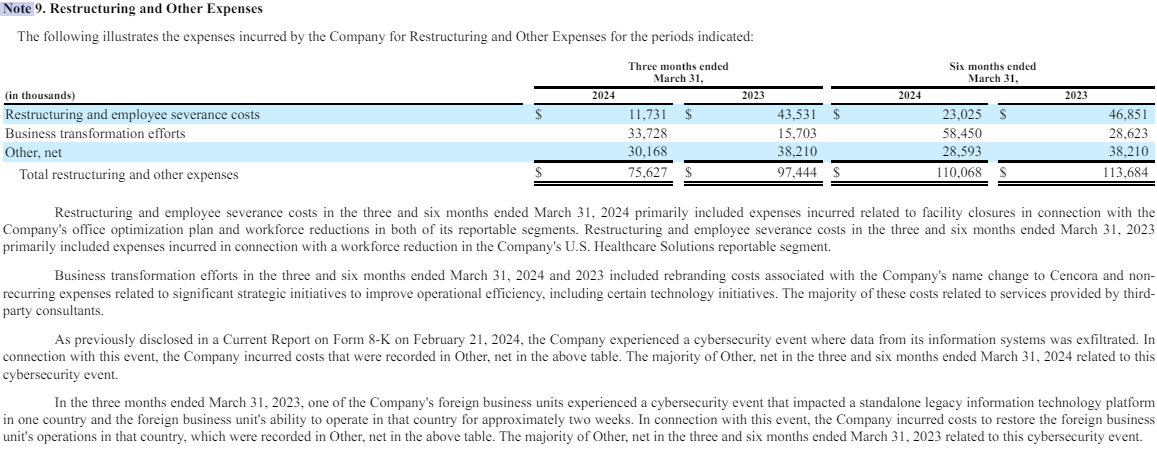

If you discover malicious apps and profiles in your phone, a clear, step-by-step action plan will help you remove them and restore your device to a secure state. Here’s how to tackle mobile malware confidently and get your device back to normal:

With a few smart habits and simple tools, you can create a safer digital environment for your family members. Here are some practical ways to safeguard family devices and keep threats at bay.

While the threat of malware and viruses continues to evolve, you now have the knowledge and tools to stay digitally protected. The signs we’ve discussed—from unexpected device behavior to suspicious pop-ups—serve as warnings, helping you catch problems before they escalate into major security incidents.

Your best defense combines proactive security measures and vigilant behavior. Applying simple, solid digital habits such as updating software, using strong passwords, and staying alert to suspicious activity will thwart the vast majority of common threats. By incorporating these practices into your routine, along with the right online security tools, you are building a robust defense that works around the clock.

The post 5 Signs Your Device May be Infected with Malware or a Virus appeared first on McAfee Blog.

A prolific cybercriminal group that calls itself “Scattered LAPSUS$ Hunters” has dominated headlines this year by regularly stealing data from and publicly mass extorting dozens of major corporations. But the tables seem to have turned somewhat for “Rey,” the moniker chosen by the technical operator and public face of the hacker group: Earlier this week, Rey confirmed his real life identity and agreed to an interview after KrebsOnSecurity tracked him down and contacted his father.

Scattered LAPSUS$ Hunters (SLSH) is thought to be an amalgamation of three hacking groups — Scattered Spider, LAPSUS$ and ShinyHunters. Members of these gangs hail from many of the same chat channels on the Com, a mostly English-language cybercriminal community that operates across an ocean of Telegram and Discord servers.

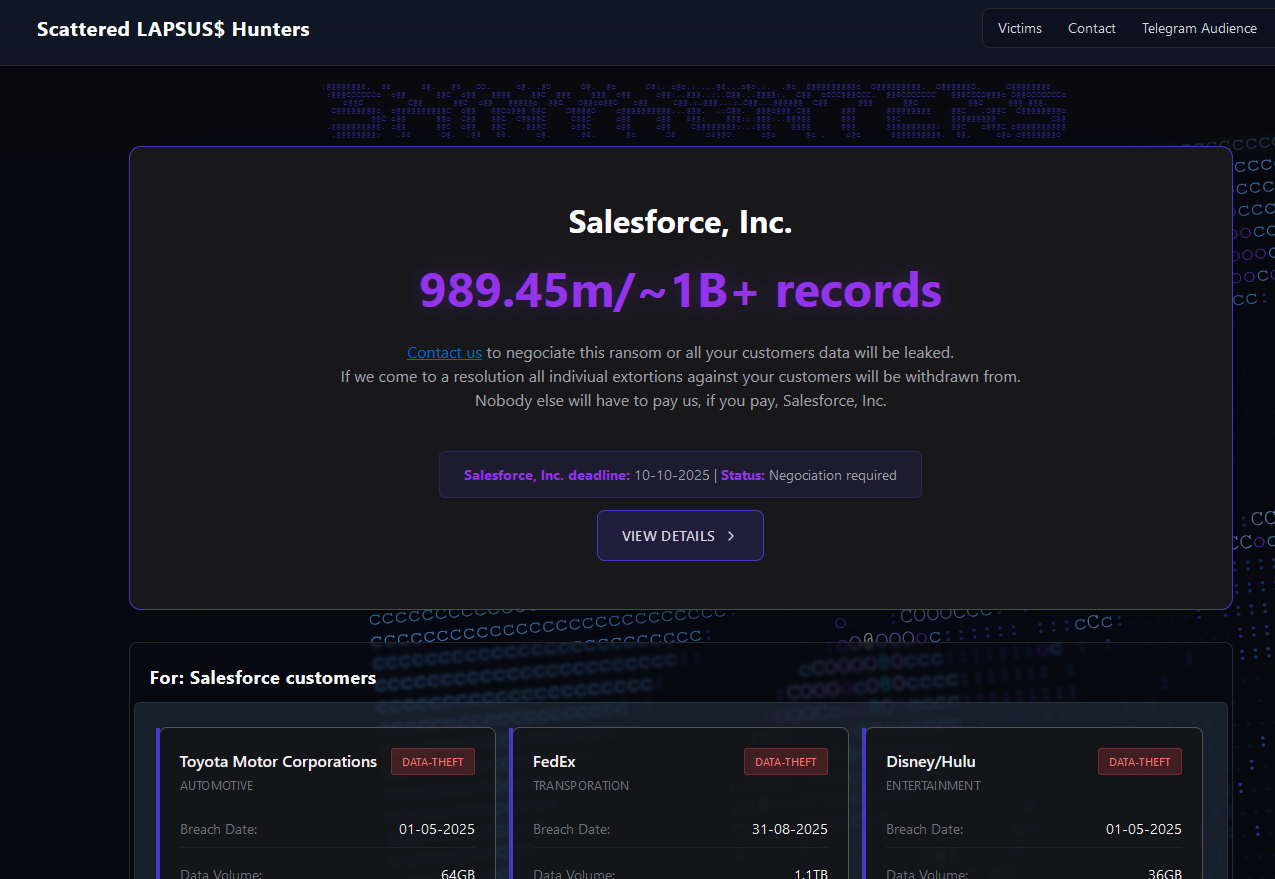

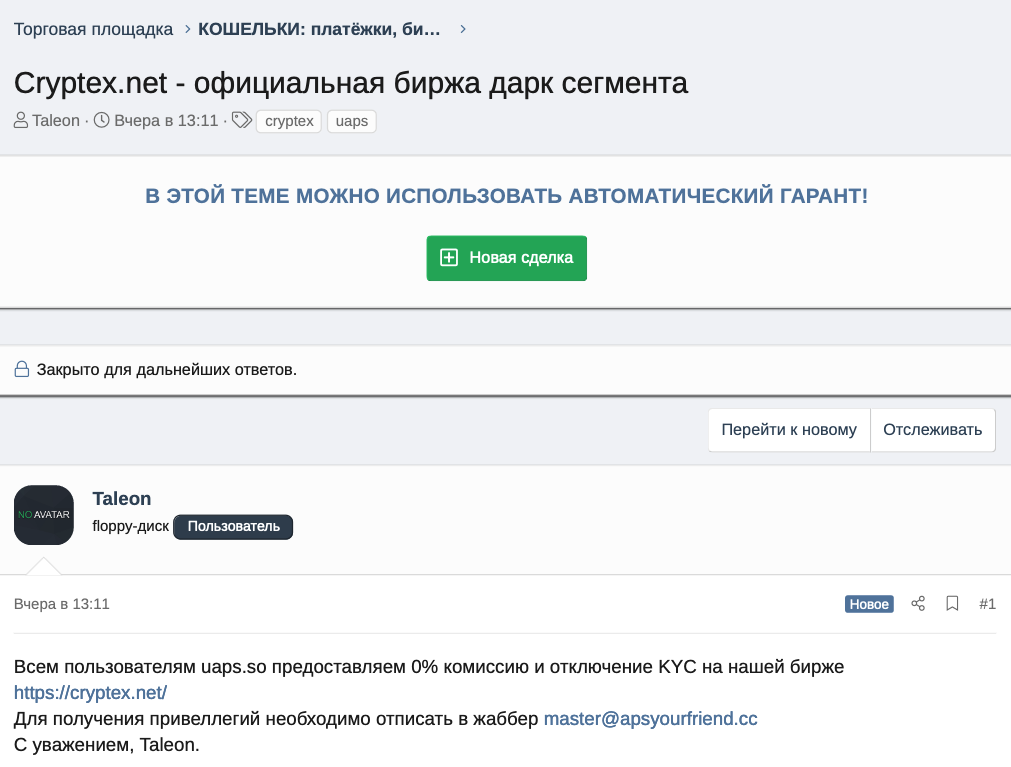

In May 2025, SLSH members launched a social engineering campaign that used voice phishing to trick targets into connecting a malicious app to their organization’s Salesforce portal. The group later launched a data leak portal that threatened to publish the internal data of three dozen companies that allegedly had Salesforce data stolen, including Toyota, FedEx, Disney/Hulu, and UPS.

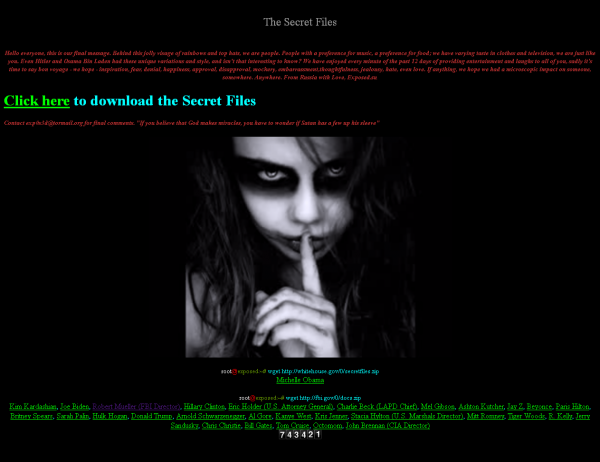

The new extortion website tied to ShinyHunters, which threatens to publish stolen data unless Salesforce or individual victim companies agree to pay a ransom.

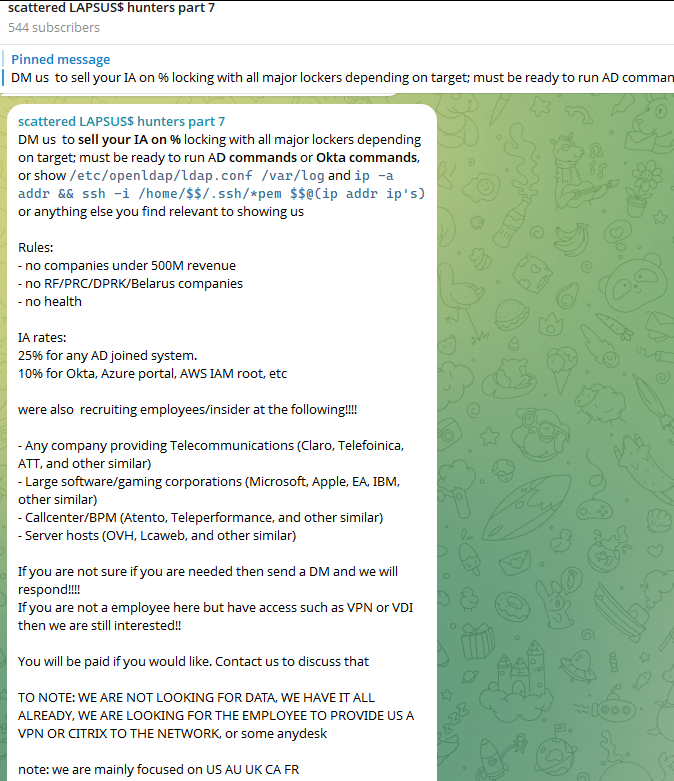

Last week, the SLSH Telegram channel featured an offer to recruit and reward “insiders,” employees at large companies who agree to share internal access to their employer’s network for a share of whatever ransom payment is ultimately paid by the victim company.

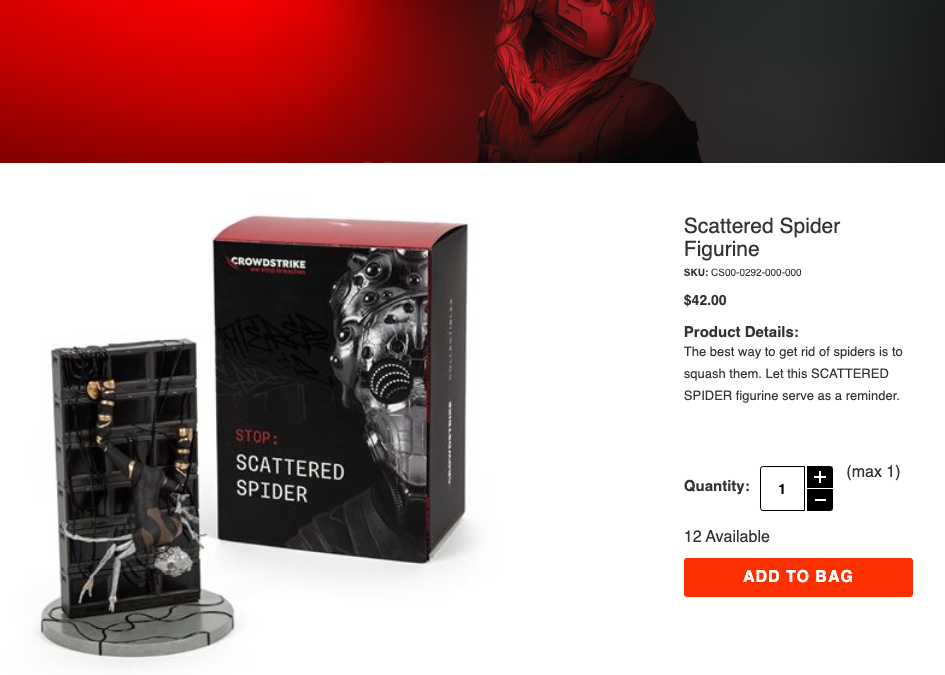

SLSH has solicited insider access previously, but their latest call for disgruntled employees started making the rounds on social media at the same time news broke that the cybersecurity firm Crowdstrike had fired an employee for allegedly sharing screenshots of internal systems with the hacker group (Crowdstrike said their systems were never compromised and that it has turned the matter over to law enforcement agencies).

The Telegram server for the Scattered LAPSUS$ Hunters has been attempting to recruit insiders at large companies.

Members of SLSH have traditionally used other ransomware gangs’ encryptors in attacks, including malware from ransomware affiliate programs like ALPHV/BlackCat, Qilin, RansomHub, and DragonForce. But last week, SLSH announced on its Telegram channel the release of their own ransomware-as-a-service operation called ShinySp1d3r.

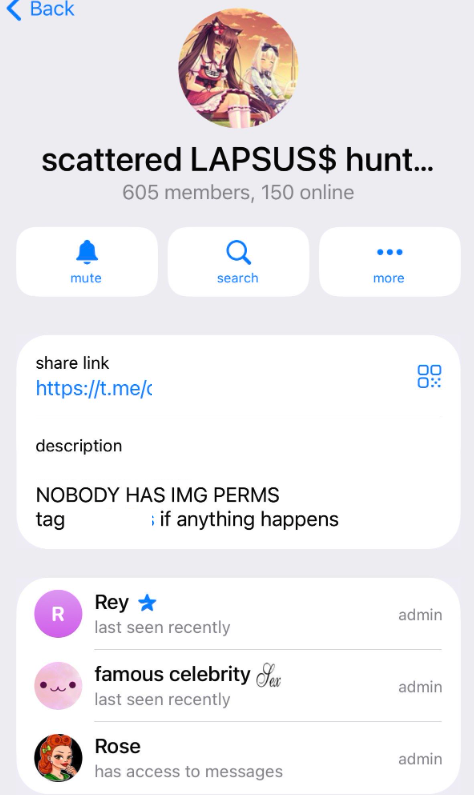

The individual responsible for releasing the ShinySp1d3r ransomware offering is a core SLSH member who goes by the handle “Rey” and who is currently one of just three administrators of the SLSH Telegram channel. Previously, Rey was an administrator of the data leak website for Hellcat, a ransomware group that surfaced in late 2024 and was involved in attacks on companies including Schneider Electric, Telefonica, and Orange Romania.

A recent, slightly redacted screenshot of the Scattered LAPSUS$ Hunters Telegram channel description, showing Rey as one of three administrators.

Also in 2024, Rey would take over as administrator of the most recent incarnation of BreachForums, an English-language cybercrime forum whose domain names have been seized on multiple occasions by the FBI and/or by international authorities. In April 2025, Rey posted on Twitter/X about another FBI seizure of BreachForums.

On October 5, 2025, the FBI announced it had once again seized the domains associated with BreachForums, which it described as a major criminal marketplace used by ShinyHunters and others to traffic in stolen data and facilitate extortion.

“This takedown removes access to a key hub used by these actors to monetize intrusions, recruit collaborators, and target victims across multiple sectors,” the FBI said.

Incredibly, Rey would make a series of critical operational security mistakes last year that provided multiple avenues to ascertain and confirm his real-life identity and location. Read on to learn how it all unraveled for Rey.

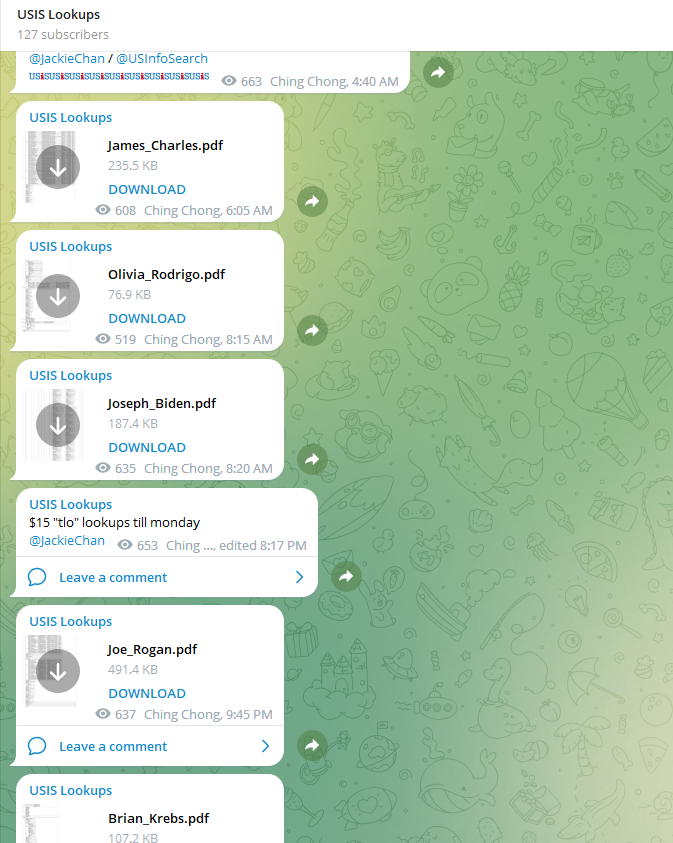

According to the cyber intelligence firm Intel 471, Rey was an active user on various BreachForums reincarnations over the past two years, authoring more than 200 posts between February 2024 and July 2025. Intel 471 says Rey previously used the handle “Hikki-Chan” on BreachForums, where their first post shared data allegedly stolen from the U.S. Centers for Disease Control and Prevention (CDC).

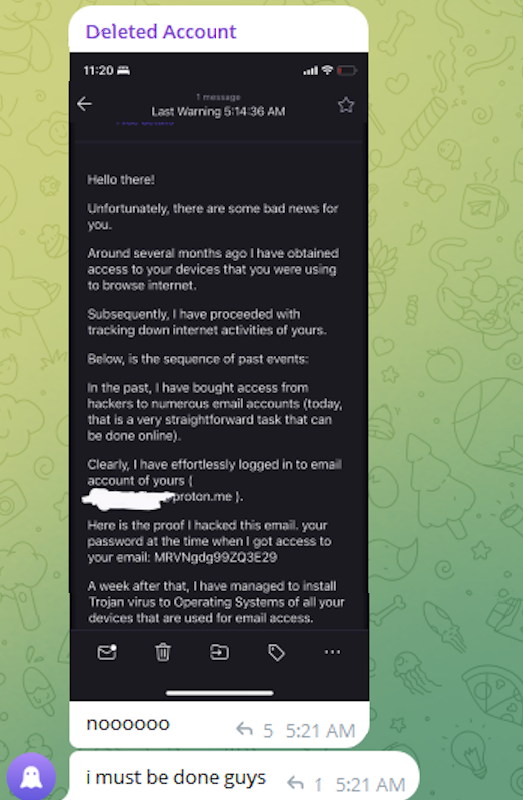

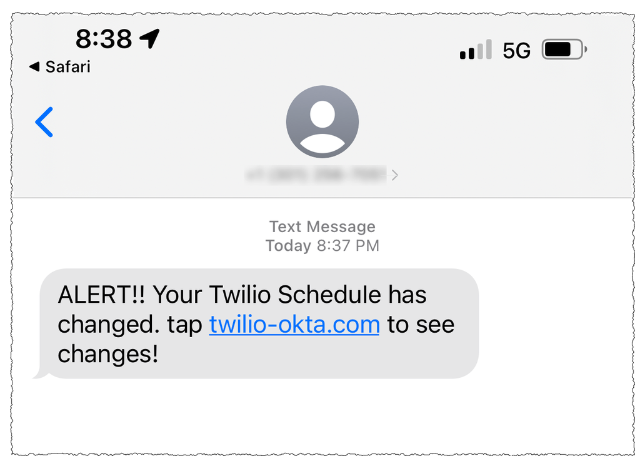

In that February 2024 post about the CDC, Hikki-Chan says they could be reached at the Telegram username @wristmug. In May 2024, @wristmug posted in a Telegram group chat called “Pantifan” a copy of an extortion email they said they received that included their email address and password.

The message that @wristmug cut and pasted appears to have been part of an automated email scam that claims it was sent by a hacker who has compromised your computer and used your webcam to record a video of you while you were watching porn. These missives threaten to release the video to all your contacts unless you pay a Bitcoin ransom, and they typically reference a real password the recipient has used previously.

“Noooooo,” the @wristmug account wrote in mock horror after posting a screenshot of the scam message. “I must be done guys.”

A message posted to Telegram by Rey/@wristmug.

In posting their screenshot, @wristmug redacted the username portion of the email address referenced in the body of the scam message. However, they did not redact their previously-used password, and they left the domain portion of their email address (@proton.me) visible in the screenshot.

Searching on @wristmug’s rather unique 15-character password in the breach tracking service Spycloud finds it is known to have been used by just one email address: cybero5tdev@proton.me. According to Spycloud, those credentials were exposed at least twice in early 2024 when this user’s device was infected with an infostealer trojan that siphoned all of its stored usernames, passwords and authentication cookies (a finding that was initially revealed in March 2025 by the cyber intelligence firm KELA).

Intel 471 shows the email address cybero5tdev@proton.me belonged to a BreachForums member who went by the username o5tdev. Searching on this nickname in Google brings up at least two website defacement archives showing that a user named o5tdev was previously involved in defacing sites with pro-Palestinian messages. The screenshot below, for example, shows that 05tdev was part of a group called Cyb3r Drag0nz Team.

Rey/o5tdev’s defacement pages. Image: archive.org.

A 2023 report from SentinelOne described Cyb3r Drag0nz Team as a hacktivist group with a history of launching DDoS attacks and cyber defacements as well as engaging in data leak activity.

“Cyb3r Drag0nz Team claims to have leaked data on over a million of Israeli citizens spread across multiple leaks,” SentinelOne reported. “To date, the group has released multiple .RAR archives of purported personal information on citizens across Israel.”

The cyber intelligence firm Flashpoint finds the Telegram user @05tdev was active in 2023 and early 2024, posting in Arabic on anti-Israel channels like “Ghost of Palestine” [full disclosure: Flashpoint is currently an advertiser on this blog].

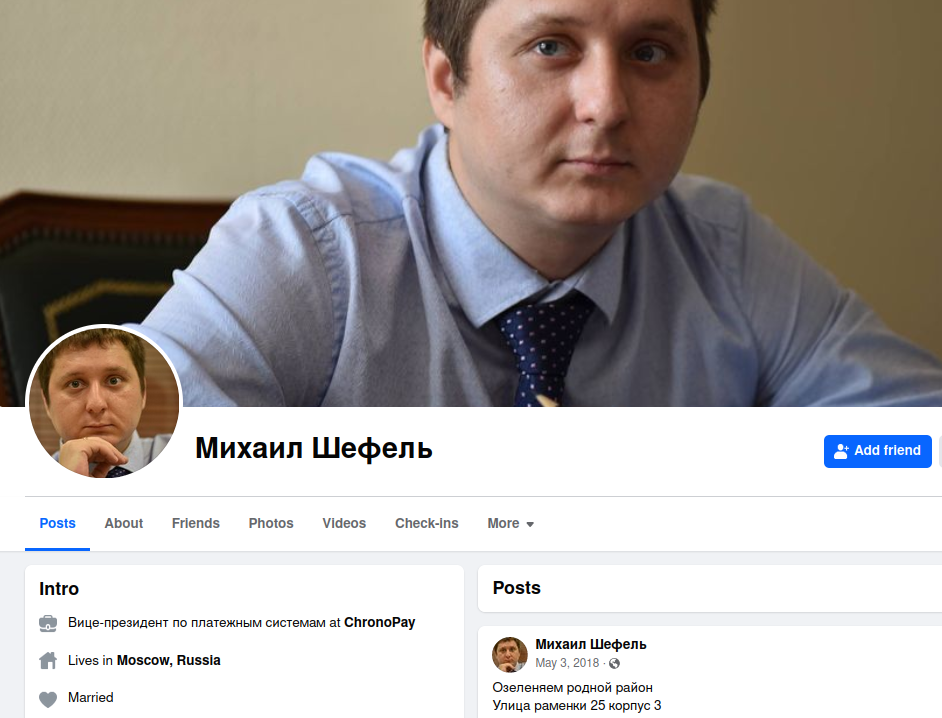

Flashpoint shows that Rey’s Telegram account (ID7047194296) was particularly active in a cybercrime-focused channel called Jacuzzi, where this user shared several personal details, including that their father was an airline pilot. Rey claimed in 2024 to be 15 years old, and to have family connections to Ireland.

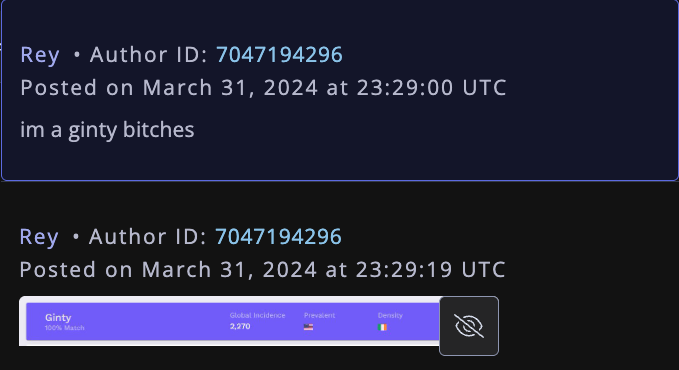

Specifically, Rey mentioned in several Telegram chats that he had Irish heritage, even posting a graphic that shows the prevalence of the surname “Ginty.”

Rey, on Telegram claiming to have association to the surname “Ginty.” Image: Flashpoint.

Spycloud indexed hundreds of credentials stolen from cybero5dev@proton.me, and those details indicate that Rey’s computer is a shared Microsoft Windows device located in Amman, Jordan. The credential data stolen from Rey in early 2024 show there are multiple users of the infected PC, but that all shared the same last name of Khader and an address in Amman, Jordan.

The “autofill” data lifted from Rey’s family PC contains an entry for a 46-year-old Zaid Khader that says his mother’s maiden name was Ginty. The infostealer data also shows Zaid Khader frequently accessed internal websites for employees of Royal Jordanian Airlines.

The infostealer data makes clear that Rey’s full name is Saif Al-Din Khader. Having no luck contacting Saif directly, KrebsOnSecurity sent an email to his father Zaid. The message invited the father to respond via email, phone or Signal, explaining that his son appeared to be deeply enmeshed in a serious cybercrime conspiracy.

Less than two hours later, I received a Signal message from Saif, who said his dad suspected the email was a scam and had forwarded it to him.

“I saw your email, unfortunately I don’t think my dad would respond to this because they think its some ‘scam email,'” said Saif, who told me he turns 16 years old next month. “So I decided to talk to you directly.”

Saif explained that he’d already heard from European law enforcement officials, and had been trying to extricate himself from SLSH. When asked why then he was involved in releasing SLSH’s new ShinySp1d3r ransomware-as-a-service offering, Saif said he couldn’t just suddenly quit the group.

“Well I cant just dip like that, I’m trying to clean up everything I’m associated with and move on,” he said.

The former Hellcat ransomware site. Image: Kelacyber.com

He also shared that ShinySp1d3r is just a rehash of Hellcat ransomware, except modified with AI tools. “I gave the source code of Hellcat ransomware out basically.”

Saif claims he reached out on his own recently to the Telegram account for Operation Endgame, the codename for an ongoing law enforcement operation targeting cybercrime services, vendors and their customers.

“I’m already cooperating with law enforcement,” Saif said. “In fact, I have been talking to them since at least June. I have told them nearly everything. I haven’t really done anything like breaching into a corp or extortion related since September.”

Saif suggested that a story about him right now could endanger any further cooperation he may be able to provide. He also said he wasn’t sure if the U.S. or European authorities had been in contact with the Jordanian government about his involvement with the hacking group.

“A story would bring so much unwanted heat and would make things very difficult if I’m going to cooperate,” Saif said. “I’m unsure whats going to happen they said they’re in contact with multiple countries regarding my request but its been like an entire week and I got no updates from them.”

Saif shared a screenshot that indicated he’d contacted Europol authorities late last month. But he couldn’t name any law enforcement officials he said were responding to his inquiries, and KrebsOnSecurity was unable to verify his claims.

“I don’t really care I just want to move on from all this stuff even if its going to be prison time or whatever they gonna say,” Saif said.

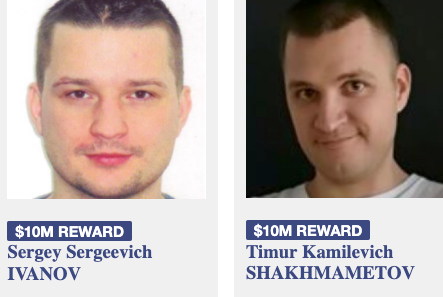

U.S. prosecutors last week levied criminal hacking charges against 19-year-old U.K. national Thalha Jubair for allegedly being a core member of Scattered Spider, a prolific cybercrime group blamed for extorting at least $115 million in ransom payments from victims. The charges came as Jubair and an alleged co-conspirator appeared in a London court to face accusations of hacking into and extorting several large U.K. retailers, the London transit system, and healthcare providers in the United States.

At a court hearing last week, U.K. prosecutors laid out a litany of charges against Jubair and 18-year-old Owen Flowers, accusing the teens of involvement in an August 2024 cyberattack that crippled Transport for London, the entity responsible for the public transport network in the Greater London area.

A court artist sketch of Owen Flowers (left) and Thalha Jubair appearing at Westminster Magistrates’ Court last week. Credit: Elizabeth Cook, PA Wire.

On July 10, 2025, KrebsOnSecurity reported that Flowers and Jubair had been arrested in the United Kingdom in connection with recent Scattered Spider ransom attacks against the retailers Marks & Spencer and Harrods, and the British food retailer Co-op Group.

That story cited sources close to the investigation saying Flowers was the Scattered Spider member who anonymously gave interviews to the media in the days after the group’s September 2023 ransomware attacks disrupted operations at Las Vegas casinos operated by MGM Resorts and Caesars Entertainment.

The story also noted that Jubair’s alleged handles on cybercrime-focused Telegram channels had far lengthier rap sheets involving some of the more consequential and headline-grabbing data breaches over the past four years. What follows is an account of cybercrime activities that prosecutors have attributed to Jubair’s alleged hacker handles, as told by those accounts in posts to public Telegram channels that are closely monitored by multiple cyber intelligence firms.

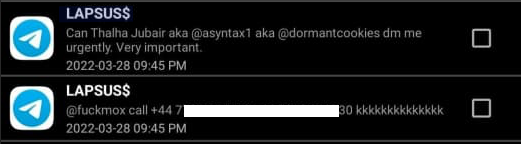

Jubair is alleged to have been a core member of the LAPSUS$ cybercrime group that broke into dozens of technology companies beginning in late 2021, stealing source code and other internal data from tech giants including Microsoft, Nvidia, Okta, Rockstar Games, Samsung, T-Mobile, and Uber.

That is, according to the former leader of the now-defunct LAPSUS$. In April 2022, KrebsOnSecurity published internal chat records taken from a server that LAPSUS$ used, and those chats indicate Jubair was working with the group using the nicknames Amtrak and Asyntax. In the middle of the gang’s cybercrime spree, Asyntax told the LAPSUS$ leader not to share T-Mobile’s logo in images sent to the group because he’d been previously busted for SIM-swapping and his parents would suspect he was back at it again.

The leader of LAPSUS$ responded by gleefully posting Asyntax’s real name, phone number, and other hacker handles into a public chat room on Telegram:

In March 2022, the leader of the LAPSUS$ data extortion group exposed Thalha Jubair’s name and hacker handles in a public chat room on Telegram.

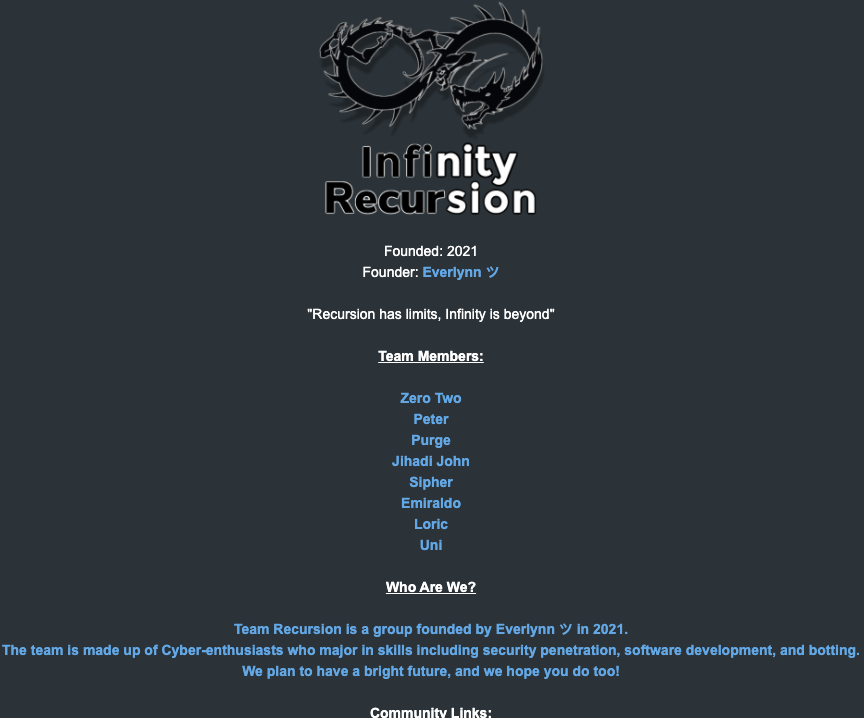

That story about the leaked LAPSUS$ chats also connected Amtrak/Asyntax to several previous hacker identities, including “Everlynn,” who in April 2021 began offering a cybercriminal service that sold fraudulent “emergency data requests” targeting the major social media and email providers.

In these so-called “fake EDR” schemes, the hackers compromise email accounts tied to police departments and government agencies, and then send unauthorized demands for subscriber data (e.g. username, IP/email address), while claiming the information being requested can’t wait for a court order because it relates to an urgent matter of life and death.

The roster of the now-defunct “Infinity Recursion” hacking team, which sold fake EDRs between 2021 and 2022. The founder “Everlynn” has been tied to Jubair. The member listed as “Peter” became the leader of LAPSUS$ who would later post Jubair’s name, phone number and hacker handles into LAPSUS$’s chat channel.

Prosecutors in New Jersey last week alleged Jubair was part of a threat group variously known as Scattered Spider, 0ktapus, and UNC3944, and that he used the nicknames EarthtoStar, Brad, Austin, and Austistic.

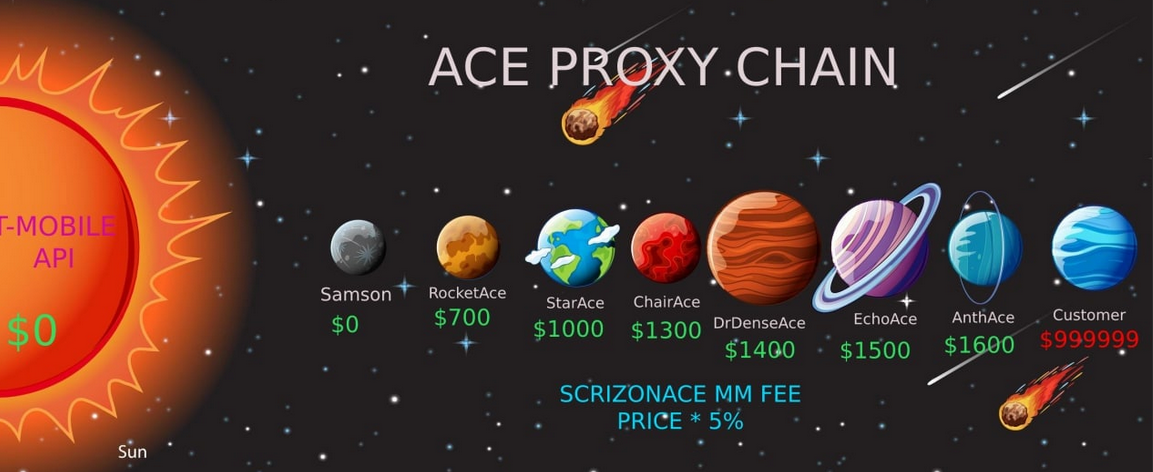

Beginning in 2022, EarthtoStar co-ran a bustling Telegram channel called Star Chat, which was home to a prolific SIM-swapping group that relentlessly used voice- and SMS-based phishing attacks to steal credentials from employees at the major wireless providers in the U.S. and U.K.

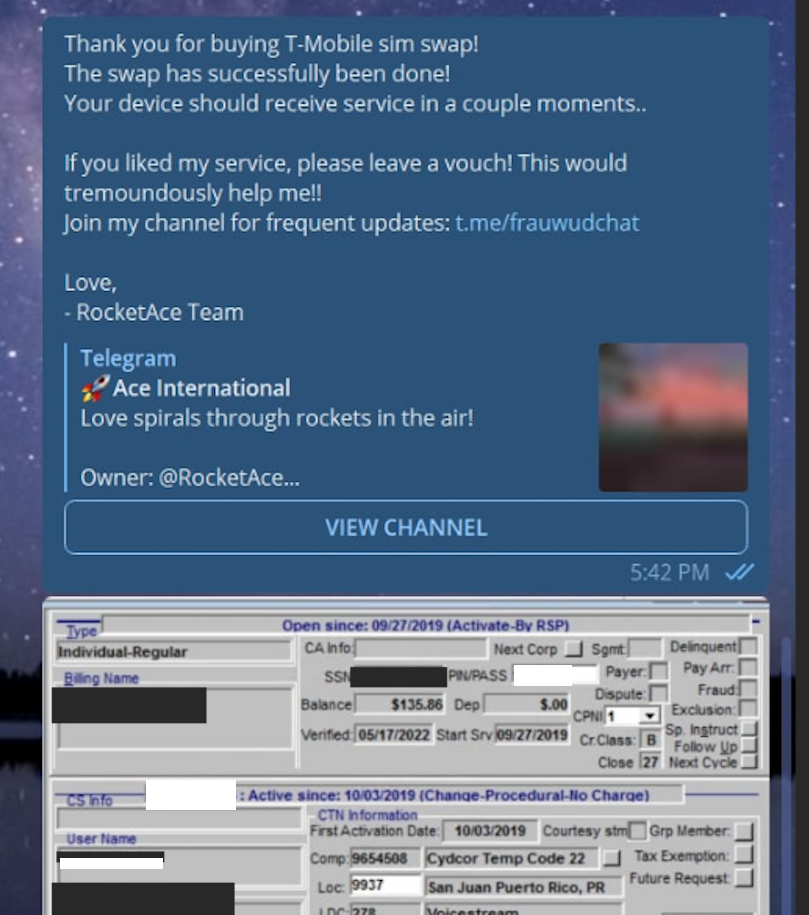

Jubair allegedly used the handle “Earth2Star,” a core member of a prolific SIM-swapping group operating in 2022. This ad produced by the group lists various prices for SIM swaps.

The group would then use that access to sell a SIM-swapping service that could redirect a target’s phone number to a device the attackers controlled, allowing them to intercept the victim’s phone calls and text messages (including one-time codes). Members of Star Chat targeted multiple wireless carriers with SIM-swapping attacks, but they focused mainly on phishing T-Mobile employees.

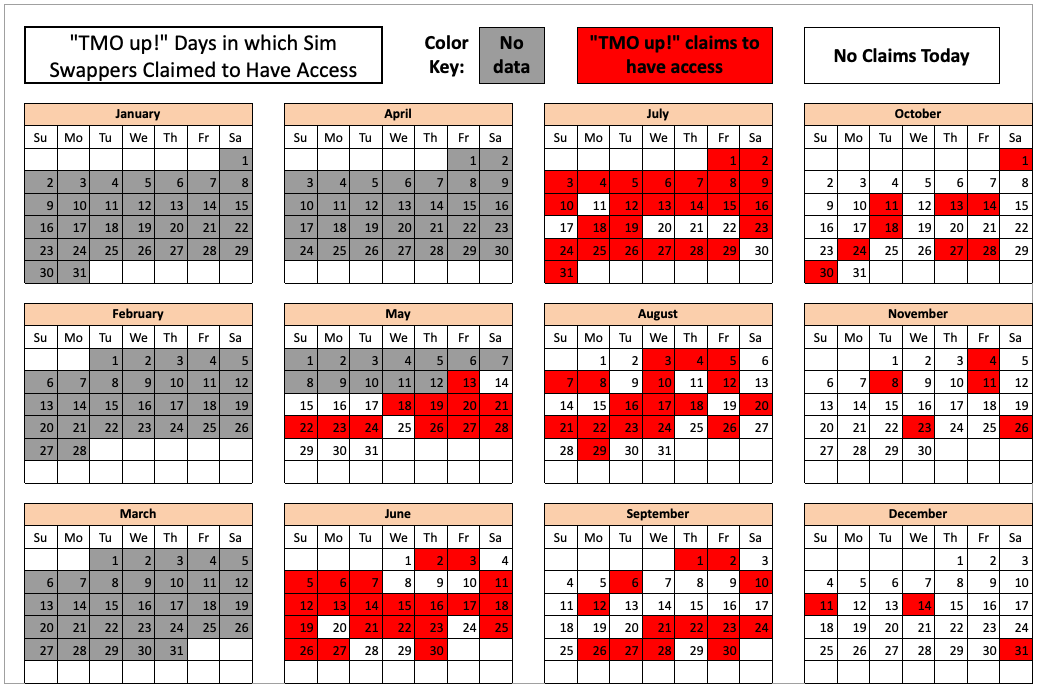

In February 2023, KrebsOnSecurity scrutinized more than seven months of these SIM-swapping solicitations on Star Chat, which almost daily peppered the public channel with “Tmo up!” and “Tmo down!” notices indicating periods wherein the group claimed to have active access to T-Mobile’s network.

A redacted receipt from Star Chat’s SIM-swapping service targeting a T-Mobile customer after the group gained access to internal T-Mobile employee tools.

The data showed that Star Chat — along with two other SIM-swapping groups operating at the same time — collectively broke into T-Mobile over a hundred times in the last seven months of 2022. However, Star Chat was by far the most prolific of the three, responsible for at least 70 of those incidents.

The 104 days in the latter half of 2022 in which different known SIM-swapping groups claimed access to T-Mobile employee tools. Star Chat was responsible for a majority of these incidents. Image: krebsonsecurity.com.

A review of EarthtoStar’s messages on Star Chat as indexed by the threat intelligence firm Flashpoint shows this person also sold “AT&T email resets” and AT&T call forwarding services for up to $1,200 per line. EarthtoStar explained the purpose of this service in post on Telegram:

“Ok people are confused, so you know when u login to chase and it says ‘2fa required’ or whatever the fuck, well it gives you two options, SMS or Call. If you press call, and I forward the line to you then who do you think will get said call?”

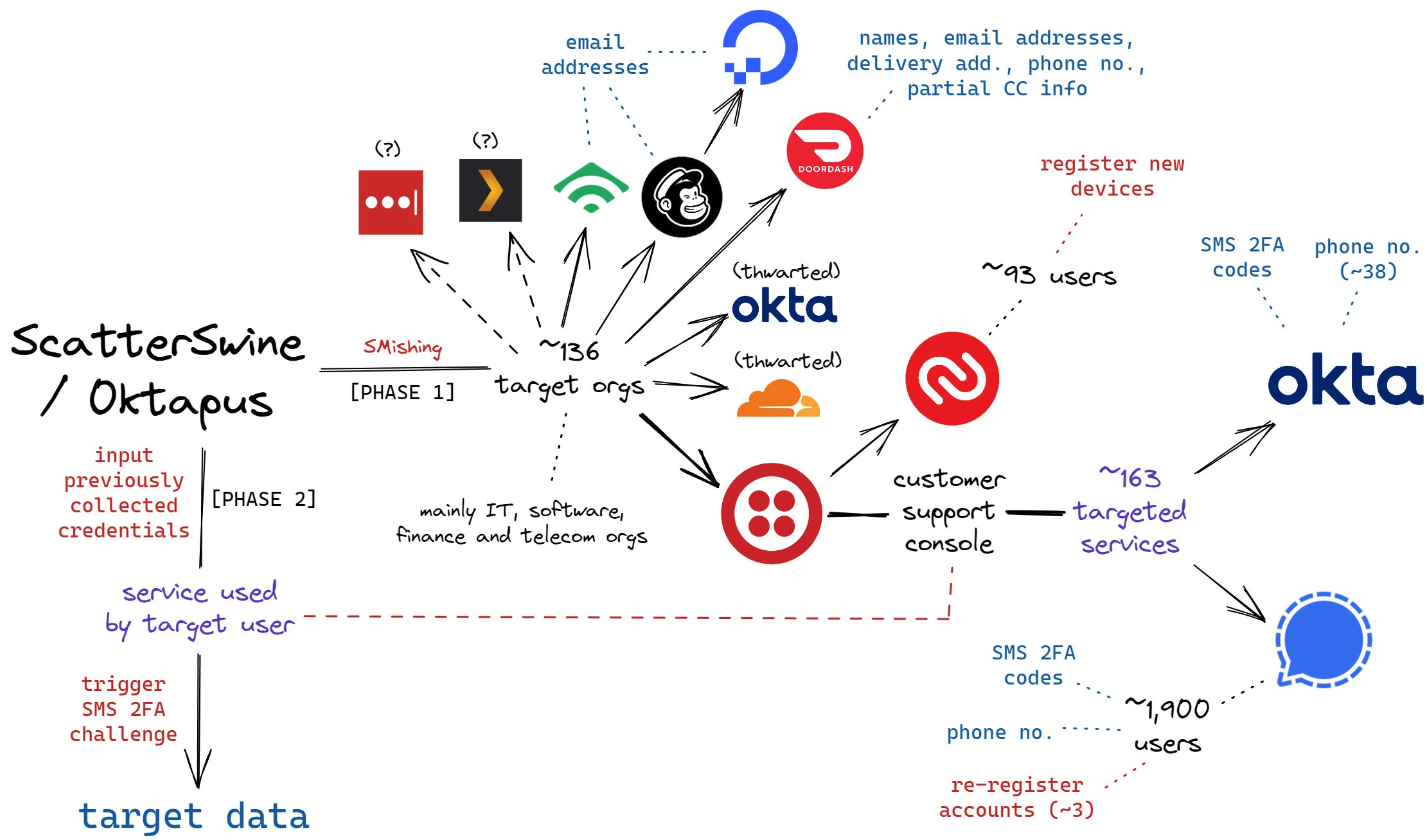

New Jersey prosecutors allege Jubair also was involved in a mass SMS phishing campaign during the summer of 2022 that stole single sign-on credentials from employees at hundreds of companies. The text messages asked users to click a link and log in at a phishing page that mimicked their employer’s Okta authentication page, saying recipients needed to review pending changes to their upcoming work schedules.

The phishing websites used a Telegram instant message bot to forward any submitted credentials in real-time, allowing the attackers to use the phished username, password and one-time code to log in as that employee at the real employer website.

That weeks-long SMS phishing campaign led to intrusions and data thefts at more than 130 organizations, including LastPass, DoorDash, Mailchimp, Plex and Signal.

A visual depiction of the attacks by the SMS phishing group known as 0ktapus, ScatterSwine, and Scattered Spider. Image: Amitai Cohen twitter.com/amitaico.

EarthtoStar’s group Star Chat specialized in phishing their way into business process outsourcing (BPO) companies that provide customer support for a range of multinational companies, including a number of the world’s largest telecommunications providers. In May 2022, EarthtoStar posted to the Telegram channel “Frauwudchat”:

“Hi, I am looking for partners in order to exfiltrate data from large telecommunications companies/call centers/alike, I have major experience in this field, [including] a massive call center which houses 200,000+ employees where I have dumped all user credentials and gained access to the [domain controller] + obtained global administrator I also have experience with REST API’s and programming. I have extensive experience with VPN, Citrix, cisco anyconnect, social engineering + privilege escalation. If you have any Citrix/Cisco VPN or any other useful things please message me and lets work.”

At around the same time in the Summer of 2022, at least two different accounts tied to Star Chat — “RocketAce” and “Lopiu” — introduced the group’s services to denizens of the Russian-language cybercrime forum Exploit, including:

-SIM-swapping services targeting Verizon and T-Mobile customers;

-Dynamic phishing pages targeting customers of single sign-on providers like Okta;

-Malware development services;

-The sale of extended validation (EV) code signing certificates.

The user “Lopiu” on the Russian cybercrime forum Exploit advertised many of the same unique services offered by EarthtoStar and other Star Chat members. Image source: ke-la.com.

These two accounts on Exploit created multiple sales threads in which they claimed administrative access to U.S. telecommunications providers and asked other Exploit members for help in monetizing that access. In June 2022, RocketAce, which appears to have been just one of EarthtoStar’s many aliases, posted to Exploit:

Hello. I have access to a telecommunications company’s citrix and vpn. I would like someone to help me break out of the system and potentially attack the domain controller so all logins can be extracted we can discuss payment and things leave your telegram in the comments or private message me ! Looking for someone with knowledge in citrix/privilege escalation

On Nov. 15, 2022, EarthtoStar posted to their Star Sanctuary Telegram channel that they were hiring malware developers with a minimum of three years of experience and the ability to develop rootkits, backdoors and malware loaders.

“Optional: Endorsed by advanced APT Groups (e.g. Conti, Ryuk),” the ad concluded, referencing two of Russia’s most rapacious and destructive ransomware affiliate operations. “Part of a nation-state / ex-3l (3 letter-agency).”

The Telegram and Discord chat channels wherein Flowers and Jubair allegedly planned and executed their extortion attacks are part of a loose-knit network known as the Com, an English-speaking cybercrime community consisting mostly of individuals living in the United States, the United Kingdom, Canada and Australia.

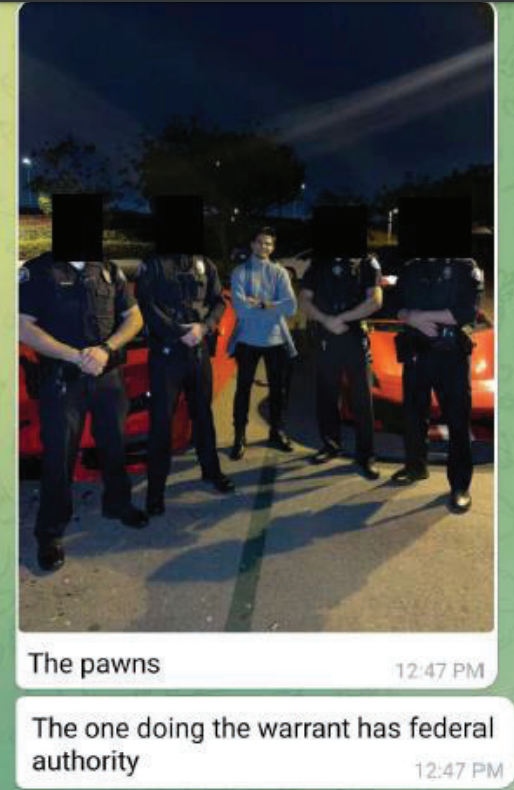

Many of these Com chat servers have hundreds to thousands of members each, and some of the more interesting solicitations on these communities are job offers for in-person assignments and tasks that can be found if one searches for posts titled, “If you live near,” or “IRL job” — short for “in real life” job.

These “violence-as-a-service” solicitations typically involve “brickings,” where someone is hired to toss a brick through the window at a specified address. Other IRL jobs for hire include tire-stabbings, molotov cocktail hurlings, drive-by shootings, and even home invasions. The people targeted by these services are typically other criminals within the community, but it’s not unusual to see Com members asking others for help in harassing or intimidating security researchers and even the very law enforcement officers who are investigating their alleged crimes.

It remains unclear what precipitated this incident or what followed directly after, but on January 13, 2023, a Star Sanctuary account used by EarthtoStar solicited the home invasion of a sitting U.S. federal prosecutor from New York. That post included a photo of the prosecutor taken from the Justice Department’s website, along with the message:

“Need irl niggas, in home hostage shit no fucking pussies no skinny glock holding 100 pound niggas either”

Throughout late 2022 and early 2023, EarthtoStar’s alias “Brad” (a.k.a. “Brad_banned”) frequently advertised Star Chat’s malware development services, including custom malicious software designed to hide the attacker’s presence on a victim machine:

We can develop KERNEL malware which will achieve persistence for a long time,

bypass firewalls and have reverse shell access.This shit is literally like STAGE 4 CANCER FOR COMPUTERS!!!

Kernel meaning the highest level of authority on a machine.

This can range to simple shells to Bootkits.Bypass all major EDR’s (SentinelOne, CrowdStrike, etc)

Patch EDR’s scanning functionality so it’s rendered useless!Once implanted, extremely difficult to remove (basically impossible to even find)

Development Experience of several years and in multiple APT Groups.Be one step ahead of the game. Prices start from $5,000+. Message @brad_banned to get a quote

In September 2023 , both MGM Resorts and Caesars Entertainment suffered ransomware attacks at the hands of a Russian ransomware affiliate program known as ALPHV and BlackCat. Caesars reportedly paid a $15 million ransom in that incident.

Within hours of MGM publicly acknowledging the 2023 breach, members of Scattered Spider were claiming credit and telling reporters they’d broken in by social engineering a third-party IT vendor. At a hearing in London last week, U.K. prosecutors told the court Jubair was found in possession of more than $50 million in ill-gotten cryptocurrency, including funds that were linked to the Las Vegas casino hacks.

The Star Chat channel was finally banned by Telegram on March 9, 2025. But U.S. prosecutors say Jubair and fellow Scattered Spider members continued their hacking, phishing and extortion activities up until September 2025.

In April 2025, the Com was buzzing about the publication of “The Com Cast,” a lengthy screed detailing Jubair’s alleged cybercriminal activities and nicknames over the years. This account included photos and voice recordings allegedly of Jubair, and asserted that in his early days on the Com Jubair used the nicknames Clark and Miku (these are both aliases used by Everlynn in connection with their fake EDR services).

Thalha Jubair (right), without his large-rimmed glasses, in an undated photo posted in The Com Cast.

More recently, the anonymous Com Cast author(s) claimed, Jubair had used the nickname “Operator,” which corresponds to a Com member who ran an automated Telegram-based doxing service that pulled consumer records from hacked data broker accounts. That public outing came after Operator allegedly seized control over the Doxbin, a long-running and highly toxic community that is used to “dox” or post deeply personal information on people.

“Operator/Clark/Miku: A key member of the ransomware group Scattered Spider, which consists of a diverse mix of individuals involved in SIM swapping and phishing,” the Com Cast account stated. “The group is an amalgamation of several key organizations, including Infinity Recursion (owned by Operator), True Alcorians (owned by earth2star), and Lapsus, which have come together to form a single collective.”

The New Jersey complaint (PDF) alleges Jubair and other Scattered Spider members committed computer fraud, wire fraud, and money laundering in relation to at least 120 computer network intrusions involving 47 U.S. entities between May 2022 and September 2025. The complaint alleges the group’s victims paid at least $115 million in ransom payments.

U.S. authorities say they traced some of those payments to Scattered Spider to an Internet server controlled by Jubair. The complaint states that a cryptocurrency wallet discovered on that server was used to purchase several gift cards, one of which was used at a food delivery company to send food to his apartment. Another gift card purchased with cryptocurrency from the same server was allegedly used to fund online gaming accounts under Jubair’s name. U.S. prosecutors said that when they seized that server they also seized $36 million in cryptocurrency.

The complaint also charges Jubair with involvement in a hacking incident in January 2025 against the U.S. courts system that targeted a U.S. magistrate judge overseeing a related Scattered Spider investigation. That other investigation appears to have been the prosecution of Noah Michael Urban, a 20-year-old Florida man charged in November 2024 by prosecutors in Los Angeles as one of five alleged Scattered Spider members.

Urban pleaded guilty in April 2025 to wire fraud and conspiracy charges, and in August he was sentenced to 10 years in federal prison. Speaking with KrebsOnSecurity from jail after his sentencing, Urban asserted that the judge gave him more time than prosecutors requested because he was mad that Scattered Spider hacked his email account.

Noah “Kingbob” Urban, posting to Twitter/X around the time of his sentencing on Aug. 20.

A court transcript (PDF) from a status hearing in February 2025 shows Urban was telling the truth about the hacking incident that happened while he was in federal custody. The judge told attorneys for both sides that a co-defendant in the California case was trying to find out about Mr. Urban’s activity in the Florida case, and that the hacker accessed the account by impersonating a judge over the phone and requesting a password reset.

Allison Nixon is chief research officer at the New York based security firm Unit 221B, and easily one of the world’s leading experts on Com-based cybercrime activity. Nixon said the core problem with legally prosecuting well-known cybercriminals from the Com has traditionally been that the top offenders tend to be under the age of 18, and thus difficult to charge under federal hacking statutes.

In the United States, prosecutors typically wait until an underage cybercrime suspect becomes an adult to charge them. But until that day comes, she said, Com actors often feel emboldened to continue committing — and very often bragging about — serious cybercrime offenses.

“Here we have a special category of Com offenders that effectively enjoy legal immunity,” Nixon told KrebsOnSecurity. “Most get recruited to Com groups when they are older, but of those that join very young, such as 12 or 13, they seem to be the most dangerous because at that age they have no grounding in reality and so much longevity before they exit their legal immunity.”

Nixon said U.K. authorities face the same challenge when they briefly detain and search the homes of underage Com suspects: Namely, the teen suspects simply go right back to their respective cliques in the Com and start robbing and hurting people again the minute they’re released.

Indeed, the U.K. court heard from prosecutors last week that both Scattered Spider suspects were detained and/or searched by local law enforcement on multiple occasions, only to return to the Com less than 24 hours after being released each time.

“What we see is these young Com members become vectors for perpetrators to commit enormously harmful acts and even child abuse,” Nixon said. “The members of this special category of people who enjoy legal immunity are meeting up with foreign nationals and conducting these sometimes heinous acts at their behest.”

Nixon said many of these individuals have few friends in real life because they spend virtually all of their waking hours on Com channels, and so their entire sense of identity, community and self-worth gets wrapped up in their involvement with these online gangs. She said if the law was such that prosecutors could treat these people commensurate with the amount of harm they cause society, that would probably clear up a lot of this problem.

“If law enforcement was allowed to keep them in jail, they would quit reoffending,” she said.

The Times of London reports that Flowers is facing three charges under the Computer Misuse Act: two of conspiracy to commit an unauthorized act in relation to a computer causing/creating risk of serious damage to human welfare/national security and one of attempting to commit the same act. Maximum sentences for these offenses can range from 14 years to life in prison, depending on the impact of the crime.

Jubair is reportedly facing two charges in the U.K.: One of conspiracy to commit an unauthorized act in relation to a computer causing/creating risk of serious damage to human welfare/national security and one of failing to comply with a section 49 notice to disclose the key to protected information.

In the United States, Jubair is charged with computer fraud conspiracy, two counts of computer fraud, wire fraud conspiracy, two counts of wire fraud, and money laundering conspiracy. If extradited to the U.S., tried and convicted on all charges, he faces a maximum penalty of 95 years in prison.

In July 2025, the United Kingdom barred victims of hacking from paying ransoms to cybercriminal groups unless approved by officials. U.K. organizations that are considered part of critical infrastructure reportedly will face a complete ban, as will the entire public sector. U.K. victims of a hack are now required to notify officials to better inform policymakers on the scale of Britain’s ransomware problem.

For further reading (bless you), check out Bloomberg’s poignant story last week based on a year’s worth of jailhouse interviews with convicted Scattered Spider member Noah Urban.

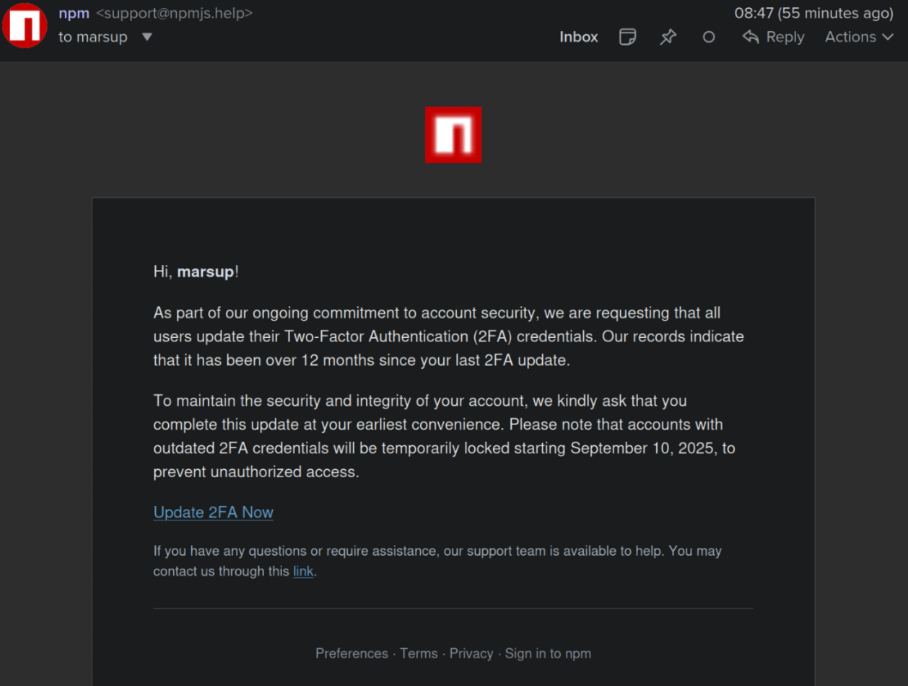

At least 18 popular JavaScript code packages that are collectively downloaded more than two billion times each week were briefly compromised with malicious software today, after a developer involved in maintaining the projects was phished. The attack appears to have been quickly contained and was narrowly focused on stealing cryptocurrency. But experts warn that a similar attack with a slightly more nefarious payload could lead to a disruptive malware outbreak that is far more difficult to detect and restrain.

This phishing email lured a developer into logging in at a fake NPM website and supplying a one-time token for two-factor authentication. The phishers then used that developer’s NPM account to add malicious code to at least 18 popular JavaScript code packages.

Aikido is a security firm in Belgium that monitors new code updates to major open-source code repositories, scanning any code updates for suspicious and malicious code. In a blog post published today, Aikido said its systems found malicious code had been added to at least 18 widely-used code libraries available on NPM (short for) “Node Package Manager,” which acts as a central hub for JavaScript development and the latest updates to widely-used JavaScript components.

JavaScript is a powerful web-based scripting language used by countless websites to build a more interactive experience with users, such as entering data into a form. But there’s no need for each website developer to build a program from scratch for entering data into a form when they can just reuse already existing packages of code at NPM that are specifically designed for that purpose.

Unfortunately, if cybercriminals manage to phish NPM credentials from developers, they can introduce malicious code that allows attackers to fundamentally control what people see in their web browser when they visit a website that uses one of the affected code libraries.

According to Aikido, the attackers injected a piece of code that silently intercepts cryptocurrency activity in the browser, “manipulates wallet interactions, and rewrites payment destinations so that funds and approvals are redirected to attacker-controlled accounts without any obvious signs to the user.”

“This malware is essentially a browser-based interceptor that hijacks both network traffic and application APIs,” Aikido researcher Charlie Eriksen wrote. “What makes it dangerous is that it operates at multiple layers: Altering content shown on websites, tampering with API calls, and manipulating what users’ apps believe they are signing. Even if the interface looks correct, the underlying transaction can be redirected in the background.”

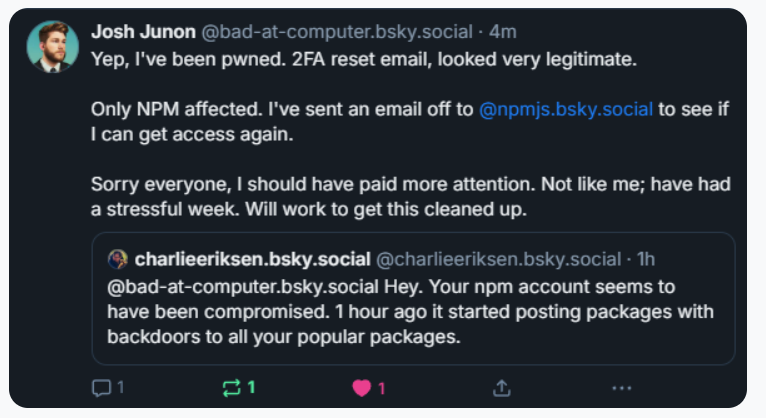

Aikido said it used the social network Bsky to notify the affected developer, Josh Junon, who quickly replied that he was aware of having just been phished. The phishing email that Junon fell for was part of a larger campaign that spoofed NPM and told recipients they were required to update their two-factor authentication (2FA) credentials. The phishing site mimicked NPM’s login page, and intercepted Junon’s credentials and 2FA token. Once logged in, the phishers then changed the email address on file for Junon’s NPM account, temporarily locking him out.

Aikido notified the maintainer on Bluesky, who replied at 15:15 UTC that he was aware of being compromised, and starting to clean up the compromised packages.

Junon also issued a mea culpa on HackerNews, telling the community’s coder-heavy readership, “Hi, yep I got pwned.”

“It looks and feels a bit like a targeted attack,” Junon wrote. “Sorry everyone, very embarrassing.”

Philippe Caturegli, “chief hacking officer” at the security consultancy Seralys, observed that the attackers appear to have registered their spoofed website — npmjs[.]help — just two days before sending the phishing email. The spoofed website used services from dnsexit[.]com, a “dynamic DNS” company that also offers “100% free” domain names that can instantly be pointed at any IP address controlled by the user.

Junon’s mea cupla on Hackernews today listed the affected packages.

Caturegli said it’s remarkable that the attackers in this case were not more ambitious or malicious with their code modifications.

“The crazy part is they compromised billions of websites and apps just to target a couple of cryptocurrency things,” he said. “This was a supply chain attack, and it could easily have been something much worse than crypto harvesting.”

Aikido’s Eriksen agreed, saying countless websites dodged a bullet because this incident was handled in a matter of hours. As an example of how these supply-chain attacks can escalate quickly, Eriksen pointed to another compromise of an NPM developer in late August that added malware to “nx,” an open-source code development toolkit with as many as six million weekly downloads.

In the nx compromise, the attackers introduced code that scoured the user’s device for authentication tokens from programmer destinations like GitHub and NPM, as well as SSH and API keys. But instead of sending those stolen credentials to a central server controlled by the attackers, the malicious code created a new public repository in the victim’s GitHub account, and published the stolen data there for all the world to see and download.

Eriksen said coding platforms like GitHub and NPM should be doing more to ensure that any new code commits for broadly-used packages require a higher level of attestation that confirms the code in question was in fact submitted by the person who owns the account, and not just by that person’s account.

“More popular packages should require attestation that it came through trusted provenance and not just randomly from some location on the Internet,” Eriksen said. “Where does the package get uploaded from, by GitHub in response to a new pull request into the main branch, or somewhere else? In this case, they didn’t compromise the target’s GitHub account. They didn’t touch that. They just uploaded a modified version that didn’t come where it’s expected to come from.”

Eriksen said code repository compromises can be devastating for developers, many of whom end up abandoning their projects entirely after such an incident.

“It’s unfortunate because one thing we’ve seen is people have their projects get compromised and they say, ‘You know what, I don’t have the energy for this and I’m just going to deprecate the whole package,'” Eriksen said.

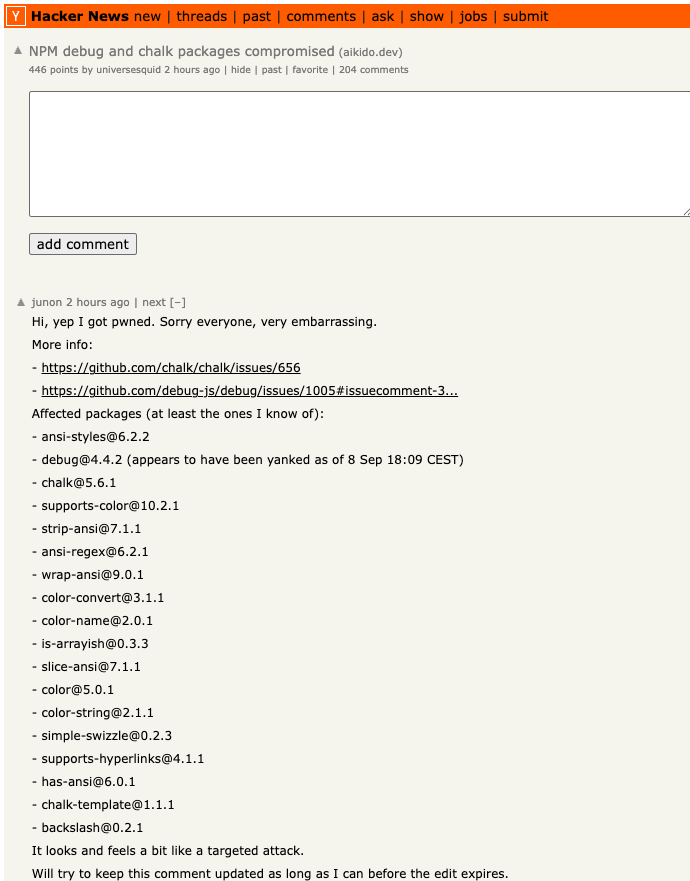

Kevin Beaumont, a frequently quoted security expert who writes about security incidents at the blog doublepulsar.com, has been following this story closely today in frequent updates to his account on Mastodon. Beaumont said the incident is a reminder that much of the planet still depends on code that is ultimately maintained by an exceedingly small number of people who are mostly overburdened and under-resourced.

“For about the past 15 years every business has been developing apps by pulling in 178 interconnected libraries written by 24 people in a shed in Skegness,” Beaumont wrote on Mastodon. “For about the past 2 years orgs have been buying AI vibe coding tools, where some exec screams ‘make online shop’ into a computer and 389 libraries are added and an app is farted out. The output = if you want to own the world’s companies, just phish one guy in Skegness.”

Image: https://infosec.exchange/@GossiTheDog@cyberplace.social.

Aikido recently launched a product that aims to help development teams ensure that every code library used is checked for malware before it can be used or installed. Nicholas Weaver, a researcher with the International Computer Science Institute, a nonprofit in Berkeley, Calif., said Aikido’s new offering exists because many organizations are still one successful phishing attack away from a supply-chain nightmare.

Weaver said these types of supply-chain compromises will continue as long as people responsible for maintaining widely-used code continue to rely on phishable forms of 2FA.

“NPM should only support phish-proof authentication,” Weaver said, referring to physical security keys that are phish-proof — meaning that even if phishers manage to steal your username and password, they still can’t log in to your account without also possessing that physical key.

“All critical infrastructure needs to use phish-proof 2FA, and given the dependencies in modern software, archives such as NPM are absolutely critical infrastructure,” Weaver said. “That NPM does not require that all contributor accounts use security keys or similar 2FA methods should be considered negligence.”

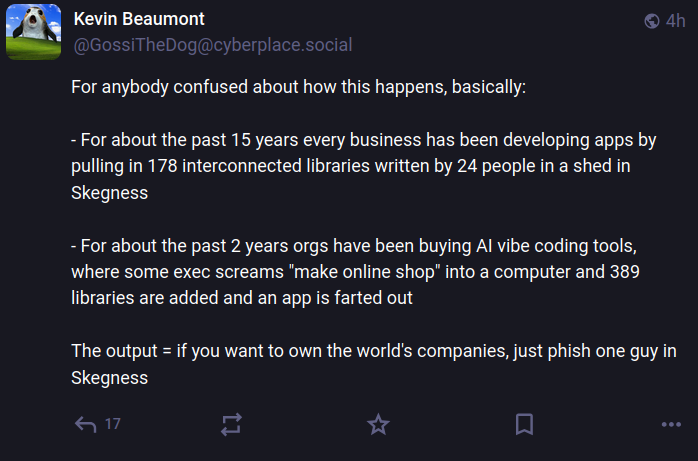

The recent mass-theft of authentication tokens from Salesloft, whose AI chatbot is used by a broad swath of corporate America to convert customer interaction into Salesforce leads, has left many companies racing to invalidate the stolen credentials before hackers can exploit them. Now Google warns the breach goes far beyond access to Salesforce data, noting the hackers responsible also stole valid authentication tokens for hundreds of online services that customers can integrate with Salesloft, including Slack, Google Workspace, Amazon S3, Microsoft Azure, and OpenAI.

Salesloft says its products are trusted by 5,000+ customers. Some of the bigger names are visible on the company’s homepage.

Salesloft disclosed on August 20 that, “Today, we detected a security issue in the Drift application,” referring to the technology that powers an AI chatbot used by so many corporate websites. The alert urged customers to re-authenticate the connection between the Drift and Salesforce apps to invalidate their existing authentication tokens, but it said nothing then to indicate those tokens had already been stolen.

On August 26, the Google Threat Intelligence Group (GTIG) warned that unidentified hackers tracked as UNC6395 used the access tokens stolen from Salesloft to siphon large amounts of data from numerous corporate Salesforce instances. Google said the data theft began as early as Aug. 8, 2025 and lasted through at least Aug. 18, 2025, and that the incident did not involve any vulnerability in the Salesforce platform.

Google said the attackers have been sifting through the massive data haul for credential materials such as AWS keys, VPN credentials, and credentials to the cloud storage provider Snowflake.

“If successful, the right credentials could allow them to further compromise victim and client environments, as well as pivot to the victim’s clients or partner environments,” the GTIG report stated.

The GTIG updated its advisory on August 28 to acknowledge the attackers used the stolen tokens to access email from “a very small number of Google Workspace accounts” that were specially configured to integrate with Salesloft. More importantly, it warned organizations to immediately invalidate all tokens stored in or connected to their Salesloft integrations — regardless of the third-party service in question.

“Given GTIG’s observations of data exfiltration associated with the campaign, organizations using Salesloft Drift to integrate with third-party platforms (including but not limited to Salesforce) should consider their data compromised and are urged to take immediate remediation steps,” Google advised.

On August 28, Salesforce blocked Drift from integrating with its platform, and with its productivity platforms Slack and Pardot.

The Salesloft incident comes on the heels of a broad social engineering campaign that used voice phishing to trick targets into connecting a malicious app to their organization’s Salesforce portal. That campaign led to data breaches and extortion attacks affecting a number of companies including Adidas, Allianz Life and Qantas.

On August 5, Google disclosed that one of its corporate Salesforce instances was compromised by the attackers, which the GTIG has dubbed UNC6040 (“UNC” stands for “uncategorized threat group”). Google said the extortionists consistently claimed to be the threat group ShinyHunters, and that the group appeared to be preparing to escalate its extortion attacks by launching a data leak site.

ShinyHunters is an amorphous threat group known for using social engineering to break into cloud platforms and third-party IT providers, and for posting dozens of stolen databases to cybercrime communities like the now-defunct Breachforums.

The ShinyHunters brand dates back to 2020, and the group has been credited with or taken responsibility for dozens of data leaks that exposed hundreds of millions of breached records. The group’s member roster is thought to be somewhat fluid, drawing mainly from active denizens of the Com, a mostly English-language cybercrime community scattered across an ocean of Telegram and Discord servers.

Recorded Future’s Alan Liska told Bleeping Computer that the overlap in the “tools, techniques and procedures” used by ShinyHunters and the Scattered Spider extortion group likely indicate some crossover between the two groups.

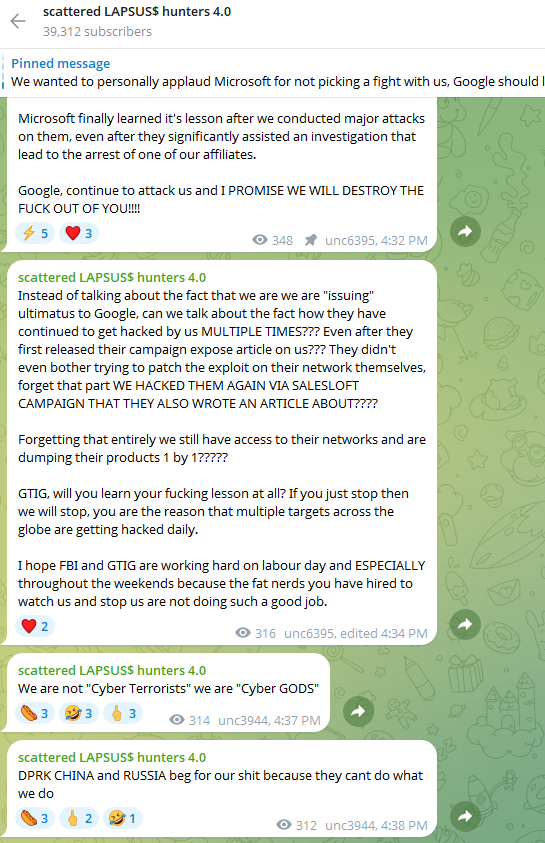

To muddy the waters even further, on August 28 a Telegram channel that now has nearly 40,000 subscribers was launched under the intentionally confusing banner “Scattered LAPSUS$ Hunters 4.0,” wherein participants have repeatedly claimed responsibility for the Salesloft hack without actually sharing any details to prove their claims.

The Telegram group has been trying to attract media attention by threatening security researchers at Google and other firms. It also is using the channel’s sudden popularity to promote a new cybercrime forum called “Breachstars,” which they claim will soon host data stolen from victim companies who refuse to negotiate a ransom payment.

The “Scattered Lapsus$ Hunters 4.0” channel on Telegram now has roughly 40,000 subscribers.

But Austin Larsen, a principal threat analyst at Google’s threat intelligence group, said there is no compelling evidence to attribute the Salesloft activity to ShinyHunters or to other known groups at this time.

“Their understanding of the incident seems to come from public reporting alone,” Larsen told KrebsOnSecurity, referring to the most active participants in the Scattered LAPSUS$ Hunters 4.0 Telegram channel.

Joshua Wright, a senior technical director at Counter Hack, is credited with coining the term “authorization sprawl” to describe one key reason that social engineering attacks from groups like Scattered Spider and ShinyHunters so often succeed: They abuse legitimate user access tokens to move seamlessly between on-premises and cloud systems.

Wright said this type of attack chain often goes undetected because the attacker sticks to the resources and access already allocated to the user.

“Instead of the conventional chain of initial access, privilege escalation and endpoint bypass, these threat actors are using centralized identity platforms that offer single sign-on (SSO) and integrated authentication and authorization schemes,” Wright wrote in a June 2025 column. “Rather than creating custom malware, attackers use the resources already available to them as authorized users.”

It remains unclear exactly how the attackers gained access to all Salesloft Drift authentication tokens. Salesloft announced on August 27 that it hired Mandiant, Google Cloud’s incident response division, to investigate the root cause(s).

“We are working with Salesloft Drift to investigate the root cause of what occurred and then it’ll be up to them to publish that,” Mandiant Consulting CTO Charles Carmakal told Cyberscoop. “There will be a lot more tomorrow, and the next day, and the next day.”

Security researchers recently revealed that the personal information of millions of people who applied for jobs at McDonald’s was exposed after they guessed the password (“123456”) for the fast food chain’s account at Paradox.ai, a company that makes artificial intelligence based hiring chatbots used by many Fortune 500 firms. Paradox.ai said the security oversight was an isolated incident that did not affect its other customers, but recent security breaches involving its employees in Vietnam tell a more nuanced story.

A screenshot of the paradox.ai homepage showing its AI hiring chatbot “Olivia” interacting with potential hires.

Earlier this month, security researchers Ian Carroll and Sam Curry wrote about simple methods they found to access the backend of the AI chatbot platform on McHire.com, the McDonald’s website that many of its franchisees use to screen job applicants. As first reported by Wired, the researchers discovered that the weak password used by Paradox exposed 64 million records, including applicants’ names, email addresses and phone numbers.

Paradox.ai acknowledged the researchers’ findings but said the company’s other client instances were not affected, and that no sensitive information — such as Social Security numbers — was exposed.

“We are confident, based on our records, this test account was not accessed by any third party other than the security researchers,” the company wrote in a July 9 blog post. “It had not been logged into since 2019 and frankly, should have been decommissioned. We want to be very clear that while the researchers may have briefly had access to the system containing all chat interactions (NOT job applications), they only viewed and downloaded five chats in total that had candidate information within. Again, at no point was any data leaked online or made public.”

However, a review of stolen password data gathered by multiple breach-tracking services shows that at the end of June 2025, a Paradox.ai administrator in Vietnam suffered a malware compromise on their device that stole usernames and passwords for a variety of internal and third-party online services. The results were not pretty.

The password data from the Paradox.ai developer was stolen by a malware strain known as “Nexus Stealer,” a form grabber and password stealer that is sold on cybercrime forums. The information snarfed by stealers like Nexus is often recovered and indexed by data leak aggregator services like Intelligence X, which reports that the malware on the Paradox.ai developer’s device exposed hundreds of mostly poor and recycled passwords (using the same base password but slightly different characters at the end).

Those purloined credentials show the developer in question at one point used the same seven-digit password to log in to Paradox.ai accounts for a number of Fortune 500 firms listed as customers on the company’s website, including Aramark, Lockheed Martin, Lowes, and Pepsi.

Seven-character passwords, particularly those consisting entirely of numerals, are highly vulnerable to “brute-force” attacks that can try a large number of possible password combinations in quick succession. According to a much-referenced password strength guide maintained by Hive Systems, modern password-cracking systems can work out a seven number password more or less instantly.

Image: hivesystems.com.

In response to questions from KrebsOnSecurity, Paradox.ai confirmed that the password data was recently stolen by a malware infection on the personal device of a longtime Paradox developer based in Vietnam, and said the company was made aware of the compromise shortly after it happened. Paradox maintains that few of the exposed passwords were still valid, and that a majority of them were present on the employee’s personal device only because he had migrated the contents of a password manager from an old computer.

Paradox also pointed out that it has been requiring single sign-on (SSO) authentication since 2020 that enforces multi-factor authentication for its partners. Still, a review of the exposed passwords shows they included the Vietnamese administrator’s credentials to the company’s SSO platform — paradoxai.okta.com. The password for that account ended in 202506 — possibly a reference to the month of June 2025 — and the digital cookie left behind after a successful Okta login with those credentials says it was valid until December 2025.

Also exposed were the administrator’s credentials and authentication cookies for an account at Atlassian, a platform made for software development and project management. The expiration date for that authentication token likewise was December 2025.

Infostealer infections are among the leading causes of data breaches and ransomware attacks today, and they result in the theft of stored passwords and any credentials the victim types into a browser. Most infostealer malware also will siphon authentication cookies stored on the victim’s device, and depending on how those tokens are configured thieves may be able to use them to bypass login prompts and/or multi-factor authentication.

Quite often these infostealer infections will open a backdoor on the victim’s device that allows attackers to access the infected machine remotely. Indeed, it appears that remote access to the Paradox administrator’s compromised device was offered for sale recently.

In February 2019, Paradox.ai announced it had successfully completed audits for two fairly comprehensive security standards (ISO 27001 and SOC 2 Type II). Meanwhile, the company’s security disclosure this month says the test account with the atrocious 123456 username and password was last accessed in 2019, but somehow missed in their annual penetration tests. So how did it manage to pass such stringent security audits with these practices in place?

Paradox.ai told KrebsOnSecurity that at the time of the 2019 audit, the company’s various contractors were not held to the same security standards the company practices internally. Paradox emphasized that this has changed, and that it has updated its security and password requirements multiple times since then.

It is unclear how the Paradox developer in Vietnam infected his computer with malware, but a closer review finds a Windows device for another Paradox.ai employee from Vietnam was compromised by similar data-stealing malware at the end of 2024 (that compromise included the victim’s GitHub credentials). In the case of both employees, the stolen credential data includes Web browser logs that indicate the victims repeatedly downloaded pirated movies and television shows, which are often bundled with malware disguised as a video codec needed to view the pirated content.

Marko Elez, a 25-year-old employee at Elon Musk’s Department of Government Efficiency (DOGE), has been granted access to sensitive databases at the U.S. Social Security Administration, the Treasury and Justice departments, and the Department of Homeland Security. So it should fill all Americans with a deep sense of confidence to learn that Mr. Elez over the weekend inadvertently published a private key that allowed anyone to interact directly with more than four dozen large language models (LLMs) developed by Musk’s artificial intelligence company xAI.

Image: Shutterstock, @sdx15.

On July 13, Mr. Elez committed a code script to GitHub called “agent.py” that included a private application programming interface (API) key for xAI. The inclusion of the private key was first flagged by GitGuardian, a company that specializes in detecting and remediating exposed secrets in public and proprietary environments. GitGuardian’s systems constantly scan GitHub and other code repositories for exposed API keys, and fire off automated alerts to affected users.

Philippe Caturegli, “chief hacking officer” at the security consultancy Seralys, said the exposed API key allowed access to at least 52 different LLMs used by xAI. The most recent LLM in the list was called “grok-4-0709” and was created on July 9, 2025.

Grok, the generative AI chatbot developed by xAI and integrated into Twitter/X, relies on these and other LLMs (a query to Grok before publication shows Grok currently uses Grok-3, which was launched in Feburary 2025). Earlier today, xAI announced that the Department of Defense will begin using Grok as part of a contract worth up to $200 million. The contract award came less than a week after Grok began spewing antisemitic rants and invoking Adolf Hitler.

Mr. Elez did not respond to a request for comment. The code repository containing the private xAI key was removed shortly after Caturegli notified Elez via email. However, Caturegli said the exposed API key still works and has not yet been revoked.

“If a developer can’t keep an API key private, it raises questions about how they’re handling far more sensitive government information behind closed doors,” Caturegli told KrebsOnSecurity.

Prior to joining DOGE, Marko Elez worked for a number of Musk’s companies. His DOGE career began at the Department of the Treasury, and a legal battle over DOGE’s access to Treasury databases showed Elez was sending unencrypted personal information in violation of the agency’s policies.

While still at Treasury, Elez resigned after The Wall Street Journal linked him to social media posts that advocated racism and eugenics. When Vice President J.D. Vance lobbied for Elez to be rehired, President Trump agreed and Musk reinstated him.

Since his re-hiring as a DOGE employee, Elez has been granted access to databases at one federal agency after another. TechCrunch reported in February 2025 that he was working at the Social Security Administration. In March, Business Insider found Elez was part of a DOGE detachment assigned to the Department of Labor.

Marko Elez, in a photo from a social media profile.

In April, The New York Times reported that Elez held positions at the U.S. Customs and Border Protection and the Immigration and Customs Enforcement (ICE) bureaus, as well as the Department of Homeland Security. The Washington Post later reported that Elez, while serving as a DOGE advisor at the Department of Justice, had gained access to the Executive Office for Immigration Review’s Courts and Appeals System (EACS).

Elez is not the first DOGE worker to publish internal API keys for xAI: In May, KrebsOnSecurity detailed how another DOGE employee leaked a private xAI key on GitHub for two months, exposing LLMs that were custom made for working with internal data from Musk’s companies, including SpaceX, Tesla and Twitter/X.

Caturegli said it’s difficult to trust someone with access to confidential government systems when they can’t even manage the basics of operational security.

“One leak is a mistake,” he said. “But when the same type of sensitive key gets exposed again and again, it’s not just bad luck, it’s a sign of deeper negligence and a broken security culture.”

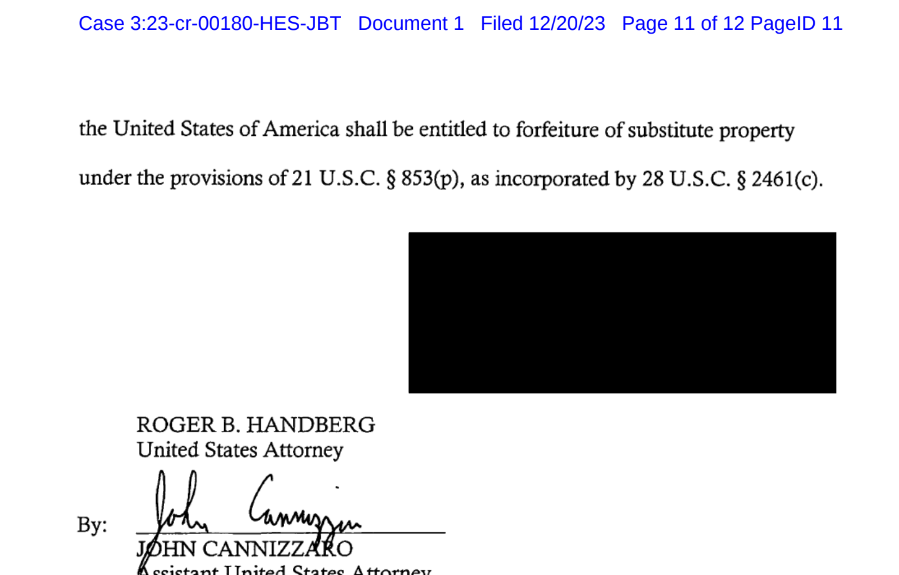

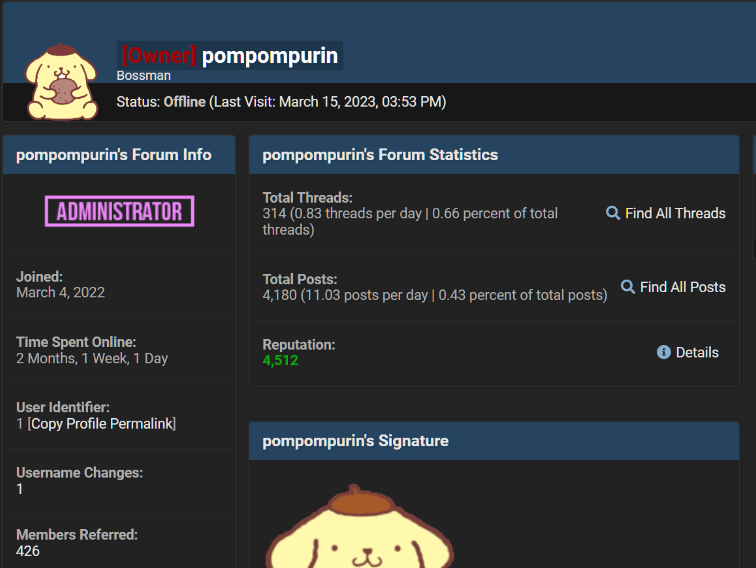

In what experts are calling a novel legal outcome, the 22-year-old former administrator of the cybercrime community Breachforums will forfeit nearly $700,000 to settle a civil lawsuit from a health insurance company whose customer data was posted for sale on the forum in 2023. Conor Brian Fitzpatrick, a.k.a. “Pompompurin,” is slated for resentencing next month after pleading guilty to access device fraud and possession of child sexual abuse material (CSAM).

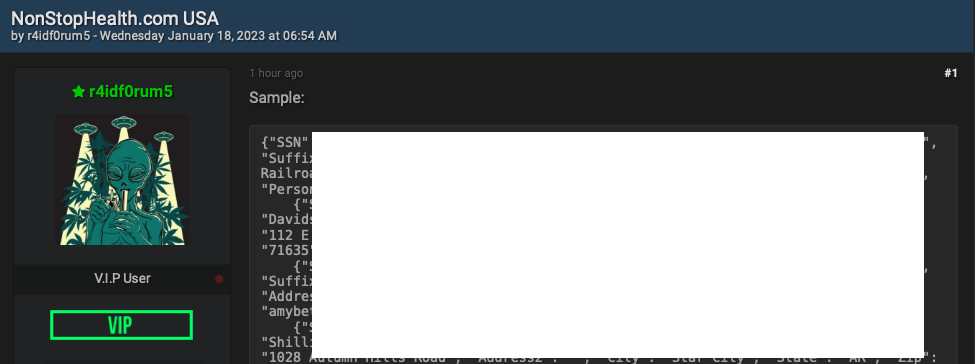

A redacted screenshot of the Breachforums sales thread. Image: Ke-la.com.

On January 18, 2023, denizens of Breachforums posted for sale tens of thousands of records — including Social Security numbers, dates of birth, addresses, and phone numbers — stolen from Nonstop Health, an insurance provider based in Concord, Calif.

Class-action attorneys sued Nonstop Health, which added Fitzpatrick as a third-party defendant to the civil litigation in November 2023, several months after he was arrested by the FBI and criminally charged with access device fraud and CSAM possession. In January 2025, Nonstop agreed to pay $1.5 million to settle the class action.

Jill Fertel is a former prosecutor who runs the cyber litigation practice at Cipriani & Werner, the law firm that represented Nonstop Health. Fertel told KrebsOnSecurity this is the first and only case where a cybercriminal or anyone related to the security incident was actually named in civil litigation.

“Civil plaintiffs are not at all likely to see money seized from threat actors involved in the incident to be made available to people impacted by the breach,” Fertel said. “The best we could do was make this money available to the class, but it’s still incumbent on the members of the class who are impacted to make that claim.”

Mark Rasch is a former federal prosecutor who now represents Unit 221B, a cybersecurity firm based in New York City. Rasch said he doesn’t doubt that the civil settlement involving Fitzpatrick’s criminal activity is a novel legal development.

“It is rare in these civil cases that you know the threat actor involved in the breach, and it’s also rare that you catch them with sufficient resources to be able to pay a claim,” Rasch said.

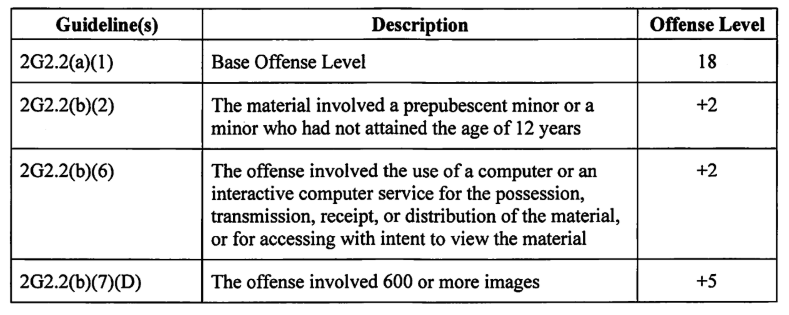

Despite admitting to possessing more than 600 CSAM images and personally operating Breachforums, Fitzpatrick was sentenced in January 2024 to time served and 20 years of supervised release. Federal prosecutors objected, arguing that his punishment failed to adequately reflect the seriousness of his crimes or serve as a deterrent.

An excerpt from a pre-sentencing report for Fitzpatrick indicates he had more than 600 CSAM images on his devices.

Indeed, the same month he was sentenced Fitzpatrick was rearrested (PDF) for violating the terms of his release, which forbade him from using a computer that didn’t have court-required monitoring software installed.

Federal prosecutors said Fitzpatrick went on Discord following his guilty plea and professed innocence to the very crimes to which he’d pleaded guilty, stating that his plea deal was “so BS” and that he had “wanted to fight it.” The feds said Fitzpatrick also joked with his friends about selling data to foreign governments, exhorting one user to “become a foreign asset to china or russia,” and to “sell government secrets.”

In January 2025, a federal appeals court agreed with the government’s assessment, vacating Fitzpatrick’s sentence and ordering him to be resentenced on June 3, 2025.

Fitzpatrick launched BreachForums in March 2022 to replace RaidForums, a similarly popular crime forum that was infiltrated and shut down by the FBI the previous month. As administrator, his alter ego Pompompurin served as the middleman, personally reviewing all databases for sale on the forum and offering an escrow service to those interested in buying stolen data.

A yearbook photo of Fitzpatrick unearthed by the Yonkers Times.

The new site quickly attracted more than 300,000 users, and facilitated the sale of databases stolen from hundreds of hacking victims, including some of the largest consumer data breaches in recent history. In May 2024, a reincarnation of Breachforums was seized by the FBI and international partners. Still more relaunches of the forum occurred after that, with the most recent disruption last month.

As KrebsOnSecurity reported last year in The Dark Nexus Between Harm Groups and The Com, it is increasingly common for federal investigators to find CSAM material when searching devices seized from cybercriminal suspects. While the mere possession of CSAM is a serious federal crime, not all of those caught with CSAM are necessarily creators or distributors of it. Fertel said some cybercriminal communities have been known to require new entrants to share CSAM material as a way of proving that they are not a federal investigator.

“If you’re going to the darkest corners of Internet, that’s how you prove you’re not law enforcement,” Fertel said. “Law enforcement would never share that material. It would be criminal for me as a prosecutor, if I obtained and possessed those types of images.”

Further reading: The settlement between Fitzpatrick and Nonstop (PDF).

In September 2023, KrebsOnSecurity published findings from security researchers who concluded that a series of six-figure cyberheists across dozens of victims resulted from thieves cracking master passwords stolen from the password manager service LastPass in 2022. In a court filing this week, U.S. federal agents investigating a spectacular $150 million cryptocurrency heist said they had reached the same conclusion.

On March 6, federal prosecutors in northern California said they seized approximately $24 million worth of cryptocurrencies that were clawed back following a $150 million cyberheist on Jan. 30, 2024. The complaint refers to the person robbed only as “Victim-1,” but according to blockchain security researcher ZachXBT the theft was perpetrated against Chris Larsen, the co-founder of the cryptocurrency platform Ripple. ZachXBT was the first to report on the heist.

This week’s action by the government merely allows investigators to officially seize the frozen funds. But there is an important conclusion in this seizure document: It basically says the U.S. Secret Service and the FBI agree with the findings of the LastPass breach story published here in September 2023.

That piece quoted security researchers who said they were witnessing six-figure crypto heists several times each month that all appeared to be the result of crooks cracking master passwords for the password vaults stolen from LastPass in 2022.

“The Federal Bureau of Investigation has been investigating these data breaches, and law enforcement agents investigating the instant case have spoken with FBI agents about their investigation,” reads the seizure complaint, which was written by a U.S. Secret Service agent. “From those conversations, law enforcement agents in this case learned that the stolen data and passwords that were stored in several victims’ online password manager accounts were used to illegally, and without authorization, access the victims’ electronic accounts and steal information, cryptocurrency, and other data.”

The document continues:

“Based on this investigation, law enforcement had probable cause to believe the same attackers behind the above-described commercial online password manager attack used a stolen password held in Victim 1’s online password manager account and, without authorization, accessed his cryptocurrency wallet/account.”

Working with dozens of victims, security researchers Nick Bax and Taylor Monahan found that none of the six-figure cyberheist victims appeared to have suffered the sorts of attacks that typically preface a high-dollar crypto theft, such as the compromise of one’s email and/or mobile phone accounts, or SIM-swapping attacks.

They discovered the victims all had something else in common: Each had at one point stored their cryptocurrency seed phrase — the secret code that lets anyone gain access to your cryptocurrency holdings — in the “Secure Notes” area of their LastPass account prior to the 2022 breaches at the company.

Bax and Monahan found another common theme with these robberies: They all followed a similar pattern of cashing out, rapidly moving stolen funds to a dizzying number of drop accounts scattered across various cryptocurrency exchanges.

According to the government, a similar level of complexity was present in the $150 million heist against the Ripple co-founder last year.

“The scale of a theft and rapid dissipation of funds would have required the efforts of multiple malicious actors, and was consistent with the online password manager breaches and attack on other victims whose cryptocurrency was stolen,” the government wrote. “For these reasons, law enforcement agents believe the cryptocurrency stolen from Victim 1 was committed by the same attackers who conducted the attack on the online password manager, and cryptocurrency thefts from other similarly situated victims.”

Reached for comment, LastPass said it has seen no definitive proof — from federal investigators or others — that the cyberheists in question were linked to the LastPass breaches.

“Since we initially disclosed this incident back in 2022, LastPass has worked in close cooperation with multiple representatives from law enforcement,” LastPass said in a written statement. “To date, our law enforcement partners have not made us aware of any conclusive evidence that connects any crypto thefts to our incident. In the meantime, we have been investing heavily in enhancing our security measures and will continue to do so.”

On August 25, 2022, LastPass CEO Karim Toubba told users the company had detected unusual activity in its software development environment, and that the intruders stole some source code and proprietary LastPass technical information. On Sept. 15, 2022, LastPass said an investigation into the August breach determined the attacker did not access any customer data or password vaults.

But on Nov. 30, 2022, LastPass notified customers about another, far more serious security incident that the company said leveraged data stolen in the August breach. LastPass disclosed that criminal hackers had compromised encrypted copies of some password vaults, as well as other personal information.

Experts say the breach would have given thieves “offline” access to encrypted password vaults, theoretically allowing them all the time in the world to try to crack some of the weaker master passwords using powerful systems that can attempt millions of password guesses per second.

Researchers found that many of the cyberheist victims had chosen master passwords with relatively low complexity, and were among LastPass’s oldest customers. That’s because legacy LastPass users were more likely to have master passwords that were protected with far fewer “iterations,” which refers to the number of times your password is run through the company’s encryption routines. In general, the more iterations, the longer it takes an offline attacker to crack your master password.

Over the years, LastPass forced new users to pick longer and more complex master passwords, and they increased the number of iterations on multiple occasions by several orders of magnitude. But researchers found strong indications that LastPass never succeeded in upgrading many of its older customers to the newer password requirements and protections.

Asked about LastPass’s continuing denials, Bax said that after the initial warning in our 2023 story, he naively hoped people would migrate their funds to new cryptocurrency wallets.

“While some did, the continued thefts underscore how much more needs to be done,” Bax told KrebsOnSecurity. “It’s validating to see the Secret Service and FBI corroborate our findings, but I’d much rather see fewer of these hacks in the first place. ZachXBT and SEAL 911 reported yet another wave of thefts as recently as December, showing the threat is still very real.”

Monahan said LastPass still hasn’t alerted their customers that their secrets—especially those stored in “Secure Notes”—may be at risk.

“Its been two and a half years since LastPass was first breached [and] hundreds of millions of dollars has been stolen from individuals and companies around the globe,” Monahan said. “They could have encouraged users to rotate their credentials. They could’ve prevented millions and millions of dollars from being stolen by these threat actors. But instead they chose to deny that their customers were are risk and blame the victims instead.”

Data Privacy Week is here, and there’s no better time to shine a spotlight on one of the biggest players in the personal information economy: data brokers. These entities collect, buy, and sell hundreds—sometimes thousands—of data points on individuals like you. But how do they manage to gather so much information, and for what purpose? From your browsing habits and purchase history to your location data and even more intimate details, these digital middlemen piece together surprisingly comprehensive profiles. The real question is: where are they getting it all, and why is your personal data so valuable to them? Let’s unravel the mystery behind the data broker industry.

Data brokers aggregate user info from various sources on the internet. They collect, collate, package, and sometimes even analyze this data to create a holistic and coherent version of you online. This data then gets put up for sale to nearly anyone who’ll buy it. That can include marketers, private investigators, tech companies, and sometimes law enforcement as well. They’ll also sell to spammers and scammers. (Those bad actors need to get your contact info from somewhere — data brokers are one way to get that and more.)

And that list of potential buyers goes on, which includes but isn’t limited to:

These companies and social media platforms use your data to better understand target demographics and the content with which they interact. While the practice isn’t unethical in and of itself (personalizing user experiences and creating more convenient UIs are usually cited as the primary reasons for it), it does make your data vulnerable to malicious attacks targeted toward big-tech servers.

Most of your online activities are related. Devices like your phone, laptop, tablets, and even fitness watches are linked to each other. Moreover, you might use one email ID for various accounts and subscriptions. This online interconnectedness makes it easier for data brokers to create a cohesive user profile.

Mobile phone apps are the most common way for data brokerage firms to collect your data. You might have countless apps for various purposes, such as financial transactions, health and fitness, or social media.

A number of these apps usually fall under the umbrella of the same or subsidiary family of apps, all of which work toward collecting and supplying data to big tech platforms. Programs like Google’s AdSense make it easier for developers to monetize their apps in exchange for the user information they collect.

Data brokers also collect data points like your home address, full name, phone number, and date of birth. They have automated scraping tools to quickly collect relevant information from public records (think sales of real estate, marriages, divorces, voter registration, and so on).

Lastly, data brokers can gather data from other third parties that track your cookies or even place trackers or cookies on your browsers. Cookies are small data files that track your online activities when visiting different websites. They track your IP address and browsing history, which third parties can exploit. Cookies are also the reason you see personalized ads and products.