A Ukrainian man indicted in 2012 for conspiring with a prolific hacking group to steal tens of millions of dollars from U.S. businesses was arrested in Italy and is now in custody in the United States, KrebsOnSecurity has learned.

Sources close to the investigation say Yuriy Igorevich Rybtsov, a 41-year-old from the Russia-controlled city of Donetsk, Ukraine, was previously referenced in U.S. federal charging documents only by his online handle “MrICQ.” According to a 13-year-old indictment (PDF) filed by prosecutors in Nebraska, MrICQ was a developer for a cybercrime group known as “Jabber Zeus.”

Image: lockedup dot wtf.

The Jabber Zeus name is derived from the malware they used — a custom version of the ZeuS banking trojan — that stole banking login credentials and would send the group a Jabber instant message each time a new victim entered a one-time passcode at a financial institution website. The gang targeted mostly small to mid-sized businesses, and they were an early pioneer of so-called “man-in-the-browser” attacks, malware that can silently intercept any data that victims submit in a web-based form.

Once inside a victim company’s accounts, the Jabber Zeus crew would modify the firm’s payroll to add dozens of “money mules,” people recruited through elaborate work-at-home schemes to handle bank transfers. The mules in turn would forward any stolen payroll deposits — minus their commissions — via wire transfers to other mules in Ukraine and the United Kingdom.

The 2012 indictment targeting the Jabber Zeus crew named MrICQ as “John Doe #3,” and said this person handled incoming notifications of newly compromised victims. The Department of Justice (DOJ) said MrICQ also helped the group launder the proceeds of their heists through electronic currency exchange services.

Two sources familiar with the Jabber Zeus investigation said Rybtsov was arrested in Italy, although the exact date and circumstances of his arrest remain unclear. A summary of recent decisions (PDF) published by the Italian Supreme Court states that in April 2025, Rybtsov lost a final appeal to avoid extradition to the United States.

According to the mugshot website lockedup[.]wtf, Rybtsov arrived in Nebraska on October 9, and was being held under an arrest warrant from the U.S. Federal Bureau of Investigation (FBI).

The data breach tracking service Constella Intelligence found breached records from the business profiling site bvdinfo[.]com showing that a 41-year-old Yuriy Igorevich Rybtsov worked in a building at 59 Barnaulska St. in Donetsk. Further searching on this address in Constella finds the same apartment building was shared by a business registered to Vyacheslav “Tank” Penchukov, the leader of the Jabber Zeus crew in Ukraine.

Vyacheslav “Tank” Penchukov, seen here performing as “DJ Slava Rich” in Ukraine, in an undated photo from social media.

Penchukov was arrested in 2022 while traveling to meet his wife in Switzerland. Last year, a federal court in Nebraska sentenced Penchukov to 18 years in prison and ordered him to pay more than $73 million in restitution.

Lawrence Baldwin is founder of myNetWatchman, a threat intelligence company based in Georgia that began tracking and disrupting the Jabber Zeus gang in 2009. myNetWatchman had secretly gained access to the Jabber chat server used by the Ukrainian hackers, allowing Baldwin to eavesdrop on the daily conversations between MrICQ and other Jabber Zeus members.

Baldwin shared those real-time chat records with multiple state and federal law enforcement agencies, and with this reporter. Between 2010 and 2013, I spent several hours each day alerting small businesses across the country that their payroll accounts were about to be drained by these cybercriminals.

Those notifications, and Baldwin’s tireless efforts, saved countless would-be victims a great deal of money. In most cases, however, we were already too late. Nevertheless, the pilfered Jabber Zeus group chats provided the basis for dozens of stories published here about small businesses fighting their banks in court over six- and seven-figure financial losses.

Baldwin said the Jabber Zeus crew was far ahead of its peers in several respects. For starters, their intercepted chats showed they worked to create a highly customized botnet directly with the author of the original Zeus Trojan — Evgeniy Mikhailovich Bogachev, a Russian man who has long been on the FBI’s “Most Wanted” list. The feds have a standing $3 million reward for information leading to Bogachev’s arrest.

Evgeniy M. Bogachev, in undated photos.

The core innovation of Jabber Zeus was an alert that MrICQ would receive each time a new victim entered a one-time password code into a phishing page mimicking their financial institution. The gang’s internal name for this component was “Leprechaun,” (the video below from myNetWatchman shows it in action). Jabber Zeus would actually re-write the HTML code as displayed in the victim’s browser, allowing them to intercept any passcodes sent by the victim’s bank for multi-factor authentication.

“These guys had compromised such a large number of victims that they were getting buried in a tsunami of stolen banking credentials,” Baldwin told KrebsOnSecurity. “But the whole point of Leprechaun was to isolate the highest-value credentials — the commercial bank accounts with two-factor authentication turned on. They knew these were far juicier targets because they clearly had a lot more money to protect.”

Baldwin said the Jabber Zeus trojan also included a custom “backconnect” component that allowed the hackers to relay their bank account takeovers through the victim’s own infected PC.

“The Jabber Zeus crew were literally connecting to the victim’s bank account from the victim’s IP address, or from the remote control function and by fully emulating the device,” he said. “That trojan was like a hot knife through butter of what everyone thought was state-of-the-art secure online banking at the time.”

Although the Jabber Zeus crew was in direct contact with the Zeus author, the chats intercepted by myNetWatchman show Bogachev frequently ignored the group’s pleas for help. The government says the real leader of the Jabber Zeus crew was Maksim Yakubets, a 38-year Ukrainian man with Russian citizenship who went by the hacker handle “Aqua.”

Alleged Evil Corp leader Maksim “Aqua” Yakubets. Image: FBI

The Jabber chats intercepted by Baldwin show that Aqua interacted almost daily with MrICQ, Tank and other members of the hacking team, often facilitating the group’s money mule and cashout activities remotely from Russia.

The government says Yakubets/Aqua would later emerge as the leader of an elite cybercrime ring of at least 17 hackers that referred to themselves internally as “Evil Corp.” Members of Evil Corp developed and used the Dridex (a.k.a. Bugat) trojan, which helped them siphon more than $100 million from hundreds of victim companies in the United States and Europe.

This 2019 story about the government’s $5 million bounty for information leading to Yakubets’s arrest includes excerpts of conversations between Aqua, Tank, Bogachev and other Jabber Zeus crew members discussing stories I’d written about their victims. Both Baldwin and I were interviewed at length for a new weekly six-part podcast by the BBC that delves deep into the history of Evil Corp. Episode One focuses on the evolution of Zeus, while the second episode centers on an investigation into the group by former FBI agent Jim Craig.

Image: https://www.bbc.co.uk/programmes/w3ct89y8

KrebsOnSecurity recently heard from a reader whose boss’s email account got phished and was used to trick one of the company’s customers into sending a large payment to scammers. An investigation into the attacker’s infrastructure points to a long-running Nigerian cybercrime ring that is actively targeting established companies in the transportation and aviation industries.

Image: Shutterstock, Mr. Teerapon Tiuekhom.

A reader who works in the transportation industry sent a tip about a recent successful phishing campaign that tricked an executive at the company into entering their credentials at a fake Microsoft 365 login page. From there, the attackers quickly mined the executive’s inbox for past communications about invoices, copying and modifying some of those messages with new invoice demands that were sent to some of the company’s customers and partners.

Speaking on condition of anonymity, the reader said the resulting phishing emails to customers came from a newly registered domain name that was remarkably similar to their employer’s domain, and that at least one of their customers fell for the ruse and paid a phony invoice. They said the attackers had spun up a look-alike domain just a few hours after the executive’s inbox credentials were phished, and that the scam resulted in a customer suffering a six-figure financial loss.

The reader also shared that the email addresses in the registration records for the imposter domain — roomservice801@gmail.com — is tied to many such phishing domains. Indeed, a search on this email address at DomainTools.com finds it is associated with at least 240 domains registered in 2024 or 2025. Virtually all of them mimic legitimate domains for companies in the aerospace and transportation industries worldwide.

An Internet search for this email address reveals a humorous blog post from 2020 on the Russian forum hackware[.]ru, which found roomservice801@gmail.com was tied to a phishing attack that used the lure of phony invoices to trick the recipient into logging in at a fake Microsoft login page. We’ll come back to this research in a moment.

DomainTools shows that some of the early domains registered to roomservice801@gmail.com in 2016 include other useful information. For example, the WHOIS records for alhhomaidhicentre[.]biz reference the technical contact of “Justy John” and the email address justyjohn50@yahoo.com.

A search at DomainTools found justyjohn50@yahoo.com has been registering one-off phishing domains since at least 2012. At this point, I was convinced that some security company surely had already published an analysis of this particular threat group, but I didn’t yet have enough information to draw any solid conclusions.

DomainTools says the Justy John email address is tied to more than two dozen domains registered since 2012, but we can find hundreds more phishing domains and related email addresses simply by pivoting on details in the registration records for these Justy John domains. For example, the street address used by the Justy John domain axisupdate[.]net — 7902 Pelleaux Road in Knoxville, TN — also appears in the registration records for accountauthenticate[.]com, acctlogin[.]biz, and loginaccount[.]biz, all of which at one point included the email address rsmith60646@gmail.com.

That Rsmith Gmail address is connected to the 2012 phishing domain alibala[.]biz (one character off of the Chinese e-commerce giant alibaba.com, with a different top-level domain of .biz). A search in DomainTools on the phone number in those domain records — 1.7736491613 — reveals even more phishing domains as well as the Nigerian phone number “2348062918302” and the email address michsmith59@gmail.com.

DomainTools shows michsmith59@gmail.com appears in the registration records for the domain seltrock[.]com, which was used in the phishing attack documented in the 2020 Russian blog post mentioned earlier. At this point, we are just two steps away from identifying the threat actor group.

The same Nigerian phone number shows up in dozens of domain registrations that reference the email address sebastinekelly69@gmail.com, including 26i3[.]net, costamere[.]com, danagruop[.]us, and dividrilling[.]com. A Web search on any of those domains finds they were indexed in an “indicator of compromise” list on GitHub maintained by Palo Alto Networks‘ Unit 42 research team.

According to Unit 42, the domains are the handiwork of a vast cybercrime group based in Nigeria that it dubbed “SilverTerrier” back in 2014. In an October 2021 report, Palo Alto said SilverTerrier excels at so-called “business e-mail compromise” or BEC scams, which target legitimate business email accounts through social engineering or computer intrusion activities. BEC criminals use that access to initiate or redirect the transfer of business funds for personal gain.

Palo Alto says SilverTerrier encompasses hundreds of BEC fraudsters, some of whom have been arrested in various international law enforcement operations by Interpol. In 2022, Interpol and the Nigeria Police Force arrested 11 alleged SilverTerrier members, including a prominent SilverTerrier leader who’d been flaunting his wealth on social media for years. Unfortunately, the lure of easy money, endemic poverty and corruption, and low barriers to entry for cybercrime in Nigeria conspire to provide a constant stream of new recruits.

BEC scams were the 7th most reported crime tracked by the FBI’s Internet Crime Complaint Center (IC3) in 2024, generating more than 21,000 complaints. However, BEC scams were the second most costly form of cybercrime reported to the feds last year, with nearly $2.8 billion in claimed losses. In its 2025 Fraud and Control Survey Report, the Association for Financial Professionals found 63 percent of organizations experienced a BEC last year.

Poking at some of the email addresses that spool out from this research reveals a number of Facebook accounts for people residing in Nigeria or in the United Arab Emirates, many of whom do not appear to have tried to mask their real-life identities. Palo Alto’s Unit 42 researchers reached a similar conclusion, noting that although a small subset of these crooks went to great lengths to conceal their identities, it was usually simple to learn their identities on social media accounts and the major messaging services.

Palo Alto said BEC actors have become far more organized over time, and that while it remains easy to find actors working as a group, the practice of using one phone number, email address or alias to register malicious infrastructure in support of multiple actors has made it far more time consuming (but not impossible) for cybersecurity and law enforcement organizations to sort out which actors committed specific crimes.

“We continue to find that SilverTerrier actors, regardless of geographical location, are often connected through only a few degrees of separation on social media platforms,” the researchers wrote.

Palo Alto has published a useful list of recommendations that organizations can adopt to minimize the incidence and impact of BEC attacks. Many of those tips are prophylactic, such as conducting regular employee security training and reviewing network security policies.

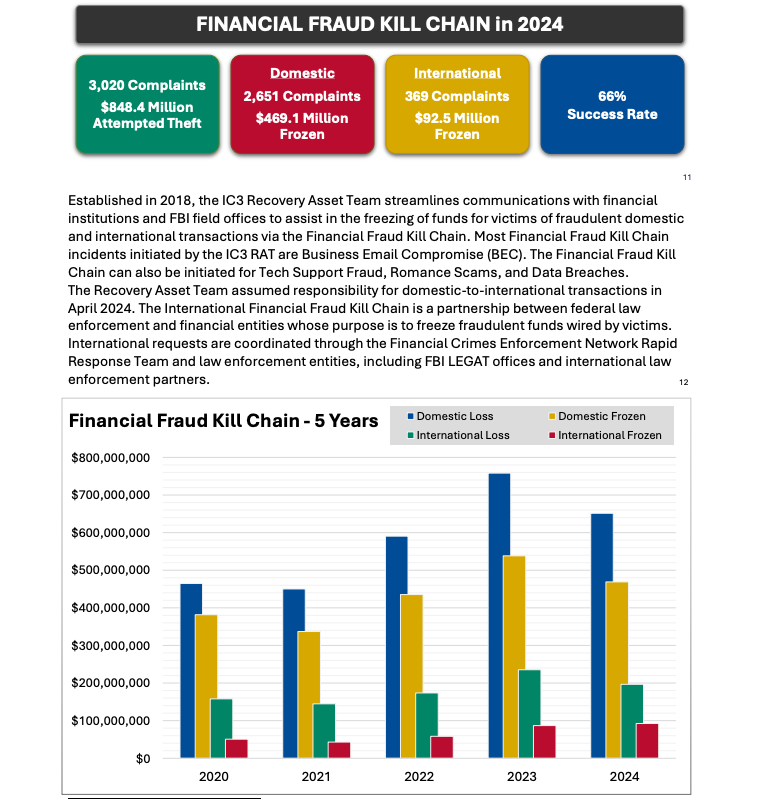

But one recommendation — getting familiar with a process known as the “financial fraud kill chain” or FFKC — bears specific mention because it offers the single best hope for BEC victims who are seeking to claw back payments made to fraudsters, and yet far too many victims don’t know it exists until it is too late.

Image: ic3.gov.

As explained in this FBI primer, the International Financial Fraud Kill Chain is a partnership between federal law enforcement and financial entities whose purpose is to freeze fraudulent funds wired by victims. According to the FBI, viable victim complaints filed with ic3.gov promptly after a fraudulent transfer (generally less than 72 hours) will be automatically triaged by the Financial Crimes Enforcement Network (FinCEN).

The FBI noted in its IC3 annual report (PDF) that the FFKC had a 66 percent success rate in 2024. Viable ic3.gov complaints involve losses of at least $50,000, and include all records from the victim or victim bank, as well as a completed FFKC form (provided by FinCEN) containing victim information, recipient information, bank names, account numbers, location, SWIFT, and any additional information.